Airtran 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

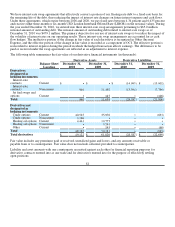

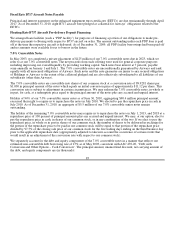

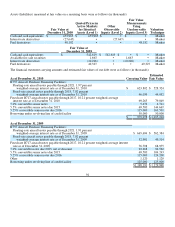

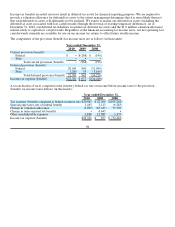

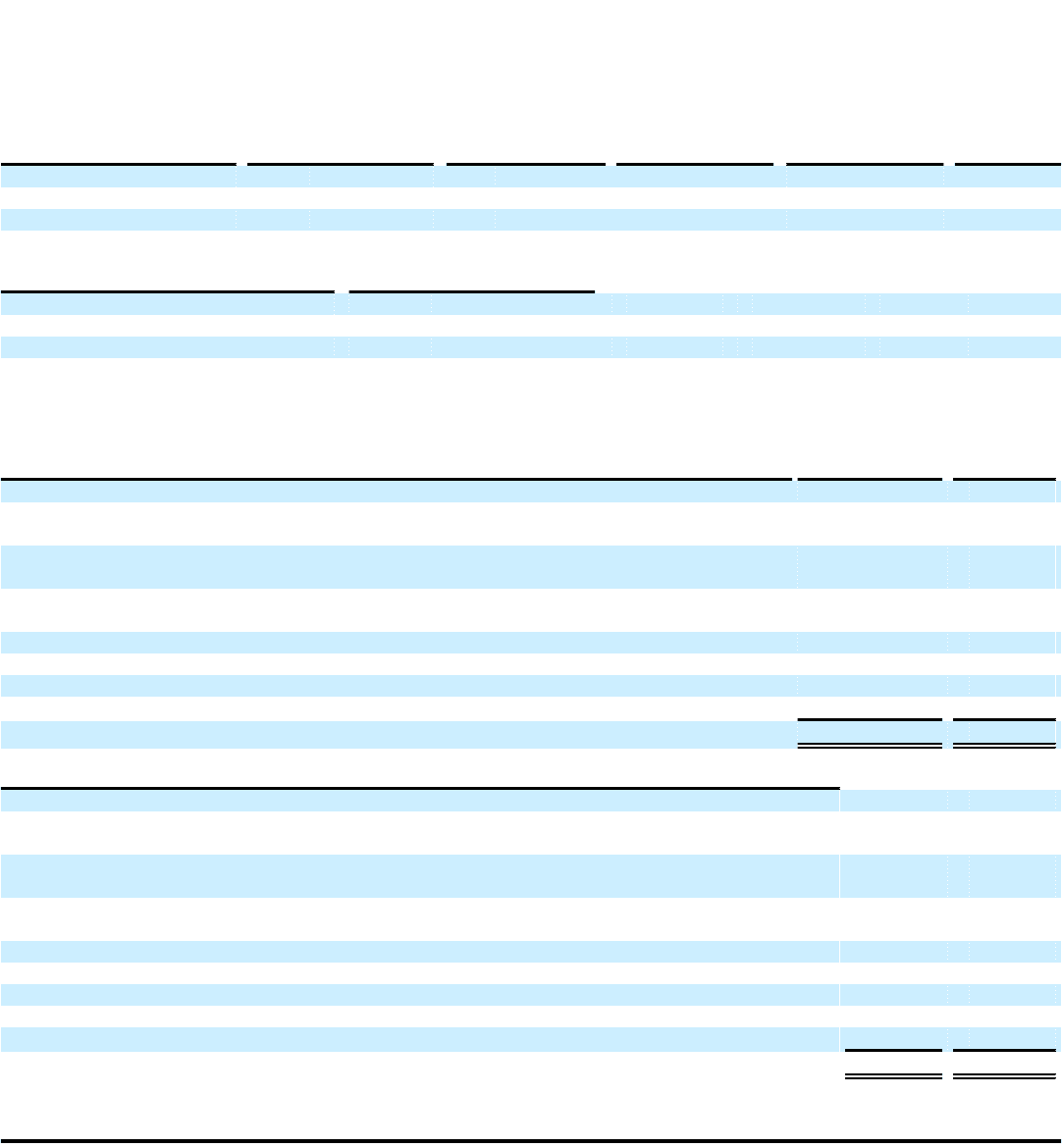

Assets (liabilities) measured at fair value on a recurring basis were as follows (in thousands):

Fair Value at

December 31, 2010

Quoted Prices in

Active Markets

for Identical

Assets (Level 1)

Other

Observable

Inputs (Level 2)

Fair Value

Measurements

Using

Unobservable

Inputs (Level 3) Valuation

Technique

Cash and cash equivalents $ 453,965 $ 453,965 $ • $ • Market

Interest rate derivatives (27,647) • (27,647) • Market

Fuel derivatives 48,182 • • 48,182 Market

Fair Value at

December 31, 2009

Cash and cash equivalents $ 542,619 $ 542,619 $ • $ • Market

Available-for-sale securities 1,663 • 1,663 • Market

Interest rate derivatives (10,206) • (10,206) • Market

Fuel derivatives 49,327 • • 49,327 Market

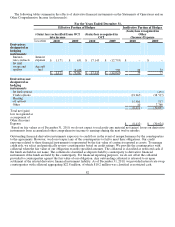

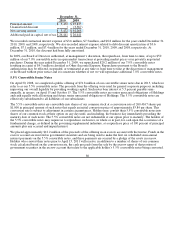

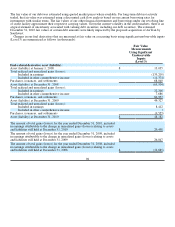

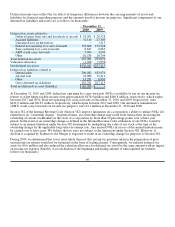

The financial statement carrying amounts and estimated fair values of our debt were as follows (in thousands):

As of December 31, 2010 Carrying Value Estimated

Fair Value

B737 Aircraft Purchase Financing Facilities:

Floating-rate aircraft notes payable through 2021, 1.97 percent

weighted-average interest rate as of December 31, 2010 $ 623,802 $ 528,324

Fixed-rate aircraft notes payable through 2018, 7.02 percent

weighted-average interest rate as of December 31, 2010 46,039 44,952

Fixed-rate B717 aircraft notes payable through 2017, 10.21 percent weighted-average

interest rate as of December 31, 2010 69,265 79,049

7.0% convertible senior notes 5,472 4,711

5.5% convertible senior notes due 2015 69,500 144,667

5.25% convertible senior notes due 2016 115,000 163,501

Borrowing under revolving line of credit facility 50,000 50,000

$ 979,078 $ 1,015,204

As of December 31, 2009

B737 Aircraft Purchase Financing Facilities:

Floating-rate aircraft notes payable through 2021, 1.91 percent

weighted-average interest rate as of December 31, 2009 $ 665,694 $ 562,384

Fixed-rate aircraft notes payable through 2018, 7.02 percent

weighted-average interest rate as of December 31, 2009 52,901 49,514

Fixed-rate B717 aircraft notes payable through 2017, 10.21 percent weighted-average interest

rate as of December 31, 2009 76,708 68,975

7.0% convertible notes due 2023, net of discount 92,268 94,562

5.5% convertible senior notes due 2015 69,500 104,243

5.25% convertible senior notes due 2016 115,000 124,200

Other 1,120 1,120

Borrowing under revolving line of credit facility 125,000 125,000

$1,198,191 $ 1,129,998

91