BP 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2006 71

three months before the beginning and end of the performance period.

They are measured in US dollars. At the end of the performance period,

the companies’ TSRs will be ranked. Executive directors’ performance

shares will vest at 100%, 70% and 35% if BP is ranked first, second

or third respectively; none will vest if BP is in fourth or fifth place.

As the comparator group is small and as the oil majors’ underlying

businesses are broadly similar, a simple ranking could sometimes distort

BP’s underlying business performance relative to the comparators.

The committee is therefore able to exercise discretion in a reasonable

and informed manner to adjust the vesting level upwards or downwards

to reflect better the underlying health of BP’s business. This would be

judged by reference to a range of measures including ROACE, growth

in EPS, reserves replacement and cash flow. The need to exercise

discretion is most likely to arise when the TSR of some companies is

clustered, so that a relatively small difference in TSR performance would

produce a major difference in vesting levels.

The remuneration committee will explain any adjustments in the

next directors’ remuneration report following the vesting, in line with its

commitment to transparency.

Group chief executive

As noted above, as group chief executive, Lord Browne is eligible for

performance share awards of up to 7.5 times his base salary. While the

largest part of this is related to TSR, the committee has decided that

up to two times base salary should be based on long-term leadership

measures. These focus on sustaining BP’s financial, strategic and

organizational health. They include, among other measures, maintenance

of BP’s performance culture and the continued development of BP’s

business strategy, executive talent and internal organization. As with

the TSR element, this element will be assessed over a three-year

performance period.

The remuneration committee has agreed that Lord Browne will be

granted a share award under the 2007-2009 plan on the above basis.

The performance targets for this award (and those granted to him on

the same basis in 2005 and 2006) will be assessed by the remuneration

committee at the end of the three-year performance period that applies

to each award. The actual number of shares received will depend on the

extent to which relevant performance conditions are satisfied.

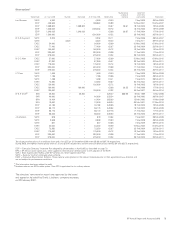

Pensions

Executive directors are eligible to participate in the appropriate pension

schemes applying in their home countries. Additional details are given

on page 74.

UK directors

UK directors are members of the regular BP Pension Scheme. The core

benefits under this scheme are non-contributory. They include a pension

accrual of 1/60th of basic salary for each year of service, up to a

maximum of two-thirds of final basic salary and a dependant’s benefit of

two-thirds of the member’s pension. The scheme pension is not

integrated with state pension benefits.

The rules of the BP Pension Scheme have recently been amended

such that the normal retirement age is 65. Scheme members can retire

on or after age 60 without reduction. Special early retirement terms apply

to pre-1 December 2006 service for members with long service as at

1 December 2006.

In April 2006, the UK government made important changes to the

operation and taxation of pensions. The remuneration committee decided

to deliver pension benefits in excess of the new lifetime allowance of

£1.5 million set by the legislation via an unapproved, unfunded pension

arrangement paid by the company direct.

US directors

Dr Grote participates in the US BP Retirement Accumulation Plan (US

plan), which features a cash balance formula. The US plan took its current

form on 1 July 2000. Pension benefits are provided through a combination

of tax-qualified and non-qualified benefit restoration plans, consistent with

US tax regulations as applicable.

The Supplemental Executive Retirement Benefit (supplemental plan) is

a non-qualified top-up arrangement that became effective on 1 January

2002 for US employees above a specified salary level. The benefit formula

is 1.3% of final average earnings, which comprise base salary and bonus

in accordance with standard US practice (and as specified under the

qualified arrangement), multiplied by years of service. There is an

offset for benefits payable under all other BP qualified and non-qualified

pension arrangements. This benefit is unfunded and therefore paid from

corporate assets.

Dr Grote is eligible to participate under the supplemental plan. His

pension accrual for 2006, shown in the table on page 74, includes the

total amount that could become payable under all plans.

Other benefits

Executive directors are eligible to participate in regular employee benefit

plans and in all-employee share saving schemes and savings plans

applying in their home countries. Benefits in kind are not pensionable.

Expatriates may receive a resettlement allowance for a limited period.

Service contracts

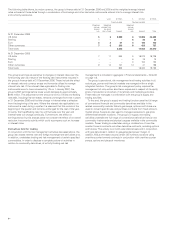

--------------------------------------------------------------------------------------------------------------------------------------------------

DirectoraContract date Salary as at 31 Dec 2006

--------------------------------------------------------------------------------------------------------------------------------------------------

Lord Browne 11 Nov 1993 £1,575,000

Dr A B Hayward 29 Jan 2003 £485,000

Dr D C Allen 29 Jan 2003 £485,000

I C Conn 22 Jul 2004 £485,000

Dr B E Grote 7 Aug 2000 $1,000,000

J A Manzoni 29 Jan 2003 £485,000

aSubsequent to 31 December 2006, Dr Hayward’s salary was increased to £750,000

and Mr Inglis’ salary, on appointment to the board, to £425,000.

When Lord Browne retires on 31 July 2007, he will become entitled to a

payment equal to the aggregate of 12 months’ base salary at that date, his

target annual bonus level (130% of base salary) and £90,000 in respect of

fringe benefits. In accordance with the committee’s policy, the payment will

be made in four quarterly instalments (the first payable in November 2007)

and each instalment will be reduced by an amount equal to any of Lord

Browne’s replacement earnings for the quarter in question, to the extent

that such earnings exceed one-third of the relevant quarterly instalment.

Service contracts are expressed to expire at a normal retirement age

of 60 (subject to age discrimination). The contracts have a notice period

of one year.

The service contracts of Dr Allen, Mr Conn, Dr Hayward and

Mr Manzoni may be terminated by the company at any time with

immediate effect, on payment in lieu of notice equivalent to one year’s

salary, or the amount of salary that would have been paid if the contract

had terminated on the expiry of the remainder of the notice period.

Dr Grote’s contract is with BP Exploration (Alaska) Inc. He is seconded

to BP p.l.c. under a secondment agreement of 7 August 2000, which had

an unexpired term of one year on 31 December 2006. The secondment

can be terminated by one month’s notice by either party and terminates

automatically on the termination of Dr Grote’s service contract.

There are no other provisions for compensation payable on early

termination of the above contracts. In the event of the early termination

of any of the contracts by the company, other than for cause (or under a

specific termination payment provision), the relevant director’s then-current

salary and benefits would be taken into account in calculating any liability of

the company.

Since January 2003, new service contracts have included a provision

to allow for severance payments to be phased, when appropriate. The

committee will also consider mitigation to reduce compensation to a

departing director, when appropriate to do so.