BP 2006 Annual Report Download - page 60

Download and view the complete annual report

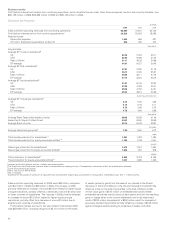

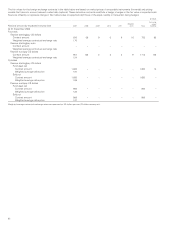

Please find page 60 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The capitalized exploration and development costs for proved oil and

gas properties (which include the costs of drilling unsuccessful wells)

are amortized on the basis of oil-equivalent barrels that are produced

in a period as a percentage of the estimated proved reserves.

The estimated proved reserves used in these unit-of-production

calculations vary with the nature of the capitalized expenditure. The

reserves used in the calculation of the unit-of-production amortization

are as follows:

– Proved developed reserves for producing wells.

– Total proved reserves for development costs.

– Total proved reserves for licence and property acquisition costs.

– Total proved reserves for future decommissioning costs.

The impact of changes in estimated proved reserves is dealt with

prospectively by amortizing the remaining book value of the asset over

the expected future production. If proved reserves estimates are revised

downwards, earnings could be affected by higher depreciation expense or

an immediate write-down of the property’s book value (see discussion

of recoverability of asset carrying values below).

Given the large number of producing fields in the group’s portfolio, it is

unlikely that any changes in reserves estimates for individual fields, either

individually or in aggregate, year on year, will have a significant effect on

the group’s prospective charges for depreciation.

At the end of 2006, BP adopted the Securities and Exchange

Commission (SEC) rules for estimating reserves for accounting and

reporting purposes instead of the UK accounting rules contained in the

UK SORP. These changes are explained in Financial statements – Note 3

on page 110.

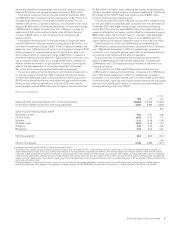

Oil and natural gas reserves

Commencing in 2006, BP has estimated its proved reserves on the basis

of the requirements of the SEC. The 2006 year-end marker prices used to

determine reserves volumes were Brent $58.93/bbl ($58.21/bbl) and

Henry Hub $5.52/mmBtu ($9.52/mmbtu). Prior to this date, BP used

guidance contained in the UK SORP to estimate reserves. In estimating

its reserves under UK SORP, BP used long-term planning prices.

The group manages its hydrocarbon resources in three major

categories: prospect inventory, non-proved resources and proved

reserves. When a discovery is made, volumes usually transfer from the

prospect inventory to the non-proved resource category. The resources

move through various non-proved resource sub-categories as their

technical and commercial maturity increases through appraisal activity.

Resources in a field will only be categorized as proved reserves when

all the criteria for attribution of proved status have been met, including

an internally imposed requirement for project sanction or for sanction

expected within six months and, for additional reserves in existing fields,

the requirement that the reserves be included in the business plan and

scheduled for development, typically within three years. Where, on

occasion, the group decides to book reserves where development is

scheduled to commence beyond three years, these reserves will be

booked only where they satisfy the SEC’s criteria for attribution of proved

status. Internal approval and final investment decision are what we refer

to as project sanction.

At the point of sanction, all booked reserves will be categorized as

proved undeveloped (PUD). Volumes will subsequently be recategorized

from PUD to proved developed (PD) as a consequence of development

activity. When part of a well’s reserves depends on a later phase of

activity, only that portion of reserves associated with existing, available

facilities and infrastructure moves to PD. The first PD bookings will occur

at the point of first oil or gas production. Major development projects

typically take one to four years from the time of initial booking to the

start of production. Changes to reserves bookings may be made due

to analysis of new or existing data concerning production, reservoir

performance, commercial factors, acquisition and divestment activity and

additional reservoir development activity. Proved reserves do not include

reserves that are dependent on the renewal of exploration and production

licences, unless there is strong evidence to support the assumption of

such renewal.

BP has an internal process to control the quality of reserves bookings

that forms part of a holistic and integrated system of internal control. As

discussed in the oil and natural gas accounting section and below, oil and

natural gas reserves have a direct impact on certain amounts reported in

the financial statements.

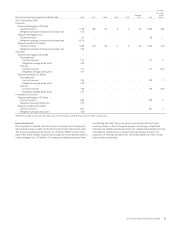

The 2006 movements in proved reserves are reflected in the tables

showing movements in oil and gas reserves by region in Financial

statements – Supplementary information on oil and natural gas on pages

196-197.

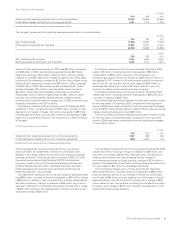

Recoverability of asset carrying values

BP assesses its fixed assets, including goodwill, for possible impairment

if there are events or changes in circumstances that indicate that carrying

values of the assets may not be recoverable. Such indicators include

changes in the group’s business plans, changes in commodity prices

leading to unprofitable performance and, for oil and gas properties,

significant downward revisions of estimated proved reserves quantities.

The assessment for impairment entails comparing the carrying value of

the cash generating unit and associated goodwill with the recoverable

amount of the asset, that is, the higher of net realizable value and value

in use. Value in use is usually determined on the basis of discounted

estimated future net cash flows.

Determination as to whether and how much an asset is impaired

involves management estimates on highly uncertain matters such

as future commodity prices, the effects of inflation and technology

improvements on operating expenses, production profiles and the outlook

for global or regional market supply-and-demand conditions for crude oil,

natural gas and refined products.

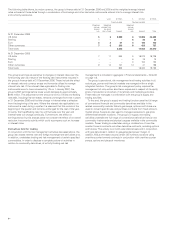

For oil and natural gas properties, the expected future cash flows are

estimated based on the group’s plans to continue to develop and produce

proved and associated risk-adjusted probable and possible reserves.

Expected future cash flows from the sale or production of reserves

are calculated based on the group’s best estimate of future oil and gas

prices. For 2006, prices for oil and natural gas used for future cash flow

calculations are based on market prices for the first five years and the

group’s long-term planning assumptions thereafter. As at 31 December

2006, the group’s long-term planning assumptions were $40 per barrel for

Brent and $5.50 per mmBtu for Henry Hub. Previously, prices for oil and

natural gas used in future cash flow calculations were assumed to decline

from the existing levels in equal steps during the following three years

to the long-term planning assumptions, which were $25 per barrel and

$4.0 per mmBtu for Brent and Henry Hub respectively. These long-term

planning assumptions are subject to periodic review and modification.

The estimated future level of production is based on assumptions about

future commodity prices, lifting and development costs, field decline

rates, market demand and supply, economic regulatory climates

and other factors.

Charges for impairment are recognized in the group’s results from

time to time as a result of, among other factors, adverse changes in the

recoverable reserves from oil and natural gas fields, low plant utilization

or reduced profitability. If there are low oil prices or natural gas prices or

refining margins or marketing margins over an extended period, the group

may need to recognize significant impairment charges.

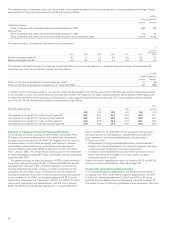

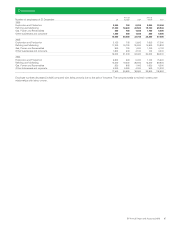

Irrespective of whether there is any indication of impairment, BP is

required to test for impairment any goodwill acquired in a business

combination. The group carries goodwill of approximately $10.8 billion on

its balance sheet, principally relating to the Atlantic Richfield and Burmah

Castrol acquisitions. In testing goodwill for impairment, the group uses a

similar approach to that described above. The cash-generating units for

impairment testing in this case are one level below business segments.

As noted above, if there are low oil prices or natural gas prices or refining

margins or marketing margins for an extended period, the group may

need to recognize significant goodwill impairment charges.

58