Air New Zealand 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2015

Air New Zealand Annual Financial Results 2015 19

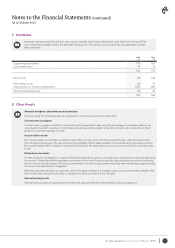

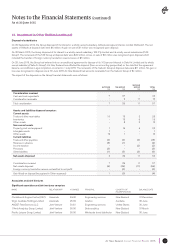

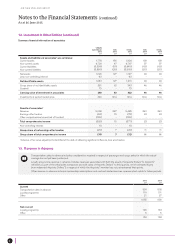

12. Investment in Other Entities (continued)

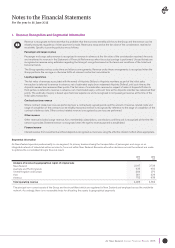

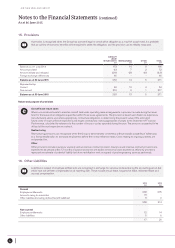

Disposal of subsidiaries

On 29 September 2014, the Group disposed of its interest in a wholly owned subsidiary, Altitude Aerospace Interiors Limited (‘Altitude’). The net

assets of Altitude at disposal date were $6 million. A gain on sale of $1 million was recognised upon disposal.

On 30 March 2015, the Group disposed of its interest in a wholly owned subsidiary, TAE Pty Limited and its wholly owned subsidiaries (‘TAE

Group’). The net assets of the TAE Group at disposal date were $39 million. A loss on sale of $5 million was recognised upon disposal which

included the transfer of foreign currency translation reserve losses of $5 million.

On 29 June 2015, the Group had entered into an unconditional agreement to dispose of its 100 percent interest in Safe Air Limited and its wholly

owned subsidiary (‘Safe Air Group’). Air New Zealand has effected the disposal (from an accounting perspective) on the date that the agreement

became unconditional. Legal completion occurred on 1 July 2015. The net assets of the Safe Air Group at disposal date were $11 million. No gain or

loss was recognised on disposal. As at 30 June 2015 Air New Zealand had amounts receivable from the Safe Air Group of $1 million.

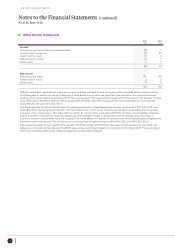

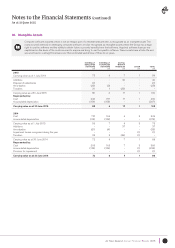

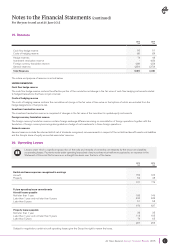

The impact of the disposals on the Group financial statements was as follows:

ALTITUDE

$M

TAE GROUP

$M

SAFE AIR

GROUP

$M

TOTAL

$M

Consideration received

Cash and cash equivalents

Consideration receivable

7

-

37

2

-

11

44

13

Total consideration 7 39 11 57

Assets and liabilities disposed comprise:

Current assets

Trade and other receivables

Inventories

Other assets

Non current assets

Property, plant and equipment

Intangible assets

Other assets

Current liabilities

Trade and other payables

Revenue in advance

Income taxation

Provisions

Other liabilities

10

-

-

1

1

12

(6)

(8)

-

(3)

(1)

13

13

8

16

-

1

(6)

(1)

-

-

(5)

2

6

5

6

-

-

(3)

-

(2)

-

(3)

25

19

13

23

1

13

(15)

(9)

(2)

(3)

(9)

Net assets disposed 639 11 56

Consideration received

Net assets disposed

Foreign currency translation reserve reclassified to net profit

7

(6)

-

39

(39)

(5)

11

(11)

-

57

(56)

(5)

Gain/(loss) on disposal (recognised in Other expenses) 1 (5) - (4)

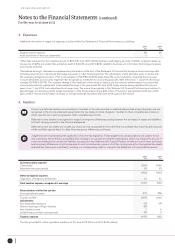

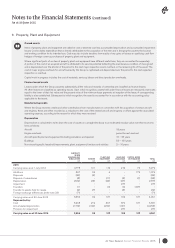

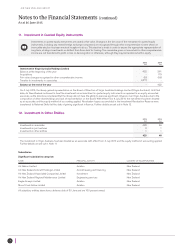

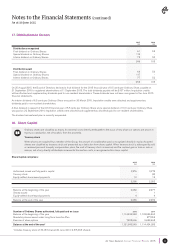

Associates and Joint Ventures

Significant associates and joint ventures comprise:

NAME RELATIONSHIP % OWNED PRINCIPAL COUNTRY OF BALANCE DATE

INCORPORATION

Christchurch Engine Centre (CEC) Associate 49.00 Engineering services New Zealand 31 December

Virgin Australia Holdings Limited Associate 25.92 Aviation Australia 30 June

ANZGT Field Services LLC Joint Venture 51.00 Engineering services United States 30 June

11Ants Analytics Group Limited Joint Venture 50.00 Data analytics New Zealand 31 March

Pacific Leisure Group Limited Joint Venture 50.00 Wholesale travel distributor New Zealand 30 June