Airtran 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

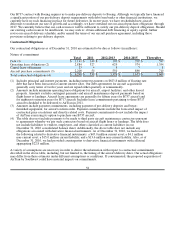

LIQUIDITY AND CAPITAL RESOURCES

At December 31, 2010, we had unrestricted cash and cash equivalents of $454.0 million, and we also had $49.2 million of

restricted cash. At December 31, 2010, we had $50 million outstanding under our revolving line of credit facility. During

2010, our primary sources of cash were cash provided by operating activities, borrowings under our revolving line of

credit facility, and borrowings to refinance aircraft related debt. Our primary uses of cash were repayment of debt,

including repayment of borrowings under our revolving line of credit facility, and expenditures for the acquisition of

property and equipment. As of January 31, 2011, we had no borrowings outstanding under our revolving line of credit

facility and a $50 million letter of credit had been issued under our letter of credit facility. The letter of credit beneficiary

was not entitled to draw any amounts as of December 31, 2010 or January 31, 2011.

2010 and 2009 Operating, Investing, and Financing Activities

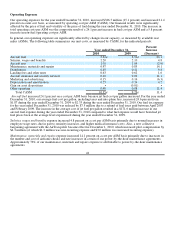

Operating activities in 2010 provided $160.8 million of cash flow compared to $118.2 million provided during 2009.

Cash flow from operating activities is related to both the level of our profitability and changes in working capital and

other assets and liabilities. Operating cash inflows are largely attributable to revenues derived from the transportation of

passengers. Operating cash outflows are largely attributable to recurring expenditures for fuel, labor, aircraft rent, aircraft

maintenance, marketing, and other activities. For the year ended December 31, 2010, we reported net income of $38.5

million compared to net income of $134.7 million for the year ended December 31, 2009.

Changes in the components of our working capital impact cash flow from operating activities. Changes in the air traffic

liability balance and the related accounts receivable balance have had a significant impact on our net cash flow from

operating activities. We have a liability to provide future air travel because travelers tend to purchase air transportation in

advance of their intended travel date. Advance ticket sales, which are recorded as air traffic liability, fluctuate seasonally

and also provide cash when we grow and consequently receive additional cash for future travel. This historical source of

cash will decline or change to a use to the extent our growth slows or reverses or the amounts held back by our credit card

processors increase. During 2010, our air traffic liability balance increased $25.1 million, contributing favorably to our net

cash flow from operating activities. During 2009, our air traffic liability balance decreased $25.2 million, negatively

impacting our net cash flow from operating activities. During 2010, our accounts receivable increased $9.9 million,

negatively impacting net cash provided by operating activities. During 2009, our accounts receivable decreased $8.7

million, contributing favorably to our net cash provided by operating activities. Changes in accounts payable, accrued, and

other current and non-current liabilities also impact our cash flow from operating activities. During 2010, our accounts

payable and accrued and other liabilities increased $14.2 million, contributing favorably to our net cash provided by

operating activities. During 2009, our accounts payable and accrued and other liabilities decreased $22.0 million,

negatively impacting net cash provided by operating activities.

Our Consolidated Statement of Cash Flow for the year ended December 31, 2010 includes a $2.6 million increase in cash

flow provided by operating activities pertaining to derivative financial instruments. We also provided deposits to interest

rate swap counterparties aggregating $3.6 million which required the use of cash.

47