Air New Zealand 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2015

Air New Zealand Annual Financial Results 2015 21

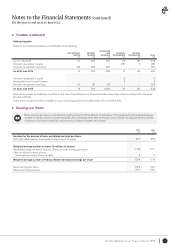

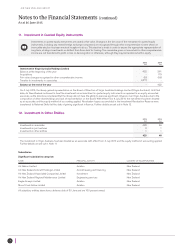

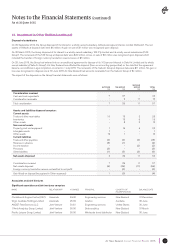

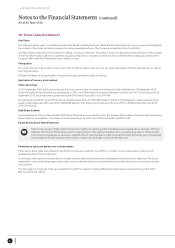

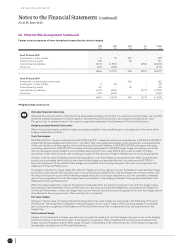

14. Interest-Bearing Liabilities

Borrowings, bonds and finance lease obligations are initially recognised at fair value, net of transaction costs incurred. They are

subsequently stated at amortised cost using the effective interest rate method, where appropriate. Borrowings, bonds and finance

lease obligations are classified as current liabilities unless the Group has an unconditional right to defer settlement of the liability

for more than 12 months after the balance date.

2015

$M

2014

$M

Current

Secured borrowings

Finance lease liabilities

46

207

22

168

253 190

Non-current

Secured borrowings

Unsecured bonds

Finance lease liabilities

466

150

1,453

191

150

1,202

2,069 1,543

Interest rates basis:

Fixed rate

Floating rate

830

1,492

727

1,006

At amortised cost 2,322 1,733

At fair value 2,314 1,671

The fair value of interest-bearing liabilities for disclosure purposes is calculated based on the present value of future principal and interest cash

flows, discounted at the market rate of interest for similar liabilities at reporting date.

All secured borrowings are secured over aircraft or aircraft related assets and are subject to floating interest rates.

The unsecured, unsubordinated fixed rate bonds have a maturity date of 15 November 2016 and an interest rate of 6.90% payable semi-annually.

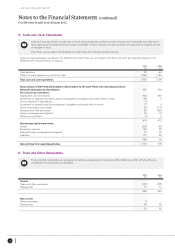

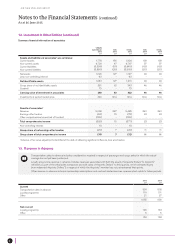

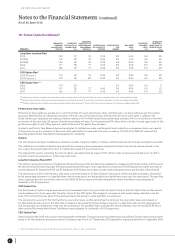

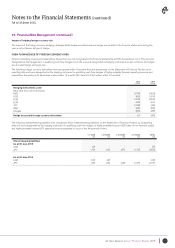

Finance lease liabilities

Payments made under finance leases are apportioned between the finance expense and the reduction of the outstanding liability.

The finance expense is allocated to each period during the lease term so as to produce a constant periodic rate of interest on the

remaining balance of the liability.

2015

$M

2014

$M

Repayable as follows:

Not later than 1 year

Later than 1 year and not later than 5 years

Later than 5 years

238

866

719

191

734

591

Less future finance costs

1,823

(163)

1,516

(146)

Present value of future rentals 1,660 1,370

Repayable as follows:

Not later than 1 year

Later than 1 year and not later than 5 years

Later than 5 years

207

777

676

168

654

548

1,660 1,370

Finance lease liabilities are secured over aircraft and are subject to both fixed and floating interest rates. Fixed interest rates ranged from 0.7

percent to 3.4 percent (30 June 2014: 0.5 percent to 4.1 percent). Purchase options are available on expiry or, if applicable under the lease

agreement, on early termination of the finance leases.