Airtran 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

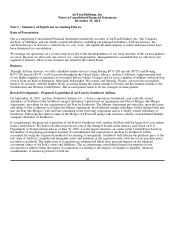

Intangible Assets

Excess of cost over fair value of net assets acquired (goodwill) and indefinite-lived intangibles, such as trade names, are

not amortized but are subject to periodic impairment tests. During the second quarter of 2008, because adverse industry

conditions and operating losses were indicators that our intangible assets may have been impaired, we prepared an

assessment and concluded that goodwill was impaired as of June 30, 2008, while our trade name and trademarks were not

impaired. The Company used current market capitalization, control premiums, discounted cash flows, and other factors as

best evidence of market value. Consequently, we recorded a charge of $8.4 million to write-off all of the gross carrying

value of our goodwill during the second quarter of 2008. There have been no subsequent changes to goodwill and

accumulated impairment losses as of December 31, 2010. We also performed the annual impairment test of the financial

statement carrying value of our trade name and trademarks in the fourth quarter of each year and concluded there was no

impairment.

Revenue Recognition

Passenger revenue is recognized when transportation is provided. Ticket sales for transportation which has not yet been

provided are recorded as air traffic liability. Air traffic liability represents tickets sold for future travel dates. The balance

of the air traffic liability fluctuates throughout the year based on seasonal travel patterns and fare sale activity. Passenger

revenue accounting is inherently complex and the measurement of the air traffic liability is subject to some uncertainty. A

nonrefundable ticket expires at the date of scheduled travel unless the customer exchanges the ticket in advance of such

date for a credit to be used by the customer as a form of payment. We recognize as revenue the value of a non-refundable

ticket at the date of scheduled travel unless the customer exchanges his or her ticket for a credit. A percent of credits we

issue expire unused. We recognize as revenue over time the value of credits that we expect to go unused in proportion to

the credits that are used. We estimate the amount of credits that we expect to go unused based on historical experience.

Estimating the amount of credits that will go unused involves some level of subjectivity and judgment. Changes in our

estimate of the amount of unused credits could have a material effect on our revenues.

Other revenue is recognized when the service is provided. Other revenues include fees for baggage, change fees, special

services fees, and pet fees. Fees for services that have not been provided are included as a component of air traffic

liability.

We are required to collect certain taxes and fees on our passenger tickets. These taxes and fees include U.S. federal

transportation taxes, federal security charges, airport passenger facility charges, and foreign arrival and departure taxes.

These taxes and fees are assessments on the customer. We have a legal obligation to act as a collection agent. Because we

do not retain these taxes and fees, we do not include such amounts in passenger revenue. We record a liability when the

amounts are collected and relieve the liability when payments are made to the applicable government agency.

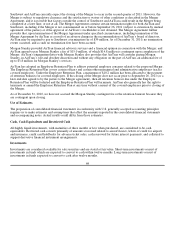

Frequent Flyer Program

We accrue a liability for the estimated incremental cost of providing free travel for awards earned under our A+ Rewards

Program based on awards we expect to be redeemed on us or the contractual rate of expected redemption on other carriers.

Incremental cost includes the cost of fuel, catering, and miscellaneous direct costs, but does not include any costs for

aircraft ownership, maintenance, labor, or overhead allocation. We adjust this liability based on credits earned and

redeemed, changes in the estimated incremental costs, and changes in the A+ Rewards Program.

71