Air New Zealand 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2015

Air New Zealand Annual Financial Results 2015 23

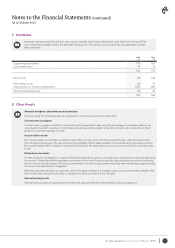

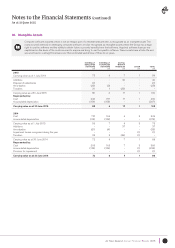

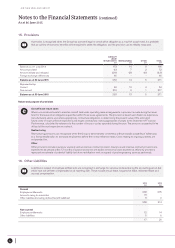

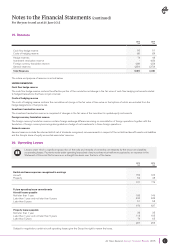

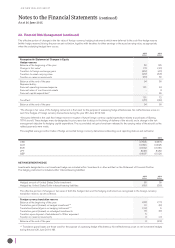

17. Distributions to Owners

2015

$M

2014

$M

Distributions recognised

Final dividend on Ordinary Shares

Special dividend on Ordinary Shares

Interim dividend on Ordinary Shares

61

112

73

55

-

50

246 105

Distributions paid

Final dividend on Ordinary Shares

Special dividend on Ordinary Shares

Interim dividend on Ordinary Shares

64

117

77

56

-

52

258 108

On 25 August 2015, the Board of Directors declared a final dividend for the 2015 financial year of 9.5 cents per Ordinary Share, payable on

21 September 2015 to registered shareholders at 11 September 2015. The total dividends payable will be $107 million. Imputation credits

will be attached and supplementary dividends paid to non-resident shareholders. These dividends have not been recognised in the June 2015

financial statements.

An interim dividend of 6.5 cents per Ordinary Share was paid on 20 March 2015. Imputation credits were attached and supplementary

dividends paid to non-resident shareholders.

A final dividend in respect of the 2014 financial year of 5.5 cents per Ordinary Share and a special dividend of 10.0 cents per Ordinary Share

was paid on 22 September 2014. Imputation credits were attached and supplementary dividends paid to non-resident shareholders.

The dividend reinvestment plan is currently suspended.

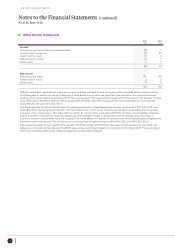

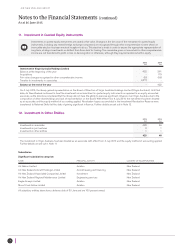

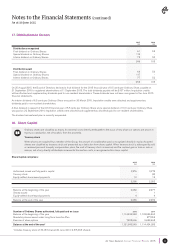

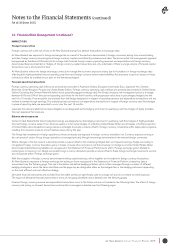

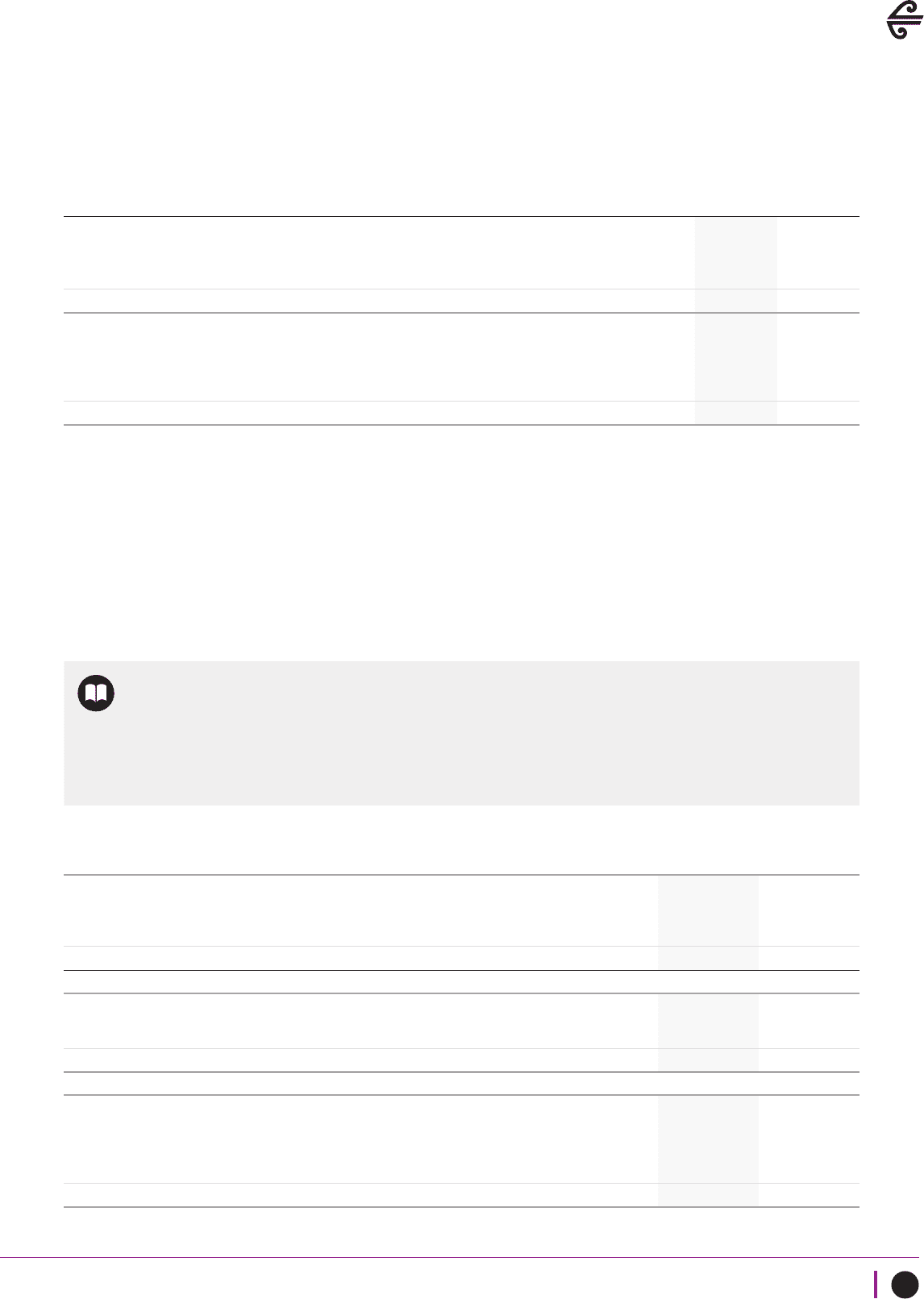

18. Share Capital

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new shares or options are shown in

equity as a deduction, net of taxation, from the proceeds.

Treasury stock

When shares are acquired by a member of the Group, the amount of consideration paid is recognised directly in equity. Acquired

shares are classified as treasury stock and presented as a deduction from share capital. When treasury stock is subsequently sold

or reissued pursuant to equity compensation plans, the cost of treasury stock is reversed and the realised gain or loss on sale or

reissue, net of any directly attributable incremental transaction costs, is recognised within share capital.

Share Capital comprises:

2015

$M

2014

$M

Authorised, issued and fully paid in capital

Treasury stock

Equity-settled share-based payments

2,276

-

10

2,273

(3)

12

2,286 2,282

Balance at the beginning of the year

Shares issued

Equity-settled share-based payments

2,282

-

4

2,277

1

4

Balance at the end of the year 2,286 2,282

Number of Ordinary Shares authorised, fully paid and on issue

Balance at the beginning of the year

Mandatory shares issued under Long Term Incentive Plan

Exercise of share options

2015

1,114,424,283

-

7,425,666

2014

1,103,924,560

877,055

9,622,668

Balance at the end of the year* 1,121,849,949 1,114,424,283

*Includes treasury stock of 34,183 shares (30 June 2014: 2,515,463 shares).