Airtran 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

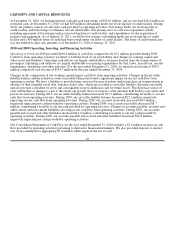

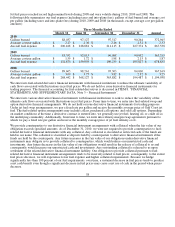

We believe we have options available to meet our debt repayment, capital expenditure needs, and operating commitments;

such options may include internally generated funds as well as various financing or leasing options, including the sale,

lease, or sublease of our aircraft or other assets. Additionally, we have a $50 million revolving line of credit facility, under

which $50 million and $0 borrowings were outstanding as of December 31, 2010, and January 31, 2011, respectively.

However, our future financing options may be limited because our owned aircraft are pledged to the lenders that provided

financing to acquire such aircraft, and we have pledged, directly or indirectly, a significant portion of our owned assets,

other than aircraft and engines, to collateralize our obligations under our Credit Facility. The counterparty to the Credit

Facility has agreed to release its lien on certain specified assets securing that facility in the event we seek to re-pledge

those assets in order to secure a new financing so long as the aggregate collateral value of the assets pledged under the

Credit Facility is at least equal to the amount then available under the Credit Facility.

We believe that our existing liquidity and forecasted 2011 cash flows will be sufficient to fund our operations and other

financial obligations in 2011. While we believe our 2011 forecast is reasonable, a combination of one or more material

and significant adverse events, most of which are outside of our direct control, could, depending on the severity and

duration thereof, have significant unfavorable impacts on our future cash flows. Such adverse events could include:

significant increases in fuel prices for an extended period of time, significant sustained declines in unit revenues as a

consequence of unfavorable macroeconomic or other conditions, or an increase in the percentage of advance ticket sales

held back by our credit card processors.

Credit Facility

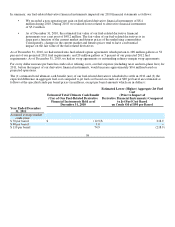

We have a combined secured letter of credit facility and a revolving line of credit facility. We refer to the combined letter

of credit facility and revolving line of credit facility as the Credit Facility, and we refer to its components as the letter of

credit facility and the revolving line of credit facility, respectively. The terms of the Credit Facility were amended

effective July 1, 2010. The following discussion summarizes the terms of the amended Credit Facility.

Under the revolving line of credit facility, we are permitted to borrow, upon two business days notice, up to $50 million

for general corporate purposes. Under the letter of credit facility, we are entitled to the issuance by a financial institution

of letters of credit up to a maximum aggregate amount of $50 million for the benefit of one or more of our credit card

processors. Amounts borrowed under the revolving line of credit facility bear interest at a rate of 12 percent per annum

and must be repaid within three business days to the extent that our aggregate unrestricted cash and investment amount

exceeds $450 million at any time. We may borrow once a month and are permitted to repay amounts borrowed at any time

without penalty. As of December 31, 2010 and 2009, we had $50 million and $125 million, respectively, in outstanding

borrowings under the revolving line of credit facility. We had no borrowings outstanding as of January 31, 2011. As of

December 31, 2010, the stated amount of the letter of credit issued for the benefit of our largest credit card processor was

$50 million. None of the letters of credit issued in favor of a processor have ever been drawn. The term of the

Credit Facility currently expires December 31, 2012.

50