BP 2006 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.170

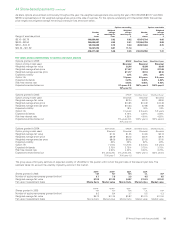

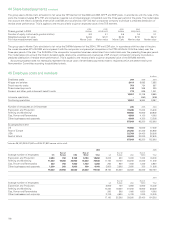

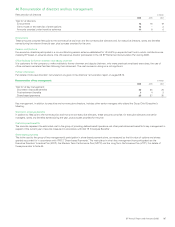

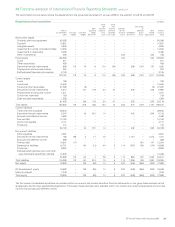

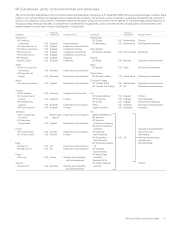

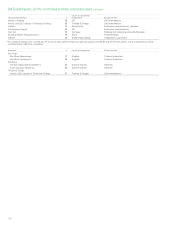

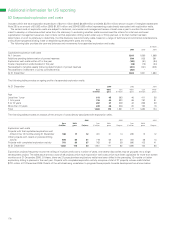

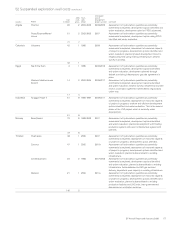

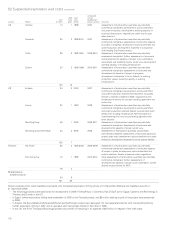

49 First-time adoption of International Financial Reporting Standards continued

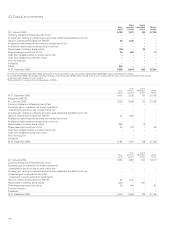

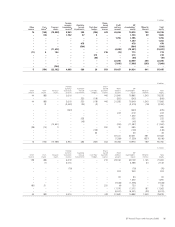

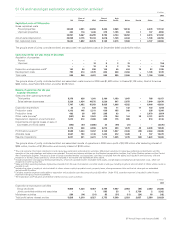

Adjustments required to the balance sheet as at 1 January 2005 for the adoption of IAS 32 and IAS 39

Under UK GAAP, all derivatives used for trading purposes were recognized on the balance sheet at fair value. However, derivative financial instruments

used for hedging purposes were recognized by applying either the accrual method or the deferral method. Under the accrual method, which was used

for derivatives, principally swaps, used to manage interest rate risk, amounts payable or receivable in respect of derivatives are recognized ratably in

earnings over the period of the contracts. Changes in the derivative’s fair value are not recognized. Under the deferral method, gains and losses from

derivatives were deferred and recognized in earnings or as adjustments to carrying amounts as the underlying hedged transaction matured or occurred.

This method was applied for derivatives used to convert non-US dollar borrowings into US dollars, to hedge significant non-US dollar firm commitments

or anticipated transactions, and to manage some of the group’s exposure to natural gas and power price fluctuations.

For IFRS, all financial assets and financial liabilities are recognized initially at fair value. In subsequent periods the measurement of these financial

instruments depends on their classification into one of the following measurement categories: i) financial assets or financial liabilities at-fair-value-

through-profit-and-loss (such as those used for trading purposes and all derivatives which do not qualify for hedge accounting); ii) loans and receivables;

and iii) available-for-sale financial assets (including certain investments held for the long term).

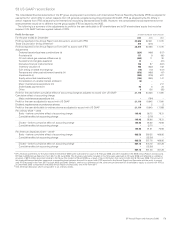

Fair value hedges

Where fair value hedge accounting was applied to transactions that hedge the group’s exposure to the changes in the fair value of a firm commitment

or a recognized asset or liability that are attributable to a specific risk the derivatives designated as hedging instruments are recorded at their fairvaluein

the group’s balance sheet and changes in their fair value are recognized in the income statement. Any gain or loss on the hedged item attributable to

the hedged risk is adjusted against the carrying amount of the hedged item and recognized in the income statement.

The ‘pay floating’ interest rate swaps and currency swaps hedging the debt book in place on 1 January 2005 were highly effective and consequently

qualify as fair value hedges for hedge accounting. The full fair value of the swaps was recognized on the balance sheet and the carrying value of debt

was adjusted.

Cash flow hedges

The group uses currency derivatives to hedge its exposure to variability in cash flows arising either from a recognized asset or liability or a forecast

transaction. The hedged instrument is recognized at fair value on the balance sheet. At maturity of the hedged item, the element deferred in equity is

treated in accordance with the nature of the hedged exposure, for example, capitalized into the cost of an item of property, plant and equipment, or

expensed in the case of a hedge of a tax payment.

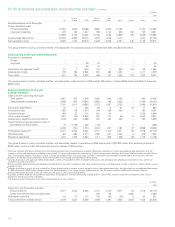

Non-qualifying hedge derivatives

Under IAS 39, there are strict criteria that need to be met in order for hedge accounting to be applied. This adjustment records the impact of those

derivatives, or elements thereof, held by the group that do not qualify for hedge accounting, or hedges for which hedge accounting has not been

claimed under IAS 39. From 1 January 2005, these positions will be fair valued (‘marked to market’) and the change in fair value taken to income.

Other non-financial contracts at fair value

Certain net-settled non-financial contracts are deemed to meet the definition of financial instruments under IAS 39 and, as such, need to be recorded on

the balance sheet at fair value.

Other non-financial contracts no longer at fair value

Certain non-financial contracts held for trading purposes were marked to market under UK GAAP. However, under IFRS they could no longer be

recorded at fair value as they did not meet the definition of financial assets or financial liabilities. These contracts are accounted for on an accruals basis.

Available-for-sale financial assets

Under UK GAAP, the group’s investments other than subsidiaries, jointly controlled entities and associates were stated at cost less accumulated

impairment losses.

For IFRS, these investments are classified as available-for-sale financial assets, and are recorded at fair value with the gain or loss arising as a result

of the change in fair value being recorded directly in equity.

The transition adjustment relates to the fair value of listed investments held by the group. In accordance with IAS 39, all future fair value adjustments

will be booked directly in equity until disposal of the investment, when the cumulative associated gains or losses are recycled through the income

statement. At this point, the gain or loss on disposal under IFRS will be identical to that which would result using historical cost accounting.

Embedded derivatives

Embedded derivatives are required to be separated from their host contracts and separately recorded at fair value, with any resulting change in gain or

loss in the period being recognized in the income statement.

Certain contracts have been determined to contain embedded derivatives. These embedded derivatives will be fair valued at each period end with the

resulting gains or losses taken to the income statement.

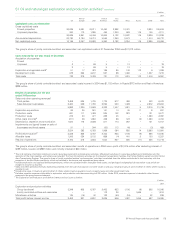

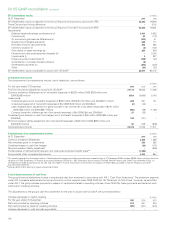

Elimination of currently deferred gains and losses from derivatives

Under UK GAAP, gains and losses from derivatives are deferred and recognized in earnings or as adjustments to carrying amounts, as appropriate,

when the underlying debt matures or the hedged transaction occurs. Where derivatives that are used to manage interest rate risk, to convert non-US

dollar debtor to hedge other anticipated cash flows are terminated before the underlying debt matures or the hedged transaction occurs, the resulting

gain or loss is recognized on a basis that matches the timing and accounting treatment of the underlying debt or hedged transaction.

On transition to IFRS, only assets and liabilities that qualify as such can continue to be recognized. Consequently, all gains and losses that were

generated by derivatives used for hedging purposes and deferred in the balance sheet as if they were assets or liabilities must be eliminated from the

transitional balance sheet. This is achieved by transferring gains and losses arising from cash flow hedges to equity, pending recycling to income at a

later date, and by transferring gains and losses arising from fair value hedges to adjust the carrying value of the hedged item, in this case, finance debt.