BP 2006 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

188

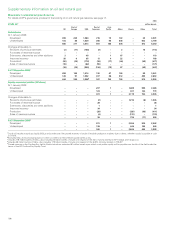

53 US GAAP reconciliation continued

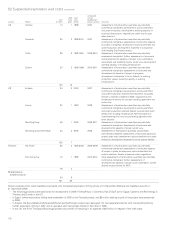

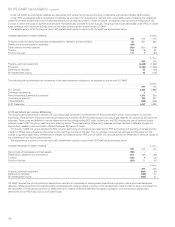

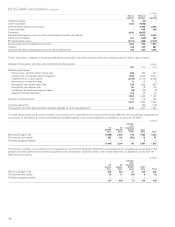

(j) Equity-accounted investments

Under IFRS the group’s accounting policies are applied in arriving at the amounts to be included in the financial statements in relation to

equity-accounted investments. The major difference between IFRS and US GAAP in this respect relates to deferred tax (see note (a) Deferred

taxation/business combinations).

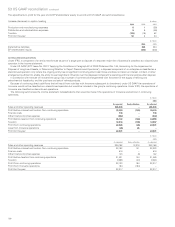

The adjustments to profit for the year and to BP shareholders’ equity to accord with US GAAP are summarized below.

Increase (decrease) in caption heading $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Earnings from jointly controlled entities (104) (255) 147

Profit for the year (104) (255) 147

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Investments in jointly controlled entities (160) (43)

BP shareholders’ equity (160) (43)

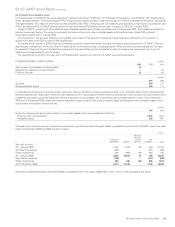

(k) Assets classified as held for sale

Recognition and measurement of assets classified as held for sale (and liabilities directly associated with assets classified as held for sale) under IFRS is

substantially equivalent to US GAAP. However, the amounts presented for IFRS reporting differ from those under US GAAP due to differences in the

underlying carrying values of the assets and liabilities classified as held for sale.

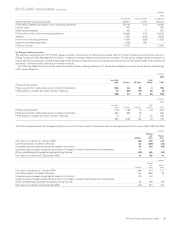

The adjustments to BP shareholders’ equity to accord with US GAAP are summarized below.

Increase (decrease) in caption heading $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Goodwill (10) –

Assets classified as held for sale 10 –

BP shareholders’ equity ––

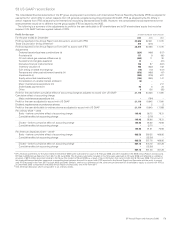

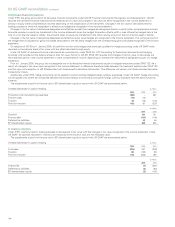

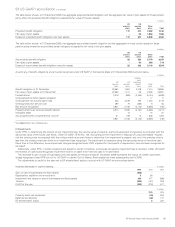

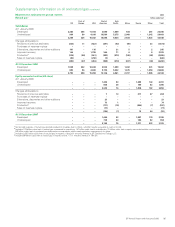

(l) Consolidation of variable interest entities

In December 2003, the FASB issued FASB Interpretation No. 46 (Revised) ‘Consolidation of Variable Interest Entities’. Interpretation 46 clarifies the

application of existing consolidation requirements to entities where a controlling financial interest is achieved through arrangements that do not involve

voting interests. Under Interpretation 46, a variable interest entity is consolidated if a company is subject to a majority of the risk of loss from the

variable interest entity’s activities or entitled to receive a majority of the entity’s residual returns.

The group currently has several ships under construction or in service which are accounted for under IFRS as operating leases. Under Interpretation

46 certain of the arrangements represent variable interest entities that would be consolidated by the group. The maximum exposure to loss as a result

of the group’s involvement with these entities is limited to the debt of the entity, less the fair value of the ships at the end of the lease term.

During 2006, a number of the existing leasing arrangements that were being consolidated for US GAAP reporting were modified. Under the revised

arrangements, the group is not the primary beneficiary. As such, the arrangements are no longer consolidated under US GAAP.

The adjustments to profit for the year and to BP shareholders’ equity to accord with US GAAP are summarized below.

Increase (decrease) in caption heading $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Production and manufacturing expenses (18) (32) (15)

Depreciation, depletion and amortization 21 23 10

Finance costs 695

Taxation (4) ––

Profit for the year (5) ––

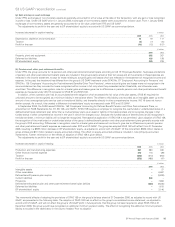

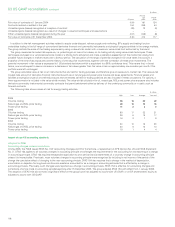

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Property, plant and equipment 497 807

Trade and other payables (45) (31)

Finance debt 551 838

Deferred tax liabilities (4) –

BP shareholders’ equity (5) –