Airtran 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

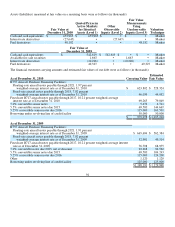

We have interest-rate swap agreements that effectively convert a portion of our floating-rate debt to a fixed-rate basis for

the remaining life of the debt, thus reducing the impact of interest rate changes on future interest expense and cash flows.

Under these agreements, which expire between 2016 and 2020, we pay fixed rates between 4.34 percent and 6.435 percent

and receive either three-month or six-month USD London Interbank Offered Rate (LIBOR) on the notional values. During

the year ended December 31, 2010, we entered into three interest-rate swap arrangements pertaining to $65.0 million

notional amount of outstanding debt. The notional amount of outstanding debt related to interest-rate swaps as of

December 31, 2010 was $479.1 million. The primary objective for our use of interest-rate swaps is to reduce the impact of

the volatility of interest rates on our operating results. These interest-rate swap arrangements are accounted for as cash

flow hedges. The ineffective portion of the change in fair value of each derivative is recognized in Other (Income)

Expense, and the effective portion of the change in fair value is recorded as a component of OCI. The effective portion is

reclassified to interest expense during the period in which the hedged transaction affects earnings. The differences to be

paid or received under the swap agreements are reflected as an adjustment to interest expense.

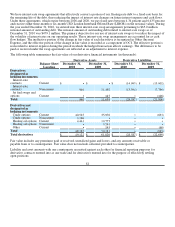

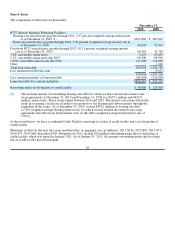

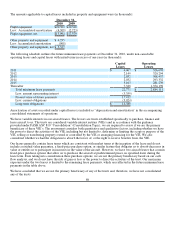

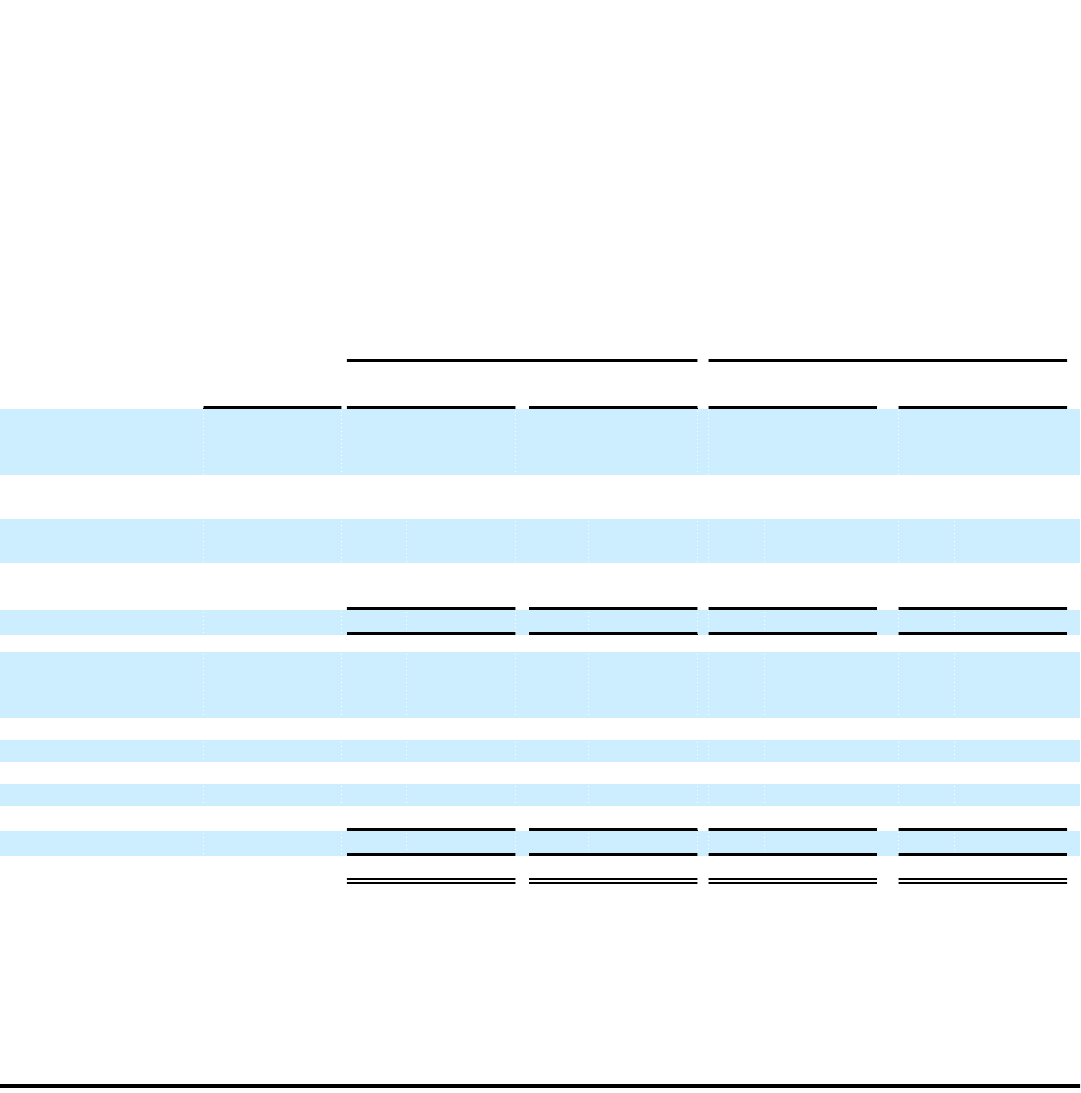

The following table summarizes the fair value of our derivative financial instruments (in thousands):

Derivative Assets Derivative Liabilities

Balance Sheet

Location December 31,

2010 December 31,

2009 December 31,

2010 December 31,

2009

Derivatives

designated as

hedging instruments

Interest-rate

contracts Current $ • $• $ (14,993) $ (13,902)

Interest-rate

contracts Noncurrent 940 11,492 (13,594) (7,796)

Jet fuel swaps and

options Current • 147 • (108)

Total 940 11,639 (28,587) (21,806)

Derivatives not

designated as

hedging instruments

Crude options Current 40,525 35,970 • (833)

Crude options Noncurrent 3,196 • • •

Heating oil options Current 4,461 10,775 • •

Heating oil options Noncurrent • 3,291 • •

Other Current • 145 • (60)

Total 48,182 50,181 • (893)

Total derivatives $ 49,122 $ 61,820 $ (28,587) $ (22,699)

Fair value includes any premiums paid or received, unrealized gains and losses, and any amounts receivable or

payable from or to counterparties. Fair value does not include collateral provided to counterparties.

Liability and asset amounts with one counterparty are netted against each other for financial reporting purposes for

derivative contracts entered into as one trade and for derivatives entered into for the purpose of effectively settling

open positions.

81