Air New Zealand 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND GROUP

Notes to the Financial Statements (continued)

As at 30 June 2015

22

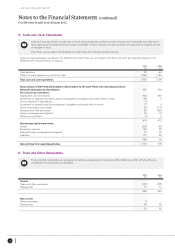

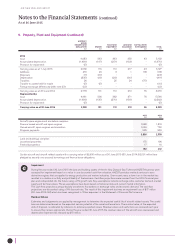

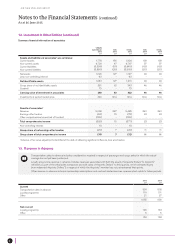

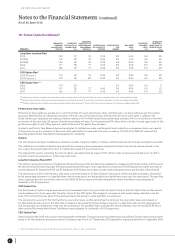

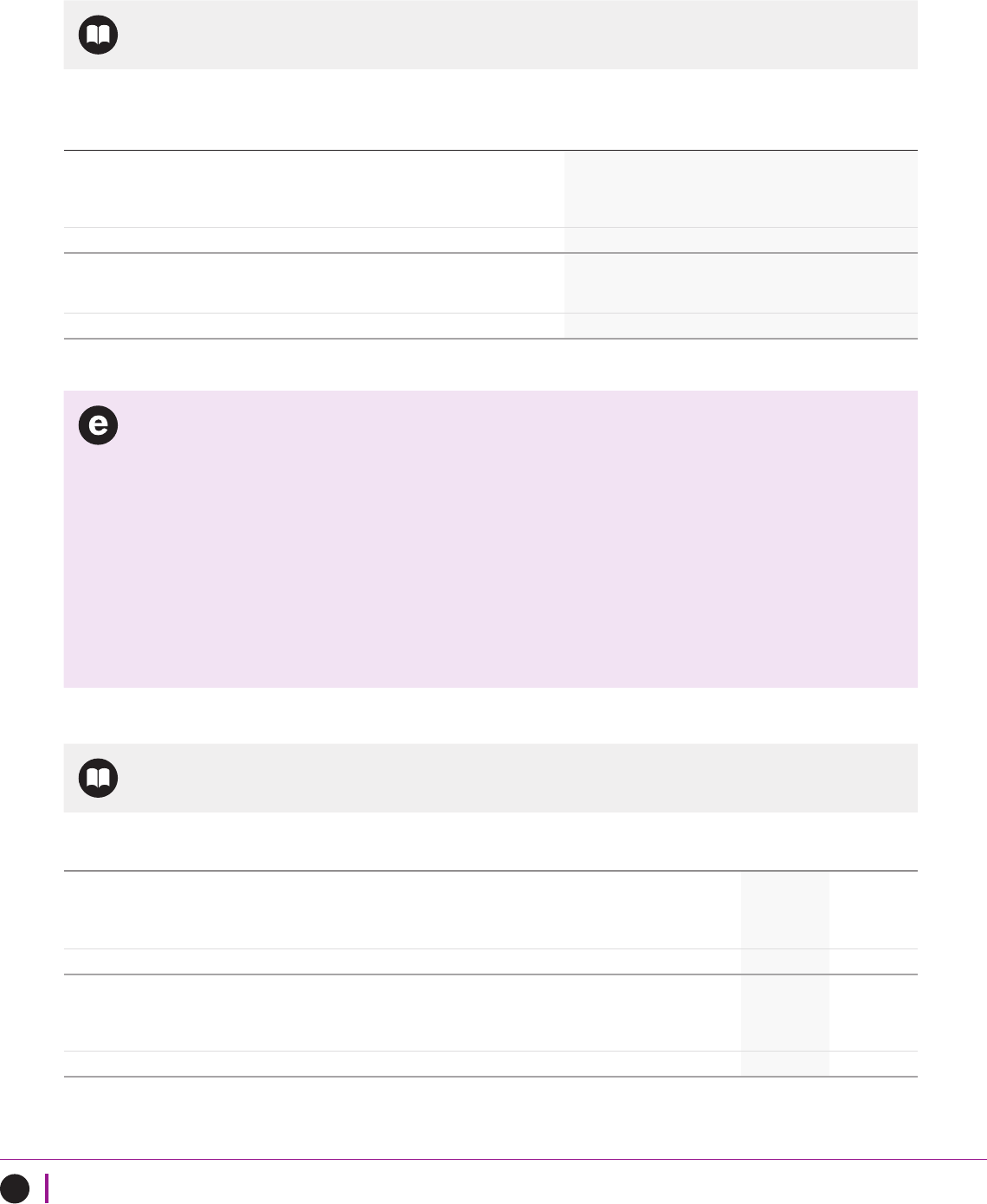

15. Provisions

A provision is recognised when the Group has a present legal or constructive obligation as a result of a past event, it is probable

that an outflow of economic benefits will be required to settle the obligation, and the provision can be reliably measured.

AIRCRAFT

LEASE

RETURN COSTS

$M

RESTRUCTURING

$M

OTHER

$M

TOTAL

$M

Balance as at 1 July 2014

Amount provided

Amount utilised and released

Foreign exchange differences

173

63

(29)

46

14

7

(8)

-

9

2

(6)

-

196

72

(43)

46

Balance as at 30 June 2015 253 13 5271

Represented by:

Current

Non-current

40

213

10

3

4

1

54

217

Balance as at 30 June 2015 253 13 5271

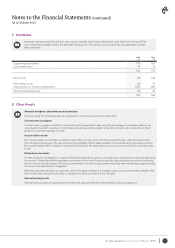

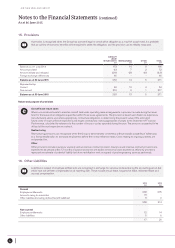

Nature and purpose of provisions

Aircraft lease return costs

Where a commitment exists to maintain aircraft held under operating lease arrangements, a provision is made during the lease

term for the lease return obligations specified within those lease agreements. The provision is based upon historical experience,

manufacturers’ advice and, where appropriate, contractual obligations in determining the present value of the estimated

future costs of major airframe inspections and engine overhauls by making appropriate charges to the Statement of Financial

Performance, calculated by reference to the number of hours or cycles operated during the year. The provision is expected to be

utilised at the next inspection or overhaul.

Restructuring

Restructuring provisions are recognised when the Group is demonstrably committed, without realistic possibility of withdrawal,

to a formal detailed plan to terminate employment before the normal retirement date. Costs relating to ongoing activities are

not provided for.

Other

Other provisions include insurance, warranty and an onerous contract provision. Insurance and onerous contract provisions are

expected to be utilised within 12 months. Insurance provisions are based on historical claim experience. Warranty provisions

represent an estimate of potential liability for future rectification work in respect of past engineering services performed.

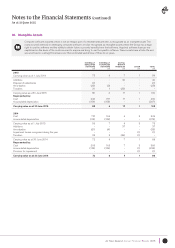

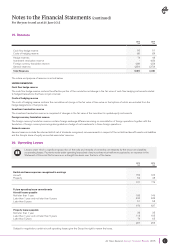

16. Other Liabilities

Liabilities in respect of employee entitlements are recognised in exchange for services rendered during the accounting period, but

which have not yet been compensated as at reporting date. These include annual leave, long service leave, retirement leave and

accrued compensation.

2015

$M

2014

$M

Current

Employee entitlements

Amounts owing to associates

Other liabilities (including defined benefit liabilities)

232

18

8

205

-

9

258 214

Non-current

Employee entitlements

Other liabilities

12

5

14

6

17 20