Airtran 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We provide postemployment defined benefits to certain eligible employees. At December 31, 2010, the liability for the

accumulated postemployment benefit obligations under the plans was $2.9 million, and unrecognized prior service costs

and net actuarial gains were $2.6 million. Benefit expense under the plans was $0.6 million, $1.0 million and $1.1 million

in 2010, 2009 and 2008, respectively. The plans have no assets and benefit payments are funded from operations and in all

periods presented are not material.

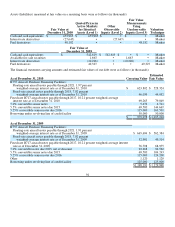

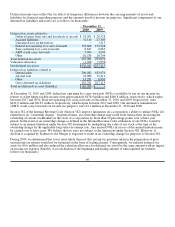

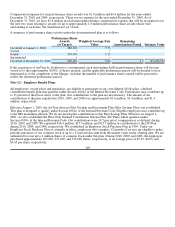

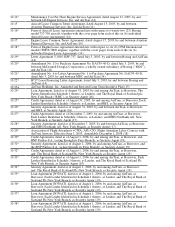

Note 13 – Supplemental Cash Flow Information

Supplemental cash flow information is summarized as follows (in thousands):

Year ended December 31,

2010 2009 2008

Supplemental disclosure of cash flow activities:

Cash paid for interest, net of capitalized interest $79,479 $77,238 $ 75,473

Cash paid (received) for income taxes, net of amounts refunded (332) (198) 332

Non-cash financing and investing activities:

Aircraft acquisition debt financing • • 178,550

Acquisition under capital leases 4,235 • 5,077

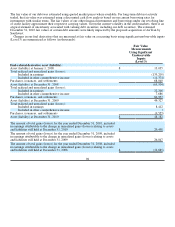

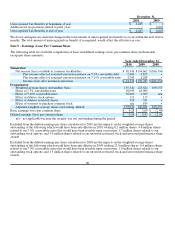

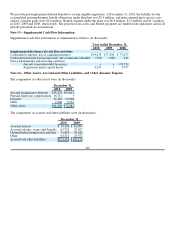

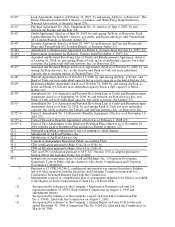

Note 14 – Other Assets, Accrued and Other Liabilities, and Other (Income) Expense

The components of other assets were (in thousands):

December 31,

2010 2009

Aircraft maintenance deposits $58,235 $55,841

Prepaid employee compensation 16,711 •

Deposits 14,384 13,906

Other 2,266 2,534

Other assets $91,596 $72,281

The components of accrued and other liabilities were (in thousands):

December 31,

2010 2009

Accrued interest $ 14,148 $ 16,897

Accrued salaries, wages and benefits 63,730 55,507

Unremitted passenger taxes and fees 31,982 29,198

Other 63,314 43,572

Accrued and other liabilities $173,174 $145,174

101