BP 2006 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2006 181

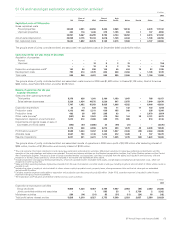

53 US GAAP reconciliation continued

The principal differences between IFRS and US GAAP for BP group reporting relate to the following:

(a) Deferred taxation/business combinations

Under IFRS, deferred tax assets and liabilities are recognized for the difference between the assigned values and the tax bases of the assets and

liabilities recognized in a purchase business combination. IFRS 3 ‘Business Combinations’ typically requires the offset to the recognition of such

deferred tax assets and liabilities to be adjusted against goodwill. However, under the exemptions contained in IFRS 1 ‘First-time Adoption of

International Financial Reporting Standards’, business combinations prior to the group’s date of transition to IFRS were not restated in accordancewith

IFRS 3 and the offset was taken as an adjustment to shareholders’ equity at the date of transition to IFRS.

Under US GAAP, deferred tax assets or liabilities are also recognized for the difference between the assigned values and the tax bases of the assets

and liabilities recognized in a purchase business combination. SFAS No. 141 ‘Business Combinations’, requires that the offset be recognized against

goodwill. As such, the treatment adopted under IFRS 1 as compared with SFAS 141 creates a difference related to business combinations accounted

for under the purchase method that occurred prior to the group’s date of transition to IFRS.

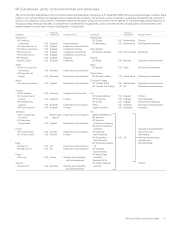

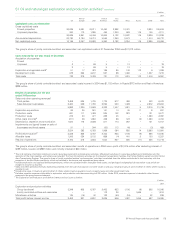

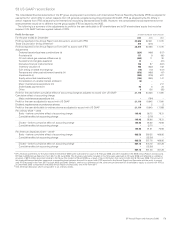

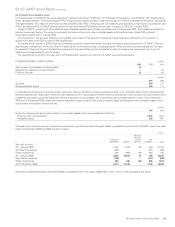

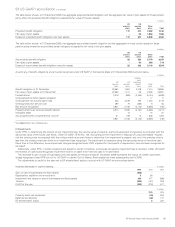

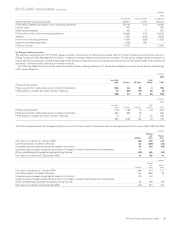

The adjustments to profit for the year and to BP shareholders’ equity to accord with US GAAP are summarized below.

Increase (decrease) in caption heading $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Depreciation, depletion and amortization 397 254 2,048

Taxation (173) 242 (1,531)

Profit for the year (224) (496) (517)

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Property, plant and equipment 3,062 3,459

Deferred tax liabilities 1,261 1,434

BP shareholders’ equity 1,801 2,025

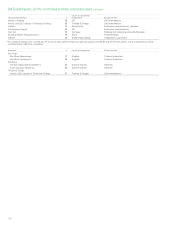

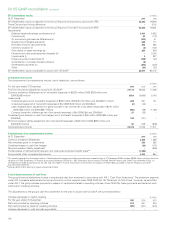

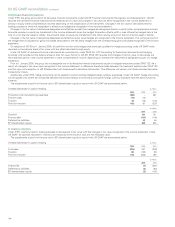

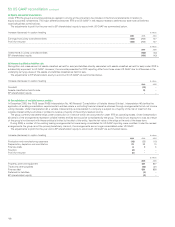

The major components of deferred tax liabilities and assets on a US GAAP basis at 31 December were as follows.

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Deferred tax liability

Depreciation 22,295 20,782

Pension plan surplus 1,733 1,371

Other taxable temporary differences 4,687 4,214

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

28,715 26,367

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Deferred tax asset

Petroleum revenue tax (457) (407)

Pension plan and other post-retirement benefit plan deficits (2,012) (1,154)

Decommissioning, environmental and other provisions (2,942) (2,292)

Derivative financial instruments (928) (770)

Tax credit and loss carry forward (3,920) (3,533)

Other deductible temporary differences (2,623) (1,591)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Gross deferred tax asset (12,882) (9,747)

Valuation allowance 3,830 3,222

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net deferred tax asset (9,052) (6,525)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net deferred tax liability 19,663 19,842

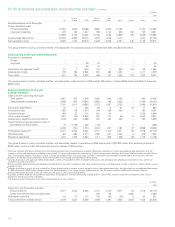

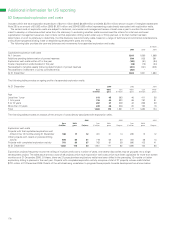

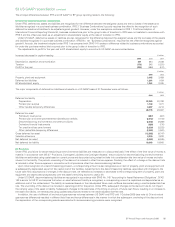

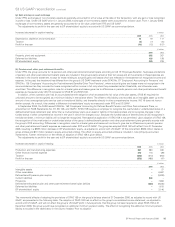

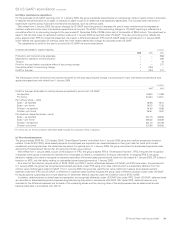

(b) Provisions

Under IFRS, provisions for decommissioning and environmental liabilities are measured on a discounted basis if the effect of the time value of money is

material. In accordance with IAS 37 ‘Provisions, Contingent Liabilities and Contingent Assets’, the provisions for decommissioning and environmental

liabilities are estimated using costs based on current prices and discounted using rates that take into consideration the time value of money and risks

inherent in the liability. The periodic unwinding of the discount is included in other finance expense. Similarly, the effect of a change in the discountrate

is included in other finance expense in connection with all provisions other than decommissioning liabilities.

Upon initial recognition of a decommissioning provision, a corresponding amount is also recognized as an item of property, plant and equipment and

is subsequently depreciated as part of the capital cost of the facilities. Adjustments to the decommissioning liabilities, associated with changes to the

future cash flow assumptions or changes in the discount rate, are reflected as increases or decreases to the corresponding item of property, plant and

equipment and depreciated prospectively over the asset’s remaining economic useful life.

Under US GAAP, decommissioning liabilities are recognized in accordance with SFAS No. 143 ‘Accounting for Asset Retirement Obligations’. SFAS

143 is similar to IAS 37 and requires that when an asset retirement liability is recognized, a corresponding amount is capitalized and depreciated as an

additional cost of the related asset. The liability is measured based on the risk-adjusted future cash outflows discounted using a credit-adjusted risk-free

rate. The unwinding of the discount is included in operating profit for the period. Unlike IFRS, subsequent changes to the discount rate do not impact

the carrying value of the asset or liability. Subsequent changes to the estimates of the timing or amount of future cash flows, resulting in an increase to

the asset and liability, are remeasured using updated assumptions related to the credit-adjusted risk-free rate.

In addition, the use of different oil and natural gas reserves volumes between US GAAP and IFRS until 1 October 2006 (see note (c) Oil and natural

gas reserves differences) resulted in different field lives and hence differences in the manner in which the subsequent unwinding of the discount and

the depreciation of the corresponding assets associated with decommissioning provisions were recognized.