Airtran 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

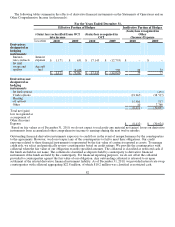

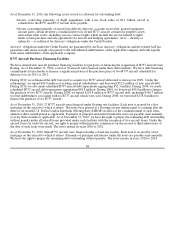

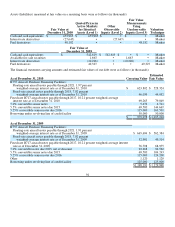

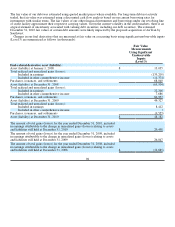

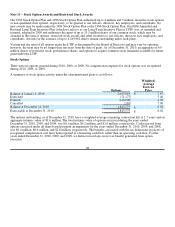

In connection with the Credit Facility, on October 31, 2008, we issued warrants expiring on October 31, 2011, to purchase

approximately 4.7 million shares of our common stock for $4.49 per share. The $8.6 million aggregate fair value of the

warrants at the date of issuance was recorded as debt issuance cost with a corresponding increase in paid in capital. The

amortization of the debt issuance cost is classified as interest expense. In September 2009, we entered into an agreement

whereby we issued and exchanged 2.9 million shares of our common stock for all of the previously issued and outstanding

warrants, which warrants were thereafter cancelled.

Note 5 – Leases

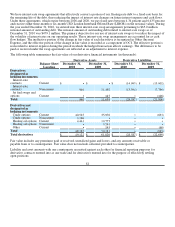

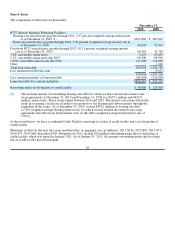

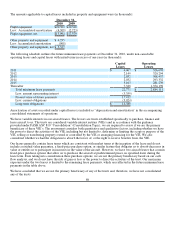

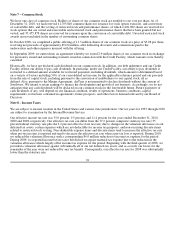

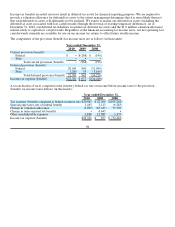

Total rental expense charged to operations for aircraft, facilities, and office space for the years ended December 31, 2010,

2009, and 2008 was approximately $331.1 million, $328.5 million, and $326.2 million, respectively.

We lease 78 B717 aircraft through various lessors under leases with terms that expire through 2022. We have the option to

renew the B717 leases for additional periods ranging from one to four years. The B717 leases have purchase options at or

near the end of the lease term at fair market value, and two have purchase options based on a stated percentage of the

lessor’s defined cost of the aircraft at the end of the thirteenth year of the lease term. Each of the leases contains return

conditions that must be met prior to the termination of the leases. Forty-one of the B717 leases are the result of sale/

leaseback transactions. Deferred gains from these transactions are included in other liabilities and are being amortized

over the terms of the leases. At December 31, 2010 and 2009, unamortized deferred gains, including gains on engine sale/

leasebacks, were $50.8 million and $54.6 million, respectively.

We lease 22 B737 aircraft through a single lessor under leases with terms that expire through 2021. We have the option to

extend the lease terms for additional periods ranging from 12 months to 39 months. There are no purchase options. Each

of the leases contains return conditions that must be met prior to the termination of the leases.

The B737 leases require us to remit monthly maintenance deposit payments to the lessor based on actual flight hours and

landings. The balance of such payments, which is capped at any point in time at $2.25 million for each aircraft, is

available to reimburse us for the cost of airframe, engine, and certain other component-part maintenance. There will be an

accounting at the end of each aircraft lease to ascertain if there is any excess balance of the deposit payments; if so, such

excess will be returned to us. These payments are accounted for as deposits and the aggregate amount of such deposits is

included in other assets. As of December 31, 2010 and 2009, the balance of all maintenance deposits for all the B737

leased aircraft and related leased engines aggregated $58.2 million and $55.8 million, respectively.

We also lease a variety of facilities including ticket counters, gates, hangers, offices, and reservations and training

facilities from local airport authorities, other carriers, and other parties under operating leases for terms ranging up to

2035. In addition, we lease spare engines, certain rotable parts, and our new operations control center under capital leases.

88