Air New Zealand 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND GROUP

Statement of Accounting Policies (continued)

For the year to 30 June 2015

8

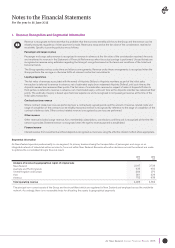

NZ IFRS 15 - Revenue from Contracts with Customers has not been adopted early. This standard has an objective of a single revenue recognition

model that applies to revenue from contracts with customers in all industries. This standard, which becomes effective for annual periods

commencing on or after 1 January 2017, is not expected to have a significant impact on the financial statements.

The significant accounting policies which are pervasive throughout the financial statements are set out below. Other significant accounting policies

which are specific to certain transactions or balances are set out within the particular note to which they relate.

Basis of consolidation

The consolidated financial statements include those of Air New Zealand Limited and its subsidiaries, accounted for using the acquisition method,

and the results of its associates and joint ventures, accounted for using the equity method.

All material intercompany transactions, balances and unrealised gains on transactions between group companies are eliminated on consolidation.

Unrealised losses are also eliminated unless the transaction provides evidence of an impairment of the asset transferred. Unrealised gains on

transactions between the Group, joint ventures and its associates are eliminated to the extent of the Group’s interest in the joint ventures and associates.

Where a business combination is achieved in stages, previously held equity interests in the acquiree are remeasured to fair value at the acquisition

date and any corresponding gain or loss is recognised in the Statement of Financial Performance.

Subsidiaries, associates and joint venture companies

Investments in associates and joint ventures are accounted for using the equity method and are measured in the Statement of Financial Position at

cost plus post-acquisition changes in the Group’s share of net assets, less dividends. Goodwill relating to associates and joint ventures is included in

the carrying amount of the investment.

If the carrying amount of the equity accounted investment exceeds its recoverable amount, it is written down to the latter. When the Group’s share of

accumulated losses in an associate or joint venture equals or exceeds its carrying value, the Group does not recognise further losses, unless it has

incurred obligations or made payments on behalf of the associate or joint venture.

Foreign currency translation

Functional currency

Items included in the financial statements of each of the Group’s entities are measured using the currency of the primary economic environment in

which the entity operates (the “functional currency”).

Transactions and balances

Foreign currency transactions are converted into the relevant functional currency using exchange rates approximating those ruling at transaction

date. Monetary assets and liabilities denominated in foreign currencies at the balance date are translated at the rate ruling at that date. Non-

monetary assets and liabilities that are measured in terms of historical cost in a foreign currency are translated using the exchange rate at the date

of the transaction. Foreign exchange gains or losses are recognised in the Statement of Financial Performance, except when deferred in equity as

qualifying cash flow hedges and qualifying net investment hedges.

Group companies

The results and financial position of all group entities that have a functional currency different from the presentation currency are translated into the

presentation currency as follows:

(a) assets and liabilities for each Statement of Financial Position presented are translated at the closing rate at the date of that Statement of

Financial Position;

(b) income and expenses for each Statement of Financial Performance are translated at exchange rates approximating those ruling at transaction

date; and

(c) all resulting exchange differences are recognised as a separate component of equity and in Other Comprehensive Income (within Foreign

Currency Translation Reserve).

On consolidation, exchange differences arising from the translation of the net investment in foreign entities, and of borrowings and other currency

instruments designated as hedges of such investments, are taken to equity.

Goodwill and fair value adjustments arising on the acquisition of a foreign entity are treated as assets and liabilities of the foreign entity and

translated at the closing rate.

Impairment

Non-financial assets are reviewed at each reporting date to determine whether there are any indicators that the carrying amount may not be

recoverable. If any such indicators exist, the asset’s recoverable amount is estimated. The recoverable amount is the higher of an asset’s fair value

less costs to sell and value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using a discount

rate that reflects current market assessments of the time value of money and the risks specific to the asset. An impairment loss is recognised in

the Statement of Financial Performance for the amount by which the asset’s carrying amount exceeds its recoverable amount. For the purposes of

assessing impairment, assets are grouped at the lowest level for which there are separately identifiable cash flows (cash-generating units).

Financial assets carried at amortised cost are assessed each reporting date for impairment. If there is objective evidence of impairment, the

difference between the asset’s carrying amount and the present value of estimated future cash flows, discounted at the financial asset’s original

effective interest rate, where appropriate, is recognised in the Statement of Financial Performance.