BP 2006 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2006 185

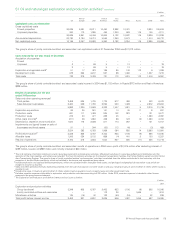

53 US GAAP reconciliation continued

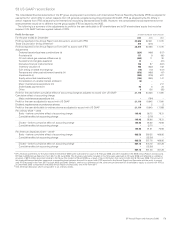

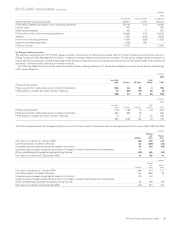

(g) Gain arising on asset exchange

Under IFRS, exchanges of non-monetary assets are generally accounted for at fair value at the date of the transaction, with any gain or loss recognized

in profit or loss. Under US GAAP prior to 1 January 2005, exchanges of non-monetary assets were accounted for at book value. From 1 January 2005

exchanges of non-monetary assets are generally accounted for at fair value under both IFRS and US GAAP.

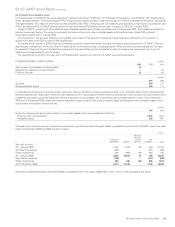

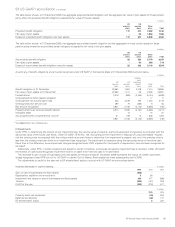

The adjustments to profit for the year and to BP shareholders’ equity to accord with US GAAP are summarized below.

Increase (decrease) in caption heading $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Depreciation, depletion and amortization 15 19 117

Taxation (5) (7) (10)

Profit for the year (10) (12) (107)

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Property, plant and equipment 352 367

Deferred tax liabilities 123 128

BP shareholders’ equity 229 239

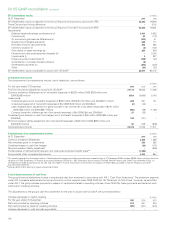

(h) Pensions and other post-retirement benefits

Under IFRS, the group accounts for its pension and other post-retirement benefit plans according to IAS 19 ‘Employee Benefits’. Surpluses and deficits

of pension and other post-retirement benefit plans are included in the group balance sheet at their fair values and all movements in these balances are

reflected in the income statement, except for those relating to actuarial gains and losses which are reflected in the statement of recognized income and

expense. In the past, this treatment has differed from the group’s US GAAP treatment under SFAS No. 87 ‘Employers’ Accounting for Pensions’ and

SFAS No. 106 ‘Employers’ Accounting for Post-retirement Benefits Other Than Pensions’, where actuarial gains and losses were not recognized in the

income statement as they occurred but were recognized within income in full only when they exceeded certain thresholds, and otherwise were

amortized. This difference in recognition rules for actuarial gains and losses gave rise to differences in periodic pension and other post-retirement benefit

expense as measured under IAS 19 compared to SFAS 87 and SFAS 106.

In addition, when a pension plan had an accumulated benefit obligation which exceeded the fair value of the plan assets, SFAS 87 required the

unfunded amount to be recognized as a minimum liability in the balance sheet. The offset to this liability was recorded as an intangible asset up to the

amount of any unrecognized prior service cost or transitional liability, and thereafter directly in other comprehensive income. IAS 19 does not have a

similar concept. As a result, this created a difference in shareholders’ equity as measured under IFRS and US GAAP.

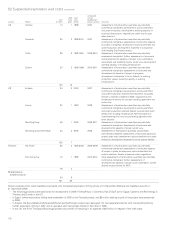

In September 2006, the FASB issued SFAS No. 158 ‘Employers’ Accounting for Defined Benefit Pension and Other Post-retirement Plans, an

amendment of FASB Statements No. 87, 88, 106, and 132(R)’. SFAS 158 requires an employer to recognize the overfunded or underfunded status of a

defined benefit post-retirement plan (other than a multi-employer plan) as an asset or liability in the balance sheet and to recognize changes in that

funded status in other comprehensive income in the year in which the changes occur. Because the funded status of benefit plans is fully recognized in

the balance sheet, a minimum liability will no longer be recognized. Retrospective application of SFAS 158 is not permitted. Upon adoption of SFAS 158,

the recognition of the overfunded or underfunded status of the group’s defined benefit pension and other post-retirement plans generally accords with

the group’s IFRS accounting. Differences in recognition rules for actuarial gains and losses will continue to give rise to differences in periodic pension

and other post-retirement benefit expense as measured under IFRS and US GAAP. The group has adopted SFAS 158 with effect from 31 December

2006, resulting in a $599 million decrease in BP shareholders’ equity, as adjusted to accord with US GAAP. Of this total effect, $586 million relates to

group entities and $13 million relates to equity-accounted entities. The effect on equity-accounted entities is included in note (j) Equity-accounted

investments. Further information on the effects of adoption of SFAS 158 is given below.

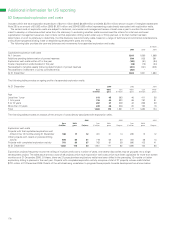

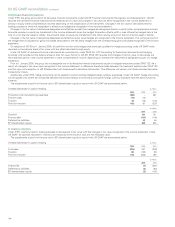

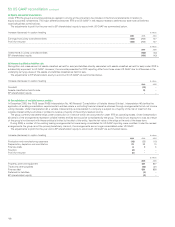

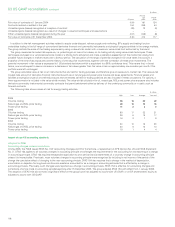

The adjustments to profit for the year and to BP shareholders’ equity to accord with US GAAP are summarized below.

Increase (decrease) in caption heading $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Production and manufacturing expenses 801 583 330

Other finance (income) expense 470 116 (29)

Taxation (398) (213) (254)

Profit for the year (873) (486) (47)

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Intangible assets –27

Other receivables –6,667

Defined benefit pension plan surplus –(3,282)

Current liabilities 603 –

Provisions –7,884

Defined benefit pension plan and other post-retirement benefit plan deficits (603) (9,230)

Deferred tax liabilities –1,612

BP shareholders’ equity –3,146

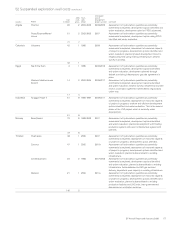

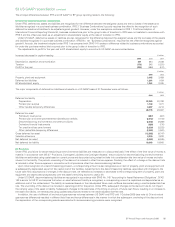

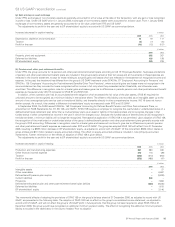

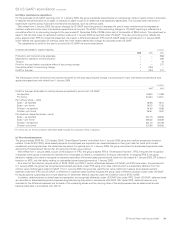

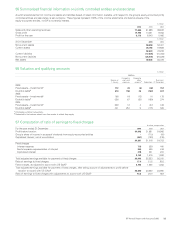

The incremental effects of adopting the provisions of SFAS 158 on the group’s balance sheet at 31 December 2006, as adjusted to accord with US

GAAP, are presented in the following table. The adoption of SFAS 158 had no effect on the group’s consolidated income statement, as adjusted to

accord with US GAAP, and will not affect the group’s US GAAP profit in future periods. Had the group not been required to adopt SFAS 158 at 31

December 2006, the group would have recognized an additional minimum pension liability. The effect of recognizing the additional minimum pension

liability is included in the table below in the column headed ‘Prior to adoption’.