Airtran 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

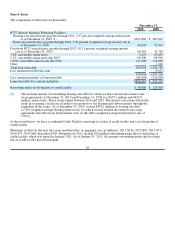

Advertising and Promotion Costs

Advertising costs are charged to expense in the period the costs are incurred. Advertising expense was approximately

$31.1 million, $31.3 million, and $35.7 million for the years ended December 31, 2010, 2009, and 2008, respectively.

From time to time, we enter into barter transactions whereby we acquire goods or services in exchange for future air travel

to be provided by us. We recognize operating expense based on the estimated fair value of travel to be provided by us.

Other Operating Expenses

Other operating expenses include various general and administrative expenses including, professional fees, audit fees,

legal fees, and property taxes. Additionally included in other operating expenses are ground handling and contracted

services at various station locations, deicing costs and overnight costs for our flight crews, including hotel costs and per

diem.

Other operating expenses for 2010 include $18.6 million of legal fees and other costs incurred in connection with both the

proposed acquisition of AirTran by Southwest and certain litigation.

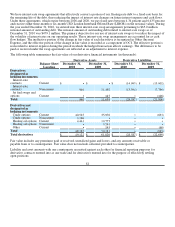

Derivative Financial Instruments

We recognize all of our derivative instruments as either assets or liabilities in the statement of financial position at fair

value. The accounting for changes in the fair value (i.e., unrealized gains or losses) of a derivative instrument depends on

whether it has been designated and qualifies as part of a hedging relationship and, further, on the type of hedging

relationship. For those derivative instruments that are designated and qualify as hedging instruments, a company must

designate the hedging instrument, based upon the exposure being hedged, as a fair-value hedge, cash flow hedge, or a

hedge of a net investment in a foreign operation.

For our derivative instruments that are designated and qualify as a cash flow hedge (i.e., hedging the exposure to

variability in expected future cash flows that is attributable to a particular risk), the effective portion of the gain or loss on

the derivative instrument is reported as a component of other comprehensive income (loss) and reclassified into earnings

in the same line item in which the forecasted transaction is reported in the same period or periods during which the hedged

transaction affects earnings (for example, in “interest expense” when the hedged transactions are interest cash flows

associated with floating-rate debt). The ineffective portion of the unrealized gain or loss on the cash flow hedges is

reported currently as Other (Income) Expense in our Consolidated Statements of Operations.

Income Taxes

We use the asset and liability method to account for income taxes whereby deferred tax assets and liabilities are

recognized based on the tax effects of temporary differences between the financial statement and the tax bases of assets

and liabilities, as measured at current enacted tax rates. When appropriate we evaluate the need for a valuation allowance

to reduce deferred tax assets.

73