Air New Zealand 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

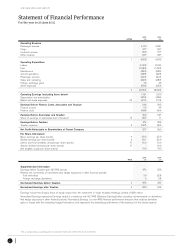

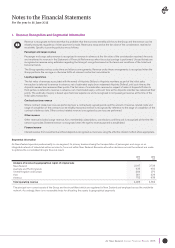

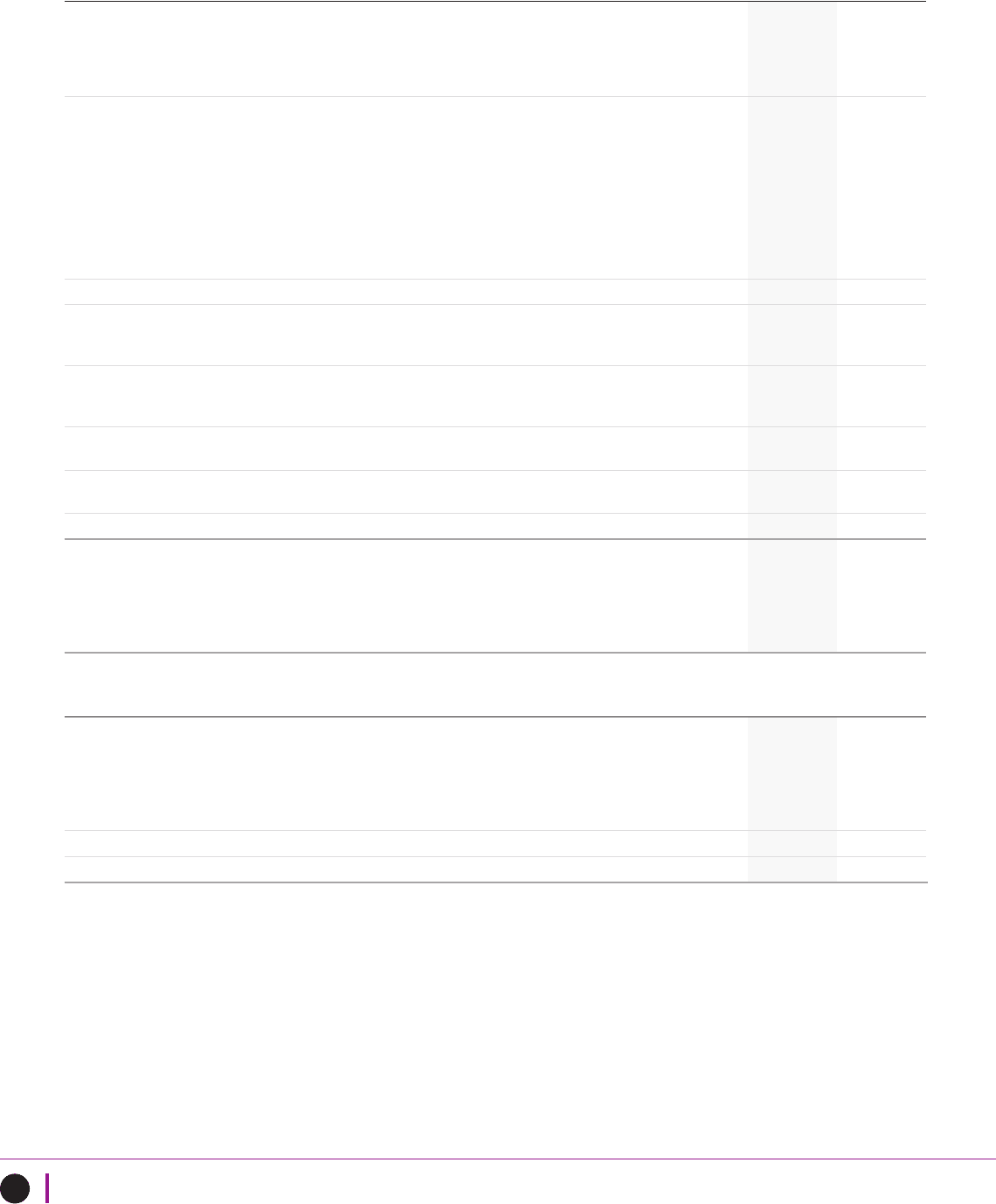

AIR NEW ZEALAND GROUP

The accompanying accounting policies and notes form part of these financial statements.

2

NOTES

2015

$M

2014

$M

Operating Revenue

Passenger revenue

Cargo

Contract services

Other revenue

4 ,113

317

258

237

3,851

287

277

237

Operating Expenditure

Labour

Fuel

Maintenance

Aircraft operations

Passenger services

Sales and marketing

Foreign exchange gains

Other expenses

1 4,925

(1,193)

(1,089)

(320)

(466)

(220)

(303)

79

(252)

4,652

(1,151)

(1,120)

(285)

(424)

(212)

(280)

45

(222)

2(3,764) (3,649)

Operating Earnings (excluding items below)

Depreciation and amortisation

Rental and lease expenses 20

1,161

(402)

( 211)

1,003

(436)

(174)

Earnings Before Finance Costs, Associates and Taxation

Finance income

Finance costs

548

56

(108)

393

44

(90)

Earnings Before Associates and Taxation

Share of earnings of associates (net of taxation) 12

496

(22)

347

11

Earnings Before Taxation

Taxation expense 3

474

(147)

358

(95)

Net Profit Attributable to Shareholders of Parent Company 327 263

Per Share Information:

Basic earnings per share (cents)

Diluted earnings per share (cents)

Interim and final dividends declared per share (cents)

Special dividend declared per share (cents)

Net tangible assets per share (cents)

4

4

17

17

29.2

29.1

16.0

-

166

23.9

23.6

10.0

10.0

160

NOTE

2015

$M

2014

$M

Supplementary Information

Earnings before Taxation (per NZ IFRS above)

Reverse net movements on derivatives that hedge exposures in other financial periods:

Fuel derivatives

Foreign exchange derivatives

474

20

2

358

(23)

(3)

Normalised Earnings before Taxation 2496 332

Normalised Earnings after Taxation 2343 244

Earnings include the Group’s share of equity losses from the investment in Virgin Australia Holdings Limited of $29 million.

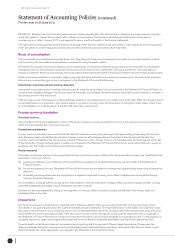

Normalised Earnings represents Earnings stated in compliance with NZ IFRS (Statutory Earnings) after excluding net movements on derivatives

that hedge exposures in other financial periods. Normalised Earnings is a non-IFRS financial performance measure that matches derivative

gains or losses with the underlying hedged transaction, and represents the underlying performance of the business for the relevant period.

Statement of Financial Performance

For the year to 30 June 2015