Airtran 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other revenues for the year ended December 31, 2009, increased $113.6 million (81.8 percent) compared to the year

ended December 31, 2008, reflecting in large part pricing changes for ancillary customer services resulting from the

unbundling of our service product. Other revenues include change and cancellation fees, direct booking fees, revenues

derived from the sale of frequent flyer credits, baggage fees, and other miscellaneous revenues.

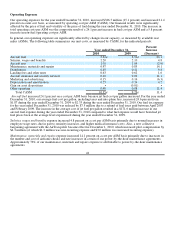

Operating Expenses

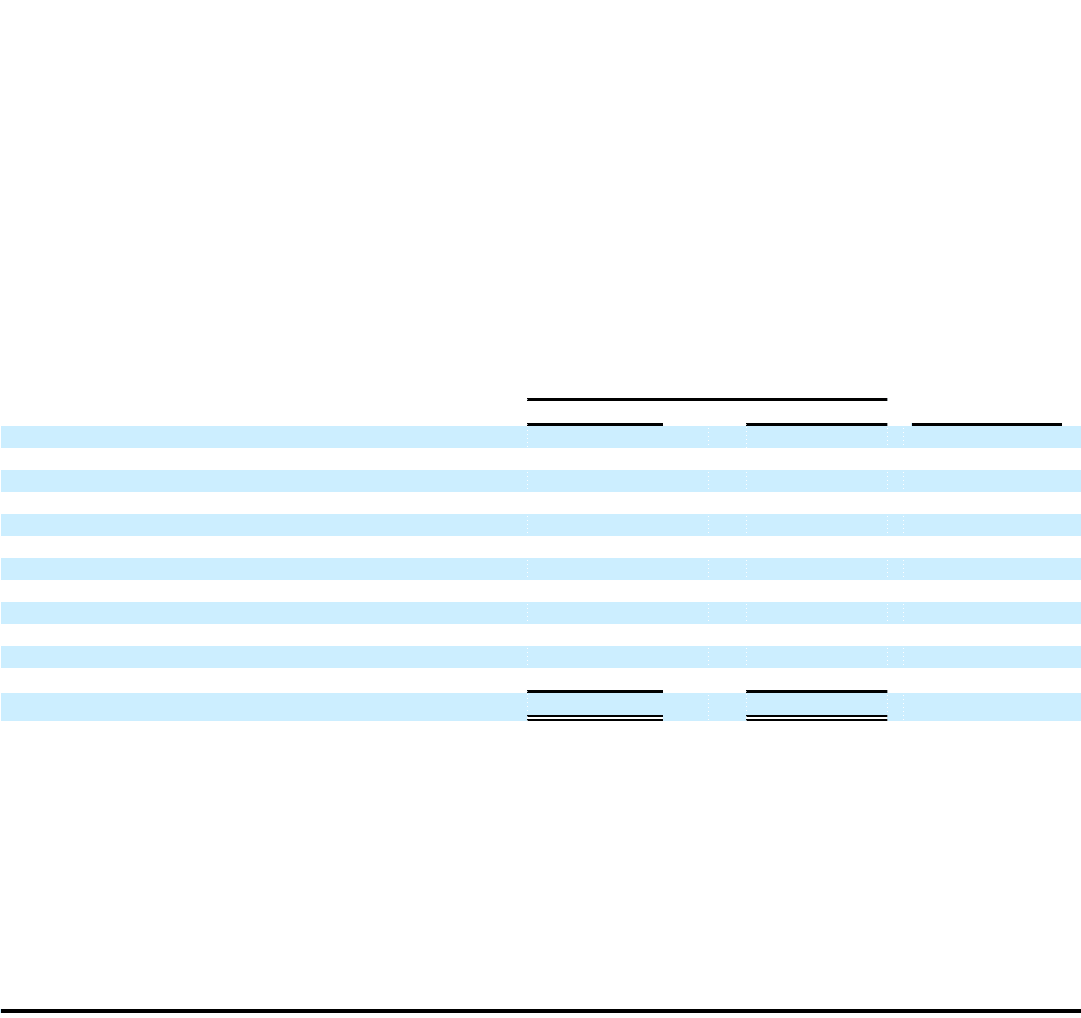

Our operating expenses for the year ended December 31, 2009, decreased $463.9 million (17.6 percent) and decreased

15.9 percent on a unit cost basis, as measured by operating cost per ASM (CASM) compared to the year ended December

31, 2008. Our financial results were significantly affected by the price of fuel and volatility of the price of fuel during the

year ended December 31, 2009. The decrease in total operating costs per ASM was the net result of a 42.0 percent

decrease in fuel cost per ASM and a 6.0 percent increase in non-fuel operating cost per ASM.

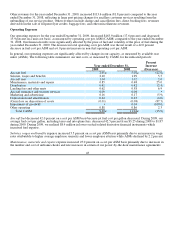

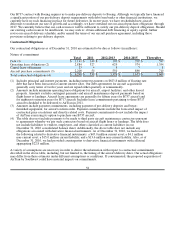

In general, our operating expenses are significantly affected by changes in our capacity, as measured by available seat

miles (ASMs). The following table summarizes our unit costs, as measured by CASM, for the indicated periods:

Year ended December 31, Percent

Increase

2009 2008 (Decrease)

Aircraft fuel 2.91¢ 5.02¢ (42.0)

Salaries, wages and benefits 2.10 1.99 5.5

Aircraft rent 1.04 1.02 2.0

Maintenance, materials and repairs 0.85 0.68 25.0

Distribution 0.41 0.42 (2.4)

Landing fees and other rents 0.62 0.58 6.9

Aircraft insurance and security services 0.09 0.09 •

Marketing and advertising 0.16 0.17 (5.9)

Depreciation and amortization 0.24 0.25 (4.0)

(Gain) loss on disposition of assets (0.01) (0.08) (87.5)

Impairment of goodwill • 0.04 (100.0)

Other operating 0.88 0.86 2.3

Total CASM 9.29¢ 11.04¢ (15.9)

Aircraft fuel decreased 42.0 percent on a cost per ASM basis because jet fuel cost per gallon decreased. During 2009, our

average fuel cost per gallon, including taxes and into-plane fees, decreased 42.5 percent from $3.25 during 2008 to $1.87

during 2009. During 2009, we realized $8.4 million in losses on fuel-related derivative financial instruments which

increased fuel expense.

Salaries, wages and benefits expense increased 5.5 percent on a cost per ASM basis primarily due to an increase in wage

rates attributable to higher average employee seniority and lower employee attrition while ASMs declined by 2.2 percent.

Maintenance, materials and repairs expense increased 25.0 percent on a cost per ASM basis primarily due to increases in

the number and cost of airframe checks and rate increases in certain of our power-by-the-hour maintenance agreements.

45