BP 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2006 73

Part 3 – Additional statutory

and other disclosures

Remuneration committee

All the members of the committee are independent non-executive

directors. Throughout this year, Dr Julius (chairman), Mr Bryan, Mr Davis,

Sir Tom McKillop and Sir Ian Prosser were members. Lord Browne was

consulted on matters relating to the other executive directors who report

to him and on matters relating to the performance of the company;

he was not present when matters affecting his own remuneration

were discussed.

Tasks

The remuneration committee’s tasks are:

– To determine, on behalf of the board, the terms of engagement and

remuneration of the group chief executive and the executive directors

and to report on these to the shareholders.

– To determine, on behalf of the board, matters of policy over which

the company has authority regarding the establishment or operation

of the company’s pension scheme of which the executive directors

are members.

– To nominate, on behalf of the board, any trustees (or directors of

corporate trustees) of the scheme.

– To monitor the policies being applied by the group chief executive in

remunerating senior executives who are not executive directors.

Constitution and operation

Each member of the remuneration committee (named on page 80) is

subject to annual re-election as a director of the company. The board

considers all committee members to be independent (see page 77).

They have no personal financial interest, other than as shareholders, in the

committee’s decisions.

The committee met five times in the period under review. There was

a full attendance record except for Mr Davis, who was unable to attend

one meeting. Mr Sutherland, as chairman of the board, attended all the

committee meetings.

The committee is accountable to shareholders through its annual

report on executive directors’ remuneration. It will consider the outcome

of the vote at the AGM on the directors’ remuneration report and take

into account the views of shareholders in its future decisions. The

committee values its dialogue with major shareholders on remuneration

matters.

Advice

Advice is provided to the committee by the company secretary’s office,

which is independent of executive management and reports to the

chairman of the board. Mr Aronson, an independent consultant, is the

committee’s secretary and special adviser. Advice was also received

from Mr Jackson, the company secretary.

The committee also appoints external advisers to provide specialist

advice and services on particular remuneration matters. The

independence of the advice is subject to annual review.

In 2006, the committee continued to engage Towers Perrin as its

principal external adviser. Towers Perrin also provided limited ad hoc

remuneration and benefits advice to parts of the group, principally

changes in employee share plans and some market information

on pay structures. The committee continued to engage Kepler Associates

to advise on performance measurement. Kepler Associates also

provided performance data and limited ad hoc advice on performance

measurement to the group.

Freshfields Bruckhaus Derringer provided legal advice on specific

matters to the committee, as well as providing some legal advice to

the group.

Ernst & Young reviewed the calculations on the financial-based targets

that form the basis of the performance-related pay for executive directors,

that is, the annual bonus and share element awards described on page 69,

to ensure they met an independent, objective standard. They also

provided audit, audit-related and taxation services for the group.

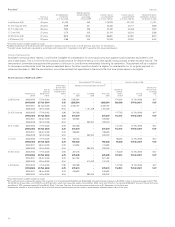

Historical TSR performancea

This graph shows the growth in value of a hypothetical £100 holding in

BP p.l.c. ordinary shares over five years, relative to the FTSE 100 and to

the FTSE All World Oil & Gas Index. BP is a constituent of both indices,

which are the most relevant broad equity market indices for this purpose.

FTSE All World Oil & Gas Index

aThis information has been subject to audit.

Past directors

Until 30 September 2006, Mr Olver acted as a consultant to BP in

relation to its activities in Russia and served as a BP-nominated director

of TNK-BP Limited, a joint venture company owned 50% by BP.

Under the consultancy agreement, he received £225,000 in fees in

2006 as well as reimbursement of costs and support for his role. He

was also entitled to retain fees paid to him by TNK-BP up to a maximum

of $120,000 a year for his role as a director, deputy chairman and

chairman of the audit committee of TNK-BP Limited.

Mr Miles (non-executive director of BP until April 2006) was appointed

as a director and non-executive chairman of BP Pension Trustees Limited

in October 2006. This position is for a term of three years and he receives

£150,000 per annum.