Airtran 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

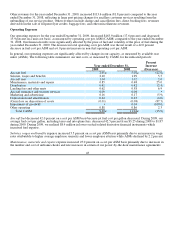

Distribution expense increased 9.8 percent on a cost per ASM basis primarily due to higher credit card commissions and

fees paid to global distribution systems and participants in other distribution channels. Credit card commissions increased

in large part due to increased unit revenue. Fees paid increased because there was a modest increase in tickets sold via

global distribution systems and other channels.

Aircraft insurance and security services expense increased 11.1 percent on a cost per ASM basis due to increased cost of

security services and an increase in hull and liability insurance rates.

Marketing and advertising costs decreased 6.3 percent on a cost per ASM basis due to planned decreases in marketing

costs.

Gain on asset dispositions for the year ended December 31, 2009 was ($3.0) million. Gain on asset dispositions pertains

primarily to aircraft related transactions. During the year ended December 31, 2009, we recognized: $2.4 million loss for

the write-off of capitalized interest related to the release in the second quarter 2009 of our obligation to purchase two

B737 aircraft which Boeing sold to an unrelated foreign airline; and, a $6.6 million gain pertaining primarily to the

deposits we previously received from the potential buyer who defaulted on its obligation to purchase two B737 aircraft in

the third quarter.

Other operating costs increased 11.4 percent on a cost per ASM basis primarily due to increases in ground handling,

contracted services costs, and legal and other professional fees. Compared to 2009, airport operations expense increased

$8.4 million for catering, ground handling and other contracted services, professional and technical fees costs increased

$5.5 million, and legal fees increased $13.5 million. Our 2010 other operating costs include $18.6 million (of which $12.9

million was incurred in the fourth quarter) of legal fees and other expenses incurred in connection with both the proposed

acquisition of AirTran by Southwest Airlines and certain litigation.

Other (Income) Expense

Other (income) expense, net increased by $26.7 million to $68.3 million expense, net for 2010 compared to $41.7 million

expense, net for 2009. Other (income) expense, net includes interest income, interest expense, capitalized interest, net

(gains) losses on derivative financial instruments, and (gain) on extinguishment of debt.

Interest income decreased by $3.7 million from 2009 to $2.0 million for 2010. During 2009, we recorded a $3.3 million

gain classified as interest income upon the redemption of all of our investments in an enhanced cash investment fund.

Interest expense, including amortization of debt discount and debt issuance costs, decreased by $3.1 million from 2009 to

$80.8 million for 2010. The decrease was primarily due to the net effects of the following: the repurchase of $90.4 million

principal amount of our 7.0% convertible notes in July 2010; interest on our 5.25% convertible senior notes issued in

October 2009; two new aircraft notes related to aircraft delivered in September 2009; three new interest-rate swap

agreements; and expense associated with our Credit Facility.

We reported net gains on derivative financial instruments of ($8.4) million for 2010, compared to net gains of ($30.6)

million for 2009. Net (gains) losses on derivative financial instruments consist primarily of realized and unrealized gains

and losses on fuel-related derivatives which were not designated as hedges for financial accounting purposes. The fuel-

related derivative financial instrument gains for 2010 were primarily unrealized and resulted in an increase of the financial

statement carrying value of our fuel-related derivative assets.

During 2009, we repurchased $29.2 million of our 7.0% convertible notes resulting in a gain of $4.3 million.

43