BP 2006 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2006 215

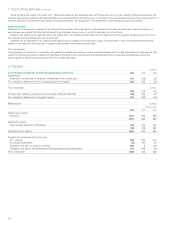

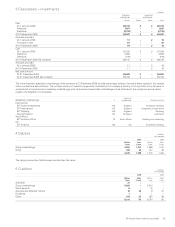

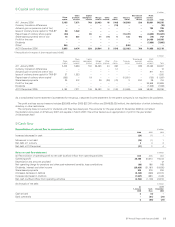

8 Capital and reserves

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Share

capital

Share

premium

account

Capital

redemption

reserve

Merger

reserve

Other

reserves

Own

shares

Treasury

shares

Share-based

payment

reserve

Profit

and loss

account Total

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 1 January 2006 5,185 7,371 749 26,493 16 (140) (10,598) 599 58,661 88,336

Currency translation differences –––––(19)–––(19)

Actuarial gain on pensions (net of tax) ––––––––785785

Issue of ordinary share capital for TNK-BP 28 1,222 – – – – – – – 1,250

Repurchase of ordinary share capital (90) – 90 – – – (11,472) – (4,009) (15,481)

Share-based payments (net of tax) 16 481 – 11 (11) 5 134 190 (79) 747

Profit for the year ––––––––24,18624,186

Dividends – – – – – – – – (7,686) (7,686)

Othera246 – – – – – (246) – – –

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 31 December 2006 5,385 9,074 839 26,504 5 (154) (22,182) 789 71,858 92,118

aReclassification in respect of share repurchases in 2005.

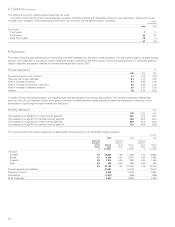

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Share

capital

Share

premium

account

Capital

redemption

reserve

Merger

reserve

Other

reserves

Own

shares

Treasury

shares

Share-based

payment

reserve

Profit

and loss

account Total

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 1 January 2005 5,403 5,636 730 26,465 44 (82) – 399 45,062 83,657

Currency translation differences –––––12–––12

Actuarial gain on pensions (net of tax) ––––––––811811

Issue of ordinary share capital for TNK-BP 27 1,223 – – – – – – – 1,250

Repurchase of ordinary share capital (265) – 19 – – – (10,601) – (750) (11,597)

Share-based payments 20 512 – 28 (28) (70) 3 200 39 704

Profit for the year – – – – – – – – 20,858 20,858

Dividends – – – – – – – – (7,359) (7,359)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 31 December 2005 5,185 7,371 749 26,493 16 (140) (10,598) 599 58,661 88,336

As a consolidated income statement is presented for the group, a separate income statement for the parent company is not required to be published.

The profit and loss account reserve includes $26,668 million (2005 $27,391 million and 2004 $25,026 million), the distribution of which is limited by

statutory or other restrictions.

The company does not account for dividends until they have been paid. The accounts for the year ended 31 December 2006 do not reflect

the dividend announced on 6 February 2007 and payable in March 2007; this will be treated as an appropriation of profit in the year ended

31 December 2007.

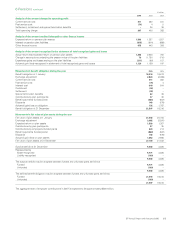

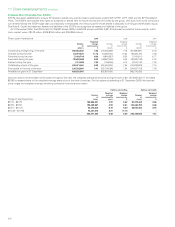

9Cashflow

Reconciliation of net cash flow to movement in net debt $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Increase (decrease) in cash (24) (1) 1

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Movement in net debt (24) (1) 1

Net debt at 1 January 343

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net debt at 31 December (21) 34

Notes on cash flow statement $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(a) Reconciliation of operating profit to net cash (outflow) inflow from operating activities 2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Operating profit 24,768 20,674 18,313

Depreciation and amounts provided ––12

Net operating charge for pensions and other post-retirement benefits, less contributions (83) 186 168

Dividends, interest and other income (25,036) (21,197) (19,626)

Share-based payments 325 278 224

(Increase) decrease in debtors (2,140) (368) 22,374

Increase (decrease) in creditors (1,537) (681) 2,448

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net cash (outflow) inflow from operating activities (3,703) (1,108) 23,913

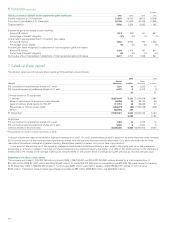

(b) Analysis of net debt $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At

1January

2006

Cash

flow

At 31

December

2006

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Cash at bank 3 (3) –

Bank overdrafts – (21) (21)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

3 (24) (21)