Airtran 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

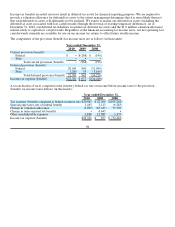

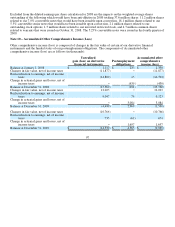

Restricted Stock

Restricted stock awards have been granted to certain of our officers, directors, and key employees pursuant to our LTIP.

Restricted stock awards are grants of shares of our common stock which typically vest over time (generally three years).

Compensation expense for our restricted stock grants was $5.4 million, $5.7 million, and $5.8 million during the years

ended December 31, 2010, 2009 and 2008, respectively. As of December 31, 2010, we have $3.7 million in total

unrecognized future compensation expense that will be recognized over the next three years relating to awards for

approximately 1.4 million restricted shares which were outstanding but which had not yet vested.

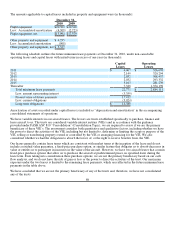

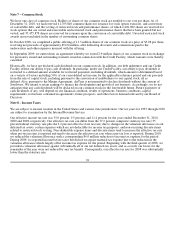

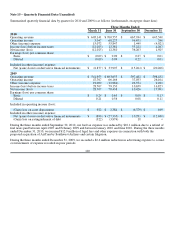

A summary of restricted stock activity under the aforementioned plan is as follows:

Restricted Stock Weighted-Average Fair

Value Remaining

Amortization Period Intrinsic Value

(in 000s)

Unvested at January 1, 2010 1,494,412 6.44

Vested (747,522) 7.38

Issued 669,031 4.68

Surrendered (9,900) 4.73

Unvested at December 31, 2010 1,406,021 5.11 1.7 $10,390

The grant date weighted-average fair value per share of restricted stock awards granted during the years ended

December 31, 2010, 2009, and 2008, was $4.68, $4.74, and $6.96, respectively. Unvested restricted stock awards are not

included in the number of outstanding common shares. Upon vesting, the shares are included in the number of outstanding

common shares. The total fair value of shares vested during the years ended December 31, 2010, 2009, and 2008, was

$3.8 million, $3.1 million, and $3.2 million, respectively.

If the acquisition of AirTran by Southwest is consummated, each outstanding share of AirTran restricted stock will

become fully vested.

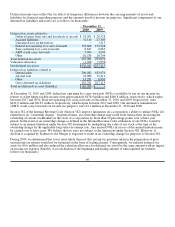

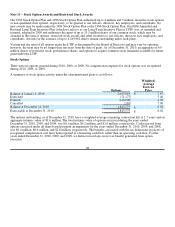

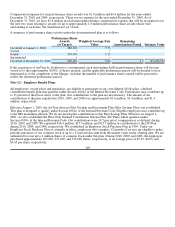

Performance Shares

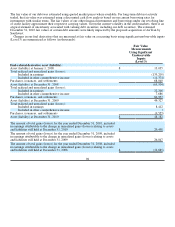

Our Long-Term Incentive Plan provides for the grant of performance share awards. In 2009 and 2010, performance share

awards were made to certain officers based on AirTran’s relative Total Shareholder Return (TSR) performance against a

peer group of companies. The actual number of shares earned at the end of the Performance Period will range from 0% to

a maximum of 200% of the target, depending on AirTran’s relative TSR performance. Payment of the earned

performance shares will be made in common stock. There are a maximum of 640,006 and 360,360 performance shares

issuable at the end of the performance period for awards made in 2010 and 2009, respectively. All existing performance

share awards are based on three-year performance periods which commenced as of January of the year in which grants

were made. There were no performance shares vested for the years ended December 31, 2010 and 2009.

99