Airtran 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The fair value of our debt was estimated using quoted market prices where available. For long-term debt not actively

traded, the fair value was estimated using a discounted cash flow analysis based on our current borrowing rates for

instruments with similar terms. The fair values of our other financial instruments and borrowings under our revolving line

of credit facility approximate their respective carrying values. Given the current volatility in the credit markets, there is an

atypical element of uncertainty associated with valuing debt securities, including our debt securities. The estimated

December 31, 2010 fair values of certain debt amounts were likely impacted by the proposed acquisition of AirTran by

Southwest.

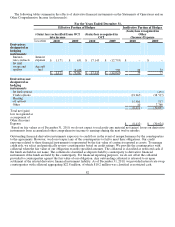

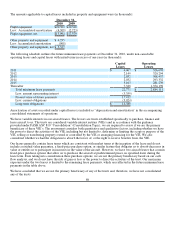

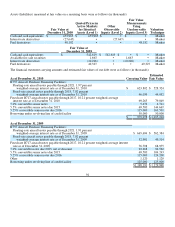

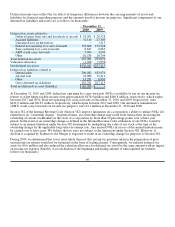

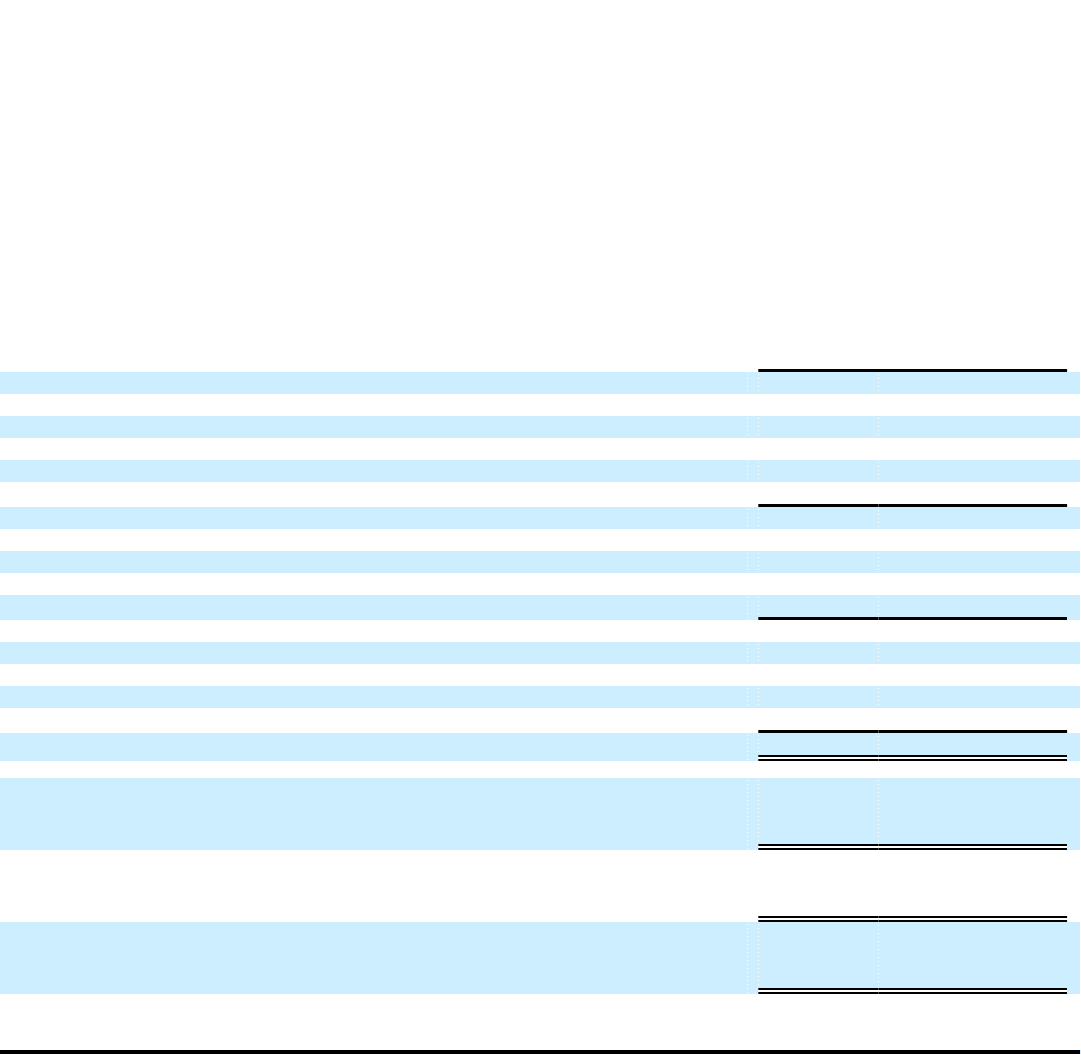

Changes in our fuel derivatives that are measured at fair value on a recurring basis using significant unobservable inputs

(Level 3) are summarized as follows (in thousands):

Fair Value

Measurements

Using Significant

Unobservable

Inputs

(Level 3)

Fuel-related derivative asset (liability):

Asset (liability) at January 1, 2008 $ 13,035

Total realized and unrealized gains (losses):

Included in earnings (135,205)

Included in other comprehensive income (11,374)

Purchases, issuances, and settlements 68,040

Asset (liability) at December 31, 2008 (65,504)

Total realized and unrealized gains (losses):

Included in earnings 22,208

Included in other comprehensive income 7,686

Purchases, issuances, and settlements 84,937

Asset (liability) at December 31, 2009 49,327

Total realized and unrealized gains (losses):

Included in earnings 8,412

Included in other comprehensive income •

Purchases, issuances, and settlements (9,557)

Asset (liability) at December 31, 2010 $ 48,182

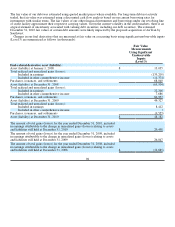

The amount of total gains (losses) for the year ended December 31, 2010, included

in earnings attributable to the change in unrealized gains (losses) relating to assets

and liabilities still held at December 31, 2010 $ 29,498

The amount of total gains (losses) for the year ended December 31, 2009, included

in earnings attributable to the change in unrealized gains (losses) relating to assets

and liabilities still held at December 31, 2009 $ 26,047

The amount of total gains (losses) for the year ended December 31, 2008, included

in earnings attributable to the change in unrealized gains (losses) relating to assets

and liabilities still held at December 31, 2008 $ (12,885)

92