Airtran 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

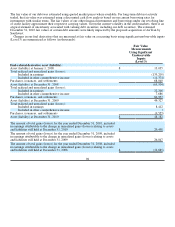

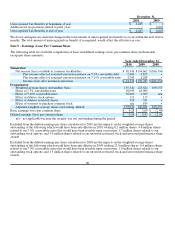

Income tax benefits recorded on losses result in deferred tax assets for financial reporting purposes. We are required to

provide a valuation allowance for deferred tax assets to the extent management determines that it is more likely than not

that such deferred tax assets will ultimately not be realized. We expect to realize our deferred tax assets (including the

deferred tax asset associated with loss carryforwards) through the reversal of existing temporary differences. As of

December 31, 2010, our deferred tax liabilities exceeded our deferred tax assets and the $1.0 million valuation allowance

related solely to capital loss carryforwards. Regardless of the financial accounting for income taxes, our net operating loss

carryforwards currently are available for use on our income tax returns to offset future taxable income.

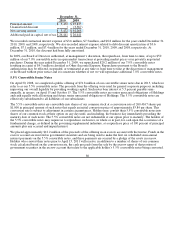

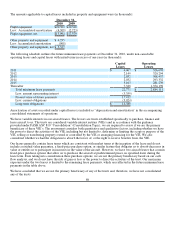

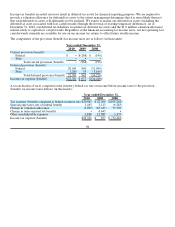

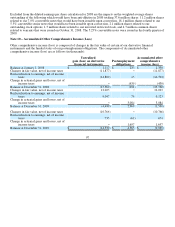

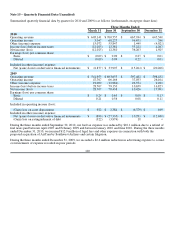

The components of the provision (benefit) for income taxes are as follows (in thousands):

Year ended December 31,

2010 2009 2008

Current provision (benefit):

Federal $ • $(268) $ (198)

State • • •

Total current provision (benefit) • (268) (198)

Deferred provision (benefit):

Federal 20,041 890 (31,049)

State 1,260 55 (3,169)

Total deferred provision (benefit) 21,301 945 (34,218)

Income tax expense (benefit) $21,301 $ 677 $(34,416)

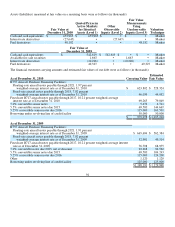

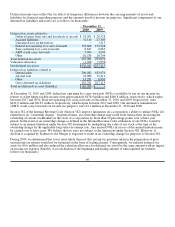

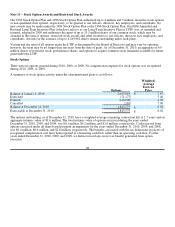

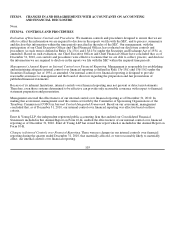

A reconciliation of taxes computed at the statutory federal tax rate on income before income taxes to the provision

(benefit) for income taxes follows (in thousands):

Year ended December 31,

2010 2009 2008

Tax expense (benefit) computed at federal statutory rate $20,945 $ 47,369 $(105,263)

State income taxes, net of federal benefit 1,463 3,113 (6,283)

Change in valuation allowance (3,995) (67,437) 73,793

Change in unrecognized tax benefits • 4,645 •

Other nondeductible expenses 2,888 12,987 3,337

Income tax expense (benefit) $21,301 $ 677 $ (34,416)

94