BP 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

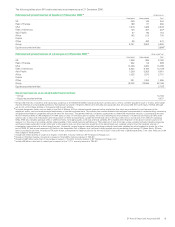

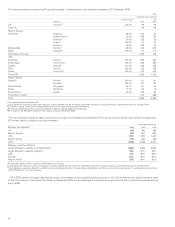

United States

2006 liquids production at 547 thousand barrels per day (mb/d) decreased

11% from 2005, while natural gas production at 2,376 million cubic feet

per day (mmcf/d) decreased 7% compared with 2005.

Crude oil production decreased 63mb/d from 2005, with production

from new projects being offset by divestments and natural reservoir

decline. The NGLs component of liquids production remained essentially

flat compared with 2005, with a slight decline of 2mb/d. Gas production

was lower (170mmcf/d) because of divestments and natural reservoir

decline.

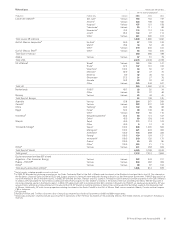

Development expenditure in the US (excluding midstream) during

2006 was $3,579 million, compared with $2,965 million in 2005 and

$3,247 million in 2004. The annual increase is the result of various

development projects in progress.

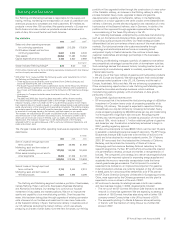

On 19 April 2006, BP announced the sale of its producing properties on

the Outer Continental Shelf of the Gulf of Mexico to Apache Corporation

for $1.3 billion. The major part of the sale was completed in June 2006

after receiving regulatory approval. In the third quarter of 2006, we

completed the sale of our remaining Gulf of Mexico Shelf assets that

were subject to pre-emption rights. BP retained certain decommissioning

obligations related to the disposed assets.

Our activities within the US take place in three main areas. Significant

events during 2006 within each of these are indicated below.

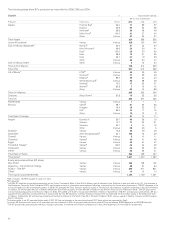

Deepwater Gulf of Mexico

Deepwater Gulf of Mexico is one of our new profit centres and our largest

area of growth in the US. In 2006, our deepwater Gulf of Mexico crude oil

production was 195mb/d and gas production was 323mmcf/d.

Significant events were:

– Offshore repair work on the Thunder Horse platform (BP 75% and

operator) was completed during 2006. However, tests conducted

during the commissioning of the platform revealed metallurgical

failure in components of the subsea system. In September 2006, we

announced our plan to retrieve and replace all the subsea components

we believed could be at risk. We currently estimate that this will cost

around $650 million (BP net). Production is expected to start up by the

end of 2008.

– The Mars platform (BP 28.5%) suffered heavy damage from Hurricane

Katrina in August 2005. Production resumed in May 2006 and was

190mboe/d gross by September 2006, a 20% increase over pre-

Katrina rates.

– Expansion of the Mars and Na Kika fields also continued during 2006

and first production from these projects is expected in 2007.

– Progress continued on the Atlantis project (BP 56% and operator)

during 2006. The semi-submersible platform will be the deepest

moored floating production facility in the world in approximately

7,100 feet of water. First oil is expected by the end of 2007.

– On 31 August 2006, we announced a significant oil exploration

discovery on the Kaskida prospect in approximately 5,900 feet of water.

– Development of the King Subsea Pump project (BP 100% and

operator) continued during 2006, with first production expected by the

end of 2007. This is the first subsea multi-phase pump application in

water depths greater than 3,000 feet.

– In July 2006, we completed the sale of our 28% interest in the Shenzi

discovery to Repsol for $2,145 million.

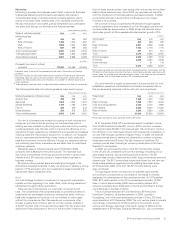

Lower 48 states

In the Lower 48 states (Onshore), our 2006 natural gas production was

1,920mmcf/d, which was up 2% compared with 2005. Liquids production

was 125mb/d, down 4% compared with 2005 as a result of normal field

decline. In 2006, we drilled approximately 330 wells as operator and

continued to maintain a level programme of drilling activity throughout

the year.

Production is derived primarily from two main areas:

– In the Western Basins (Colorado, New Mexico and Wyoming), our

assets produced 218mboe/d in 2006.

– In the Gulf Coast and Mid-Continental basins (Kansas, Louisiana,

Oklahoma and Texas), our assets produced 183mboe/d in 2006.

– The development of recovery technology continues to be a

fundamental strategy in accessing our North America tight gas

resources. Through the use of horizontal drilling and advanced hydraulic

fracturing techniques, we are achieving well rates up to 10 times

higher than more conventional techniques and per-well recoveries

some five times higher.

Significant events were:

– Drilling continued during 2006 on the Wamsutter natural gas expansion

project. The multi-year drilling programme is expected to increase

production significantly by the end of 2010. We are currently testing

horizontal fracturing technology and carrying out wireless seismic

studies on the reservoir.

– In January 2007, we announced our investment of up to $2.4 billion

over the next 13 years in the Coal Bed Methane Field development

project in the San Juan Basin of Colorado. The project includes the

drilling of more than 700 wells, nearly all from existing well sites, and

the installation of associated field facilities.

– In October 2006, we completed the sale of five onshore properties in

South Louisiana to Swift Energy for approximately $160 million.

Alaska

In Alaska, BP net crude oil production in 2006 was 224mb/d, a decrease

of 16% from 2005, due to mature field decline and operational issues

associated with transit pipelines described below.

BP operates 13 North Slope oil fields (including Prudhoe Bay, Northstar

and Milne Point) and four North Slope pipelines and owns a significant

interest in six other producing fields. Our 26.4% interest in the Prudhoe

Bay natural gas resource is a large undeveloped source of natural gas.

Developing viscous oil is an important part of the Alaska business. We

are continually looking to develop viscous oil production in various fields

through the application of advanced technology.

Significant events were:

– BP, along with ExxonMobil, ConocoPhillips and the Executive Branch

of the State of Alaska, reached agreement on a gas pipeline fiscal

contract. Two special sessions of the legislature called by the former

governor ended without legislative ratification of the contract. The

change of governor, which took place in December 2006, has

temporarily delayed continued negotiations with the State of Alaska

until a clear process leading to ratification of the gas pipeline fiscal

contract is defined by the new administration. BP stands ready to

execute a modified fiscal contract that is agreeable to all the parties.

– The State of Alaska significantly increased production taxes by

adopting a new Petroleum Production Tax (PPT) bill on 19 August

2006, effective from 1 April 2006. The key terms of the PPT include a

22.5% oil tax rate with capital credits and a clause whereby the oil tax

rate increases as the net margin rises above $40/bbl.

– On 27 November 2006, the State of Alaska Department of Natural

Resources (DNR) issued a decision regarding the Plan of Development

(POD) submitted by ExxonMobil on behalf of the Point Thompson Unit

owners (BP 32%) on 18 October 2006. The DNR decision was to reject

the modified POD, deny the proposed settlement of the expansion

lease acreage and terminate the Point Thompson Unit. BP, along with

the other owners, is studying options available in response to this

decision. BP intends to pursue vigorously the retention of its interest in

the Point Thompson Unit and remains committed to its development in

conjunction with our broader gas strategy and the proposal to construct

a gas pipeline from Alaska, through Canada, to the Midwest US.

– Alaska viscous and heavy oil assets produced their 100 millionth barrel

(gross) in November 2006. West Sak 1J Phase 1 viscous project has

drilled more than half the planned 31 development wells, Milne Point

is planning the NW Schrader Bluff winter appraisal programme and

the Orion Phase II sanction in Prudhoe Bay is expected in the first

quarter of 2007. Orion Phase II completes GC-2 viscous oil facility

modifications and develops eight additional producer wells and 22

injector wells; first oil is planned for 2009.

– On 2 March 2006, a transit pipeline in the Western operating area of

the Prudhoe Bay field was discovered to have spilled approximately

4,800 barrels of crude oil over approximately two acres. The processing

facility that feeds into the transit line was immediately shut down. An

investigation team determined that the leak was caused by internal

corrosion. Spill clean-up was completed and business operations

resumed in April 2006 using a separate bypass line. (See also

Environmental Protection – Health, Safety and Environmental

Regulation on page 42.)