Airtran 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

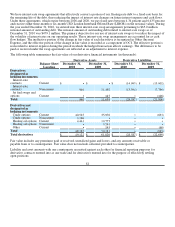

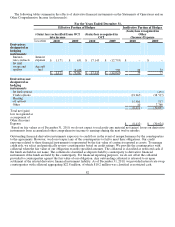

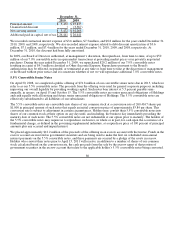

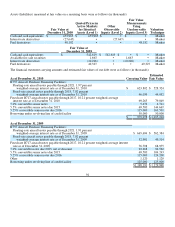

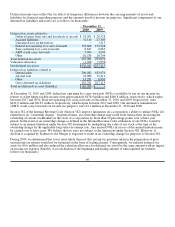

December 31,

2010 2009

Principal amount $ 5,472 $ 95,835

Unamortized discount • (3,567)

Net carrying amount $ 5,472 $ 92,268

Additional paid-in capital, net of tax $ 26,441 $ 26,441

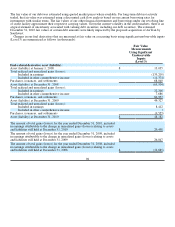

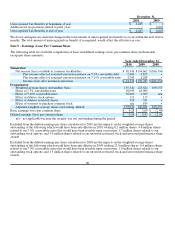

We recorded contractual interest expense of $3.6 million, $7.3 million, and $8.8 million for the years ended December 31,

2010, 2009, and 2008, respectively. We also recorded interest expense related to debt discount amortization of $3.6

million, $7.1 million, and $7.4 million for the years ended December 31, 2010, 2009, and 2008, respectively. At

December 31, 2010, the discount had been fully amortized.

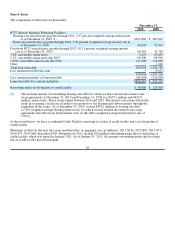

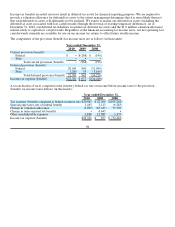

In 2009, our Board of Directors authorized, at management’s discretion, the repurchase, from time-to-time, of up to $50

million of our 7.0% convertible notes in open market transactions at prevailing market prices or in privately negotiated

purchases. During the year ended December 31, 2009, we repurchased $29.2 million of our 7.0% convertible notes

resulting in a gain of $4.3 million classified as Other (Income) Expense. Repurchases pursuant to the Board's

authorization may be effected, suspended, or terminated at any time or from time to time at the discretion of management

or the Board without prior notice and it is uncertain whether or not we will repurchase additional 7.0% convertible notes.

5.5% Convertible Senior Notes

On April 30, 2008, we completed a public offering of $74.8 million of our convertible senior notes due in 2015, which we

refer to as our 5.5% convertible notes. The proceeds from the offering were used for general corporate purposes including

improving our overall liquidity by providing working capital. Such notes bear interest at 5.5 percent payable semi-

annually, in arrears, on April 15 and October 15. The 5.5% convertible notes are senior unsecured obligations of Holdings

and rank equally with all existing and future senior unsecured obligations of Holdings. The 5.5% convertible notes are

effectively subordinated to all liabilities of our subsidiaries.

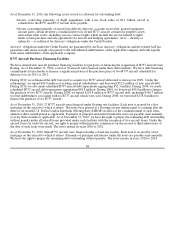

The 5.5% convertible notes are convertible into shares of our common stock at a conversion rate of 260.4167 shares per

$1,000 in principal amount of such notes that equals an initial conversion price of approximately $3.84 per share. This

conversion rate is subject to adjustment in certain circumstances. Holders may convert their 5.5% convertible notes into

shares of our common stock at their option on any day until, and including, the business day immediately preceding the

maturity date of such notes. The 5.5% convertible notes are not redeemable at our option prior to maturity. The holders of

the 5.5% convertible notes may require us to repurchase such notes, in whole or in part, for cash upon the occurrence of a

fundamental change, as defined in the governing supplemental indenture, at a repurchase price of 100 percent of principal

amounts plus any accrued and unpaid interest.

We placed approximately $12.2 million of the proceeds of the offering in an escrow account with the trustee. Funds in the

escrow account are invested in government securities and are being used to make the first six scheduled semi-annual

interest payments on the 5.5% convertible notes, and these payments are secured by a pledge of the assets in escrow.

Holders who convert their notes prior to April 15, 2011 will receive, in addition to a number of shares of our common

stock calculated based on the conversion rate, the cash proceeds from the sale by the escrow agent of that portion of

government securities in the escrow account that relate to the applicable holder’s 5.5% convertible notes being converted.

86