Airtran 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

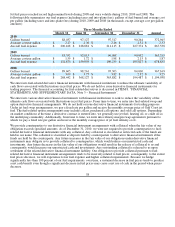

In 2009, our Board of Directors authorized, at management’s discretion, the repurchase, from time-to-time, of up to $50

million of our 7.0% convertible notes in open market transactions at prevailing market prices or in privately negotiated

purchases. During 2009, we repurchased $29.2 million of our 7.0% convertible notes resulting in a gain of $4.3 million.

During October 2009, we completed a public offering of $115.0 million of our 5.25% convertible senior notes due in 2016

and a public offering of 11.3 million shares of our common stock at a price of $5.08 per share. The net proceeds from the

two offerings aggregated $166.3 million, after deducting offering expenses, discounts and commissions paid to the

underwriters. The net proceeds were used for general corporate purposes including improving our overall liquidity.

See ITEM 8. “FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA, Note 4 – “Debt” for additional

information regarding our outstanding debt.

Year 2011 Cash Requirements and Potential Sources of Liquidity

Our 2011 cash flows will be impacted by a variety of factors including our operating results, payments of our debt and

capital lease obligations, and capital expenditure requirements. If consummated, the proposed acquisition of AirTran by

Southwest will have material impacts on the liquidity, sources and uses of liquidity, operating results, financial

commitments, and financial position of AirTran. The following discussion does not address the potential impacts of the

proposed acquisition of AirTran by Southwest.

Expenditures for acquisition of property and equipment, other than aircraft and aircraft parts, are anticipated to be

approximately $17 million during 2011. Additionally, during 2011, we currently have scheduled payments of $50 million

related to aircraft purchase commitments. Payments of current maturities of existing debt and capital lease obligations are

expected to aggregate $119.5 million during 2011, including the $50 million repaid in January 2011 under our revolving

line of credit facility.

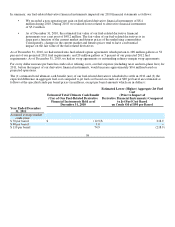

We may need cash resources to fund increases in collateral provided to counterparties to our derivative financial

arrangements and our cash flows may be adversely impacted in the event that one or more credit card processors

withholds amounts that would otherwise be remitted to us. We provide counterparties to our derivative financial

instrument arrangements with collateral when the fair value of our obligation exceeds specified amounts. Our obligation

to provide collateral pursuant to fuel-related derivative financial instrument arrangements tends to be inversely related to

fuel prices; consequently, to the extent fuel prices decrease, we will experience lower fuel expense and higher collateral

requirements. Because we hedge significantly less than 100 percent of our fuel requirements, over time, a sustained

decrease in fuel prices tends to produce a net cash benefit even though a significant decrease in fuel prices may cause a

net use of cash in the period when prices decrease. As of December 31, 2010, we provided interest rate swap

counterparties with collateral aggregating $22.8 million.

Each agreement with our two largest credit card processors allows, under specified conditions, the processor to retain cash

related to future travel that such processor otherwise would remit to us (a holdback). During 2010, we amended our

agreement with our largest credit card processor on terms favorable to us in part because of our improved operating

performance. As of December 31, 2010, we were in compliance with our processing agreements and our two largest credit

card processors were holding back no cash remittances from us. Our potential cash exposure to holdbacks by our largest

two credit card processors, based on advance ticket sales as of December 31, 2010, was $179.9 million (after considering

the $50 million letter of credit issued in favor of our largest credit card processor). Even had there been no letter of credit

issued for the benefit of our largest credit card processor, as of December 31, 2010, neither of our two largest credit card

processors would have been entitled to holdback any cash remittances from us. While we may be subject to holdbacks in

the future in accordance with the terms of our credit card processing agreements, based on our current liquidity and

current forecast, we do not expect that our two largest credit card processors would be entitled to holdback cash amounts

during 2011.

49