Airtran 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fuel

Aircraft fuel is our largest expenditure and accounted for 34.8 percent, 31.4 percent, and 45.5 percent of our 2010, 2009,

and 2008 operating expenses, respectively. Increases in fuel prices or a shortage of supply could have a material adverse

effect on our operations and operating results. Efforts to reduce our exposure to increases in the price of aviation fuel have

included the utilization of both fuel pricing arrangements in purchase contracts with fuel suppliers and derivative financial

instruments. As of December 31, 2010, we had no fixed pricing arrangements with fuel suppliers for any future period.

We have entered into various derivative financial instruments with financial institutions to reduce the variability of

ultimate cash flows associated with fluctuations in jet fuel prices. As of December 31, 2010, we had fuel-related option

agreements and we had no swap agreements or refinery-margin swap agreements. For a discussion of jet fuel-related

derivative financial instruments, see ITEM 8. “FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA, Note 3

– Financial Instruments.” Also, see ITEM 7A. “QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT

MARKET RISK – Aviation Fuel” for a discussion of the effects of future fuel prices.

The adverse impacts of high fuel prices are mitigated somewhat by our operation of relatively new fuel-efficient B737 and

B717 aircraft which comprise our fleet. While we believe the fuel efficiency of our fleet offers us an advantage over many

of our competitors who operate less fuel-efficient aircraft, increases in fuel costs which are not offset by the impact of

fuel-related derivative financial instruments or by fare increases will have an adverse effect on our future operating

margins.

Warranties, Maintenance, Repairs and Training

When we purchase aircraft we receive certain manufacturer warranties. The lengths of manufacturer warranties for

airframes and engines are established by mutual agreement and vary based on a numerous factors including: the identity

of the manufacturer; the identity of the customer; the number of aircraft ordered; the number of aircraft previously

ordered; whether the aircraft or engines are new production models, established production models, or production models

nearing the end of their expected manufacture; the demand for aircraft and engines in general and by specific type at the

time the purchase commitments are negotiated; and various other factors.

Our B737 airframes and our B737 engines are purchased with manufacturer warranties for specific limited periods which

we believe are within the range of customary warranty periods. Manufacturer warranties commence upon the date of

delivery of the applicable aircraft. The manufacturer warranties for all of our B717 airframes and engines have expired.

Manufacturer warranties for our B737 airframes and engines expire as the applicable aircraft and engines age.

We receive certain limited third party warranties when our aircraft and engines undergo maintenance and overhaul.

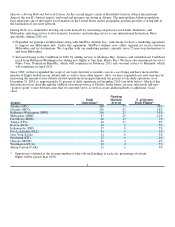

As of December 31, 2010, our aircraft fleet consisted of 86 B717 aircraft and 52 B737 aircraft having a collective

weighted-average age of 7.5 years. We expect our maintenance expenses to rise as the ages of our aircraft increase and as

manufacturer warranties expire. Maintenance costs also increase as the maintenance, repair, and overhaul providers

escalate their pricing. During 2011, we expect aircraft maintenance costs to increase due to the aging of both aircraft types

and an increased number of heavy checks for our B717 aircraft.

11