Airtran 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

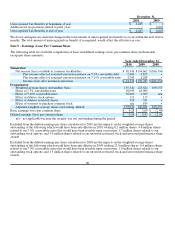

Excluded from the diluted earnings per share calculation for 2008 are the impacts on the weighted average shares

outstanding of the following which would have been anti-dilutive in 2008 totaling 37.6 million shares: 11.2 million shares

related to our 7.0% convertible notes that would have been issuable upon conversion, 18.1 million shares related to our

5.5% convertible senior notes that would have been issuable upon conversion, 2.1 million shares related to our

outstanding stock options, 1.5 million shares related to our unvested restricted stock, and 4.7 million common shares

related to warrants that were issued on October 31, 2008. The 5.25% convertible notes were issued in the fourth quarter of

2009.

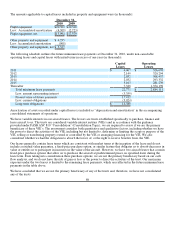

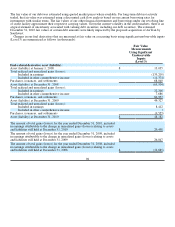

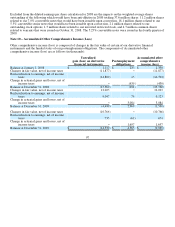

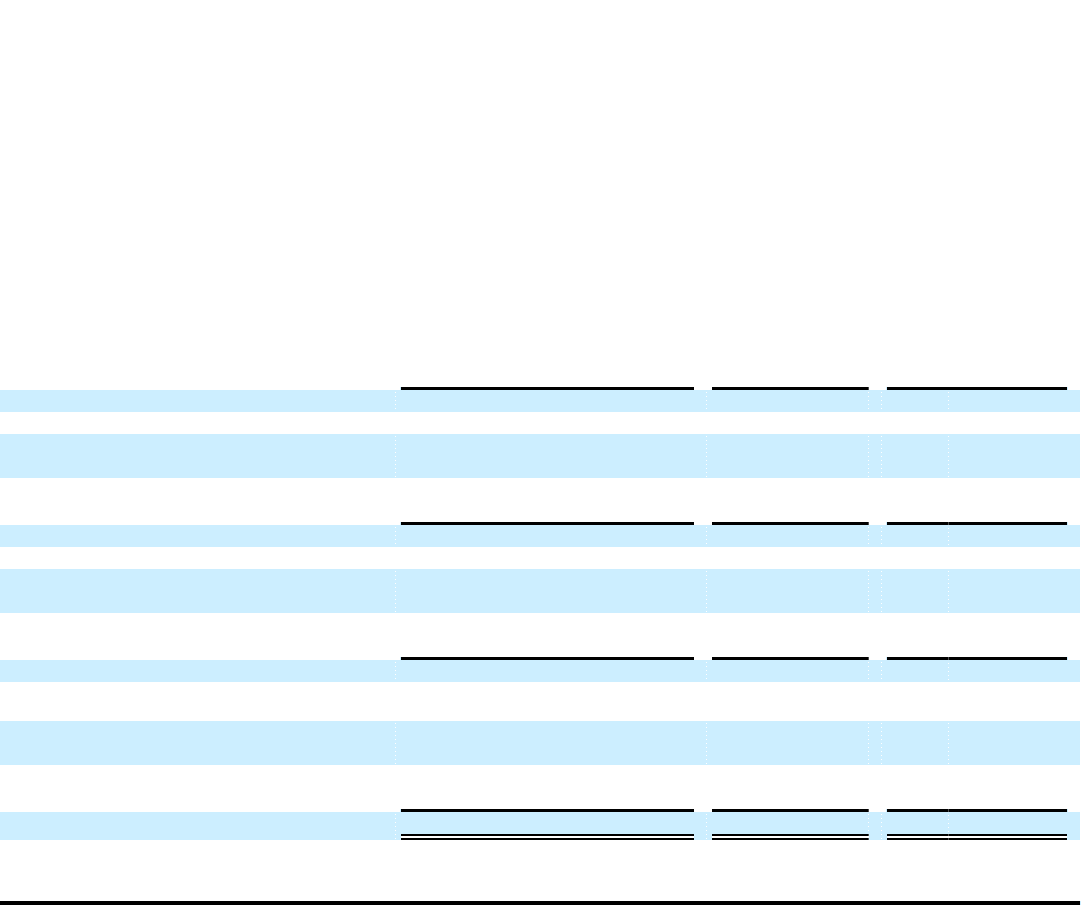

Note 10 – Accumulated Other Comprehensive Income (Loss)

Other comprehensive income (loss) is composed of changes in the fair value of certain of our derivative financial

instruments and the funded status of our postemployment obligations. The components of Accumulated other

comprehensive income (loss) are as follows (in thousands):

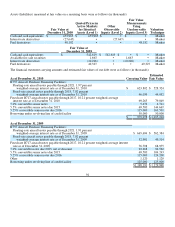

Unrealized

gain (loss) on derivative

financial instruments Postemployment

obligations

Accumulated other

comprehensive

income (loss)

Balance at January 1, 2008 $ 1,117 $ 233 $ 1,350

Changes in fair value, net of income taxes (11,877) • (11,877)

Reclassification to earnings, net of income

taxes (14,809) 15 (14,794)

Change in actuarial gains and losses, net of

income taxes • (439 ) (439)

Balance at December 31, 2008 (25,569) (191) (25,760)

Changes in fair value, net of income taxes 12,023 • 12,023

Reclassification to earnings, net of income

taxes 9,047 76 9,123

Change in actuarial gains and losses, net of

income taxes • 3,084 3,084

Balance at December 31, 2009 (4,499) 2,969 (1,530)

Changes in fair value, net of income taxes (10,766

) • (10,766)

Reclassification to earnings, net of income

taxes 735 (61) 674

Change in actuarial gains and losses, net of

income taxes • 1,657 1,657

Balance at December 31, 2010 $ (14,530) $ 4,565 $ (9,965)

97