Air New Zealand 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2015

Air New Zealand Annual Financial Results 2015 31

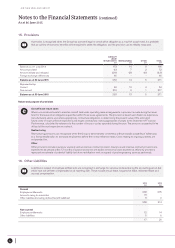

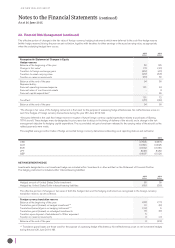

23. Financial Risk Management (continued)

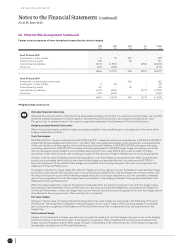

Impact of hedging foreign currency risk

The impact of the foreign currency hedging strategies (both hedge accounted and non hedge accounted) on the financial statements during the

year is set out below, by type of hedge.

CASH FLOW HEDGES OF FOREIGN CURRENCY RISK

Forecast operating revenue and expenditure transactions are not recognised in the financial statements until the transactions occur. The amounts

designated as the hedged item in qualifying cash flow hedges mirror the amounts designated as hedging instruments as set out below. All hedges

are at a spot foreign exchange risk.

The following foreign currency derivatives were recognised within ‘Derivative financial instruments’ on the Statement of Financial Position as at

reporting date and were designated as the hedging instrument in qualifying cash flow hedges of highly probable forecast operating revenue and

expenditure transactions. All derivatives mature within 12 months (30 June 2014: $1 million within 13 months).

2015

NZ$M

2014

NZ$M

Hedging instruments used

Derivative financial instruments

NZD

USD

AUD

EUR

JPY

GBP

OTHER

(276)

885

(165)

(46)

(182)

(85)

(80)

(500)

1,009

(260)

(61)

(49)

(95)

(83)

Hedge accounted foreign currency derivatives 51 (39)

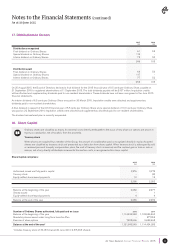

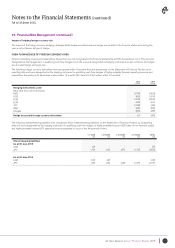

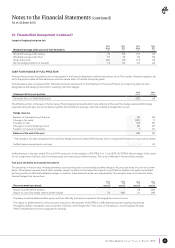

The following interest-bearing liabilities were recognised within ‘Interest-bearing liabilities’ on the Statement of Financial Position as at reporting

date and were designated as the hedging instrument in qualifying cash flow hedges of highly probable forecast USD sales of non financial assets

and highly probable forecast JPY operating revenue expected to occur in the time periods shown.

< 1 YEAR

$M

1-2 YEARS

$M

2-5 YEARS

$M

5+ YEARS

$M

TOTAL

$M

Interest-bearing liabilities

As at 30 June 2015

USD

JPY

(3)

(15)

-

(15)

-

(47)

-

(173)

(3)

(250)

As at 30 June 2014

USD

JPY

(10)

(13)

(2)

(14)

-

(43)

-

(147)

(12)

(217)