Airtran 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

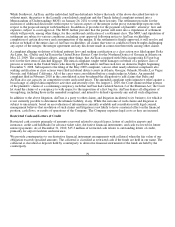

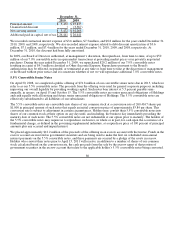

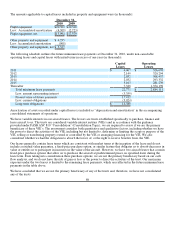

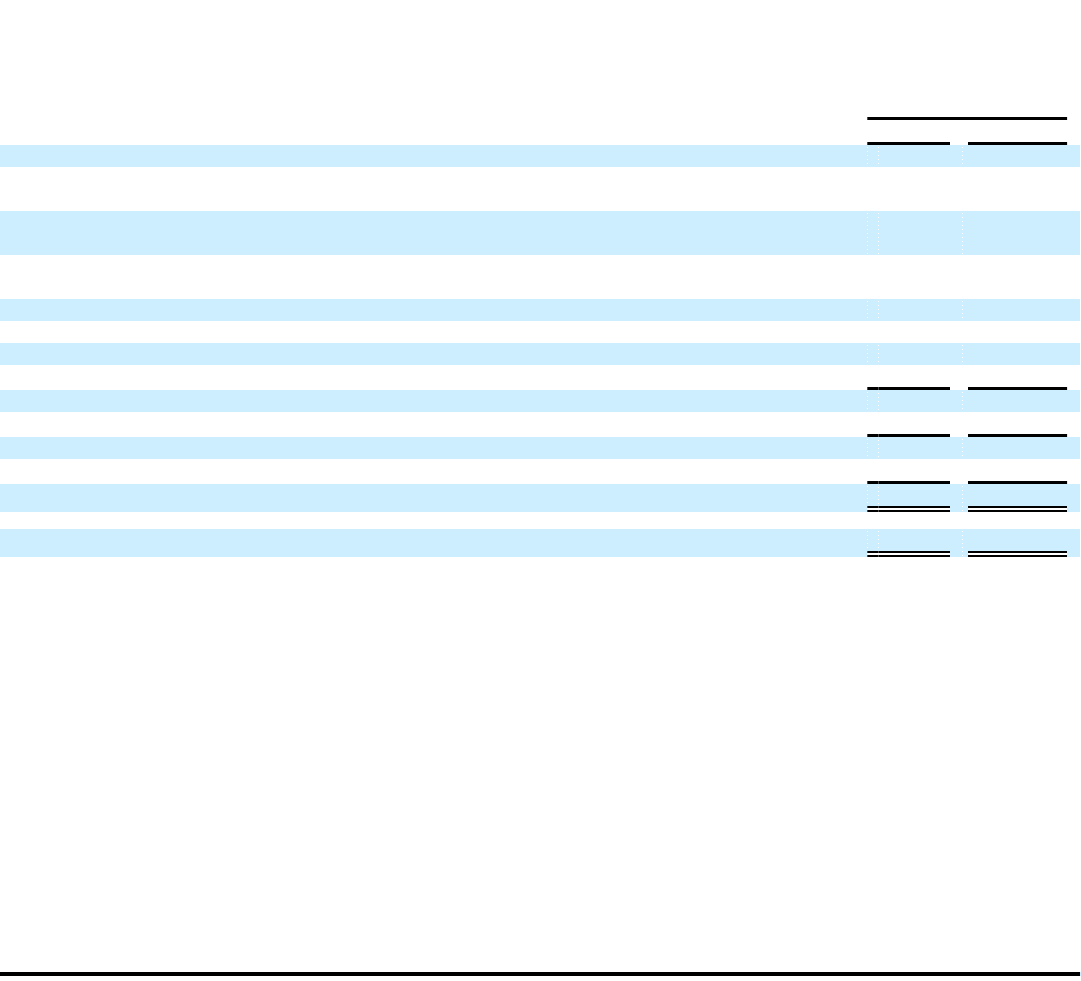

Note 4 –Debt

The components of debt were (in thousands):

December 31,

2010 2009

B737 Aircraft Purchase Financing Facilities:

Floating-rate aircraft notes payable through 2021, 1.97 percent weighted-average interest rate

as of December 31, 2010 (1) $623,802 $ 665,694

Fixed-rate aircraft notes payable through 2018, 7.02 percent weighted-average interest rate as

of December 31, 2010 46,039 52,901

Fixed-rate B717 aircraft notes payable through 2017, 10.21 percent weighted-average interest

rate as of December 31, 2010 69,265 76,708

7.0% convertible senior notes 5,472 95,835

5.5% convertible senior notes due 2015 69,500 69,500

5.25% convertible senior notes due 2016 115,000 115,000

Other • 1,120

Total long-term debt 929,078 1,076,758

Less unamortized debt discount • (3,632)

929,078 1,073,126

Less current maturities of long-term debt (66,459) (156,004)

Long-term debt less current maturities $862,619 $ 917,122

Borrowing under revolving line of credit facility $ 50,000 $ 125,000

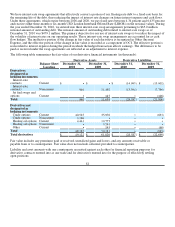

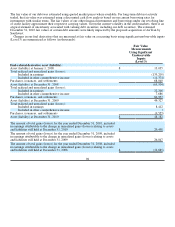

(1) The notional amount of outstanding floating-rate debt for which we have entered into interest-rate

swap agreements at December 31, 2010 and December 31, 2009 was $479.1 million and $447.0

million, respectively. These swaps expire between 2016 and 2020. The interest-rate swaps effectively

result in us paying a fixed rate of interest on a portion of our floating-rate debt securities through the

expiration of the swaps. As of December 31, 2010, we had $479.1 million of floating rate debt

(1.76% weighted average floating interest rate) for which we had entered into interest-rate swap

agreements that effectively fixed interest rates on this debt (weighted average fixed interest rate of

5.01%).

As discussed below, we have a combined Credit Facility consisting of a letter of credit facility and a revolving line of

credit facility.

Maturities of debt for the next five years and thereafter, in aggregate, are (in millions): 2011-$116; 2012-$63; 2013-$73;

2014-$72; 2015-$86; thereafter-$569. Maturities for 2011 include $50 million outstanding under the revolving line of

credit facility, which was repaid in January 2011. As of January 31, 2011, all amounts outstanding under the revolving

line of credit facility have been repaid.

83