Air New Zealand 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND GROUP

Notes to the Financial Statements (continued)

As at 30 June 2015

24

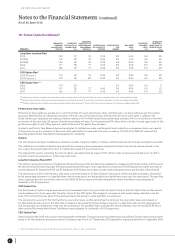

18. Share Capital (continued)

Kiwi Share

One fully paid special rights convertible share (the Kiwi Share) is held by the Crown. While the Kiwi Share does not carry any general Voting Rights,

the consent of the Crown as holder is required for certain prescribed actions of the Company as specified in the Constitution.

Non New Zealand nationals are restricted from holding or having an interest in 10 percent or more of voting shares unless the prior written consent

of the Kiwi Shareholder is obtained. In addition, any person that owns or operates an airline business is restricted from holding any shares in the

Company without the Kiwi Shareholder’s prior written consent.

Voting rights

On a show of hands or by a vote of voices, each holder of Ordinary Shares has one vote. On a poll, each holder of Ordinary Shares has one vote for

each fully paid share.

All Ordinary Shares carry equal rights to dividends and equal distribution rights on wind up.

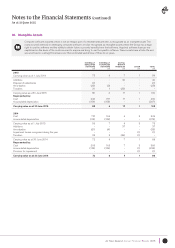

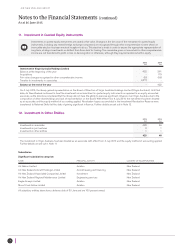

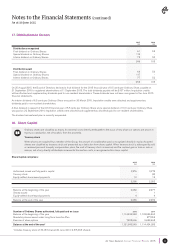

Application of treasury stock method

Share repurchase

On 30 September 2014, the Group announced that it was renewing the on-market share buyback facility established on 28 September 2012.

Under the facility Air New Zealand may purchase up to 3% or up to $66 million of its shares (whichever is lower) over the 12 month period to 29

September 2015. No shares were acquired during the 2015 financial year (30 June 2014: Nil).

During the year ended 30 June 2015 the Group utilised treasury stock of 2,481,280 Ordinary Shares to fulfil obligations under employee share-

based compensation plans (30 June 2014: 6,252,332 shares). Total treasury stock held as at 30 June 2015 is 34,090 shares (30 June 2014:

2,515,370 shares).

Staff Share Scheme

Unallocated shares of the Air New Zealand Staff Share Schemes are accounted for under the Treasury Stock method, and deducted from Ordinary

Share capital on consolidation. The number of unallocated shares as at 30 June 2015 was 93 (30 June 2014: 93).

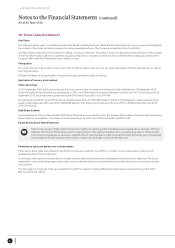

Equity-Settled Share-Based Payments

The fair value (at grant date) of performance share rights and options granted to employees is recognised as an expense, within the

Statement of Financial Performance, over the vesting period of the rights and options, with a corresponding entry to “Share Capital”.

The amount recognised as an expense is adjusted at each reporting date to reflect the extent to which the vesting period has expired

and management’s best estimate of the number of rights and share options that will ultimately vest.

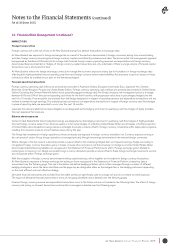

Performance rights and options over ordinary shares

Performance share rights were offered for the first time in the year ended 30 June 2015 to a number of senior executives on attainment of

predetermined performance objectives.

In prior years, share options were granted to a number of senior executives on attainment of predetermined performance objectives. The Group

undertakes a stock settled share appreciation rights scheme whereby shares are issued equating to the delta between the market price and the

exercise price.

The total expense recognised in the year ended 30 June 2015 in respect of equity-settled share-based payment transactions was $4 million

(30 June 2014: $4 million).