Air New Zealand 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND GROUP

Notes to the Financial Statements (continued)

As at 30 June 2015

28

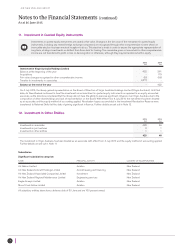

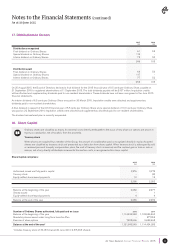

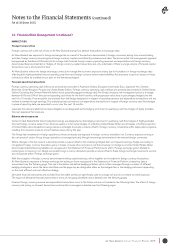

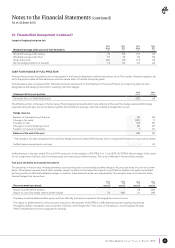

21. Capital Commitments

Commitments shown are for those asset purchases authorised and contracted for as at reporting date but not provided for in the

financial statements, converted at the year end exchange rate.

2015

$M

2014

$M

Aircraft and engines

Other property, plant and equipment and intangible assets

2,545

18

2,409

9

2,563 2,418

Commitments as at reporting date include nine Boeing 787-9 aircraft (delivery from 2015 to 2018 calendar years), three Airbus A320s

(delivery in 2015 and 2016 calendar years), three Airbus A321 NEOs and ten Airbus A320 NEOs (delivery from 2017 to 2019 calendar years)

and seven ATR72-600s (delivery from 2015 to 2016 calendar years).

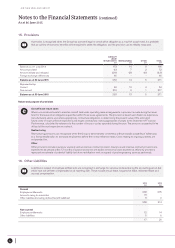

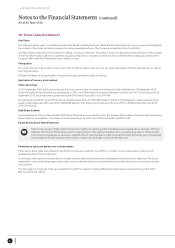

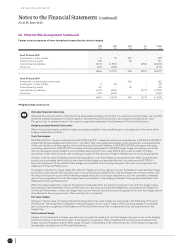

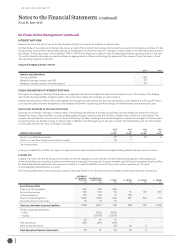

22. Contingent Liabilities

Contingent liabilities are subject to uncertainty or cannot be reliably measured and are not provided for. Disclosures as to the

nature of any contingent liabilities are set out below. Judgements and estimates are applied to determine the probability that an

outflow of resources will be required to settle an obligation. These are made based on a review of the facts and circumstances

surrounding the event and advice from both internal and external parties.

2015

$M

2014

$M

Letters of credit and performance bonds 58 52

All significant legal disputes involving probable loss that can be reliably estimated have been provided for in the financial statements. There are

no contingent liabilities for which it is practicable to estimate the financial effect.

Air New Zealand is defending two class actions in the United States. One makes allegations of anti-competitive conduct against many airlines

in relation to pricing in the air cargo business. Following settlements, four airlines including Air New Zealand continue to defend the claim.

A similar, previously reported class action filed in Australia was discontinued against Air New Zealand in June 2014 resulting in legal costs of

over $3 million being recovered.

A second class action in the United States, alleges that Air New Zealand together with other airlines acted anti-competitively in respect of fares

and surcharges on trans-Pacific routes.

Allegations of anti-competitive conduct in the air cargo business in Hong Kong and Singapore were the subject of proceedings by the Australian

Competition and Consumer Commission (ACCC). Following a defended hearing, the Federal Court released its decision in October 2014, finding

in favour of Air New Zealand. The ACCC has appealed the decision. The appeal will be defended and is to be heard in August 2015.

In the event that a Court determined that Air New Zealand had breached competition laws, the Group would have potential liability for damages

or (in Australia) pecuniary penalties. No other significant contingent liability claims are outstanding at balance date.

The Group has a partnership agreement with Pratt and Whitney in relation to the Christchurch Engine Centre (CEC) (Note 12). By the nature of

the agreement, joint and several liability exists between the two parties. Total liabilities of the CEC are $76 million (30 June 2014: $82 million).

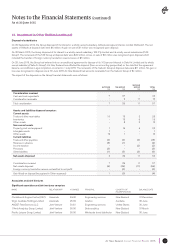

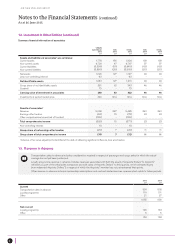

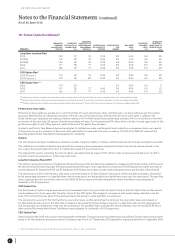

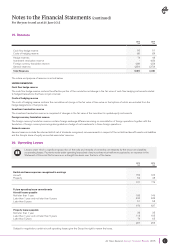

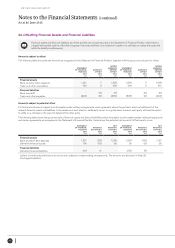

23. Financial Risk Management

Air New Zealand is subject to credit, foreign currency, interest rate and fuel price risks. These risks are managed with various financial instruments,

using a set of policies approved by the Board of Directors. Compliance with these policies is reviewed and reported monthly to the Board and is

included as part of the internal audit programme. Group policy is not to enter, issue or hold financial instruments for speculative purposes.

CREDIT RISK

Credit risk is the potential loss from a transaction in the event of default by a counterparty during the term of the transaction or on settlement of the

transaction. Air New Zealand incurs credit risk in respect of trade receivable transactions and other financial instruments in the normal course of

business. The maximum exposure to credit risk is represented by the carrying value of financial assets.

Air New Zealand places cash, short term deposits and derivative financial instruments with good credit quality counterparties, having a minimum

Standard and Poors credit rating of A. Limits are placed on the exposure to any one financial institution.

Credit evaluations are performed on all customers requiring direct credit. Air New Zealand is not exposed to any concentrations of credit risk within

receivables, other assets and derivatives. Air New Zealand does not require collateral or other security to support financial instruments with credit risk.

A significant proportion of receivables are settled through the International Air Transport Association (IATA) clearing mechanism which undertakes its

own credit review of members. Over 86% of trade and other receivables are current, with less than 1% falling due after more than 90 days.