Airtran 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

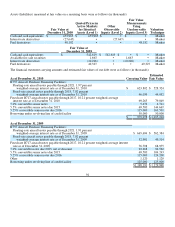

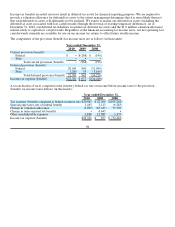

Compensation expense for our performance share awards was $1.0 million and $0.4 million for the years ended

December 31, 2010 and 2009, respectively. There was no expense for the year ended December 31, 2008. As of

December 31, 2010, we have $1.6 million in total unrecognized future compensation expense that will be recognized over

the next two years relating to awards for up to approximately 1.0 million performance share awards which were

outstanding at such date, but which had not yet vested.

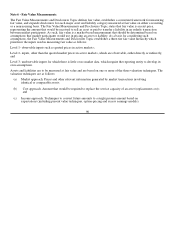

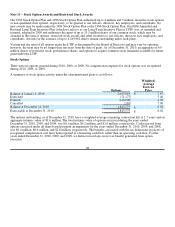

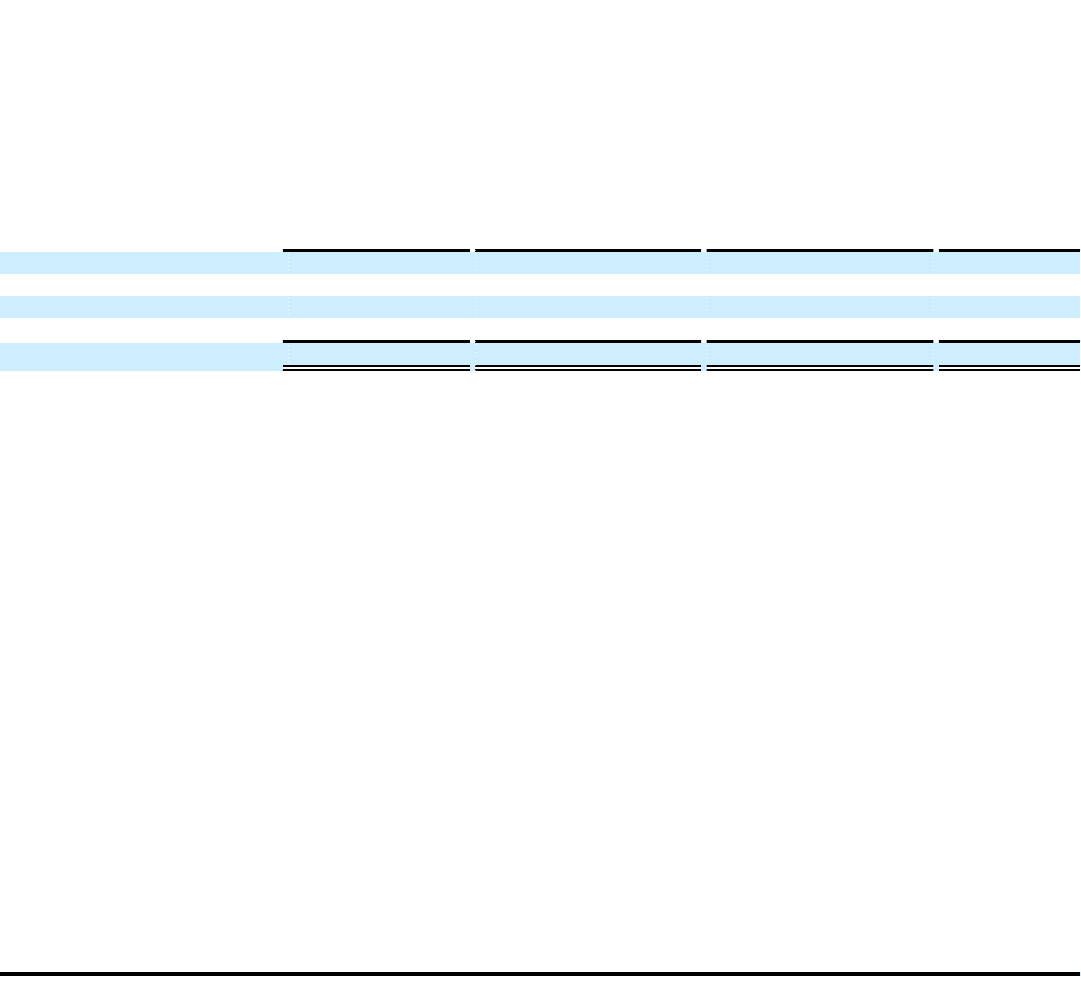

A summary of performance share activity under the aforementioned plan is as follows:

Performance Share

Awards

(at Target)

Weighted-Average Fair

Value

Remaining

Amortization Period

Intrinsic Value

Unvested at January 1, 2010 180,180 7.35

Vested • •

Issued 320,003 5.13

Surrendered • •

Unvested at December 31, 2010 500,183 5.93 1.7 $3,696,352

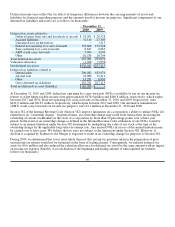

If the acquisition of AirTran by Southwest is consummated, each outstanding AirTran performance share will become

vested as to the target number (100%) of shares granted, and the applicable performance period will be deemed to have

terminated as of the completion of the Merger, such that the number of performance shares earned will be prorated to

reflect the shortened performance period.

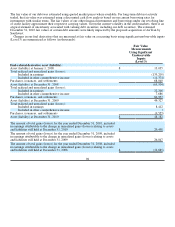

Note 12 – Employee Benefit Plans

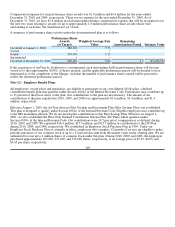

All employees, except pilots and mechanics, are eligible to participate in our consolidated 401(k) plan, a defined

contribution benefit plan that qualifies under Section 401(k) of the Internal Revenue Code. Participants may contribute up

to 15 percent of their base salary to the plan. Our contributions to the plan are discretionary. The amount of our

contributions to the plan expensed in 2010, 2009, and 2008 was approximately $1.6 million, $1.4 million, and $1.4

million, respectively.

Effective August 1, 2001, the AirTran Airways Pilot Savings and Investment Plan (Pilot Savings Plan) was established.

This plan is designed to qualify under Section 401(k) of the Internal Revenue Code. Eligible employees may contribute up

to the IRS maximum allowed. We do not match pilot contributions to this Pilot Savings Plan. Effective on August 1,

2001, we also established the Pilot-Only Defined Contribution Pension Plan (DC Plan) which qualifies under

Section 403(b) of the Internal Revenue Code. Our contributions were 10.5 percent of compensation, as defined, during

2010, 2009, and 2008. We expensed $18.4 million, $17.3 million, and $15.7 million in contributions to the DC Plan

during 2010, 2009, and 2008, respectively. We established an Employee Stock Purchase Plan in 1995. Under our

Employee Stock Purchase Plan as currently in effect, employees who complete 12 months of service are eligible to make

periodic purchases of our common stock at up to a 15 percent discount from the market value on the offering date. We are

authorized to issue up to 4 million shares of common stock under this plan. During 2010, 2009, and 2008, the employees

purchased approximately 205,000, 227,000, and 376,000 shares, respectively, at an average price of $5.45, $4.85, and

$3.65 per share, respectively.

100