Air New Zealand 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND GROUP

Notes to the Financial Statements (continued)

For the year to 30 June 2015

10

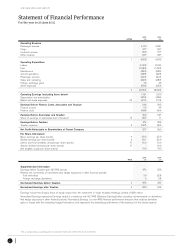

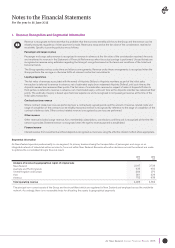

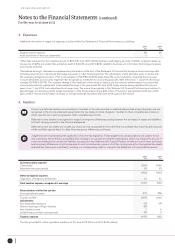

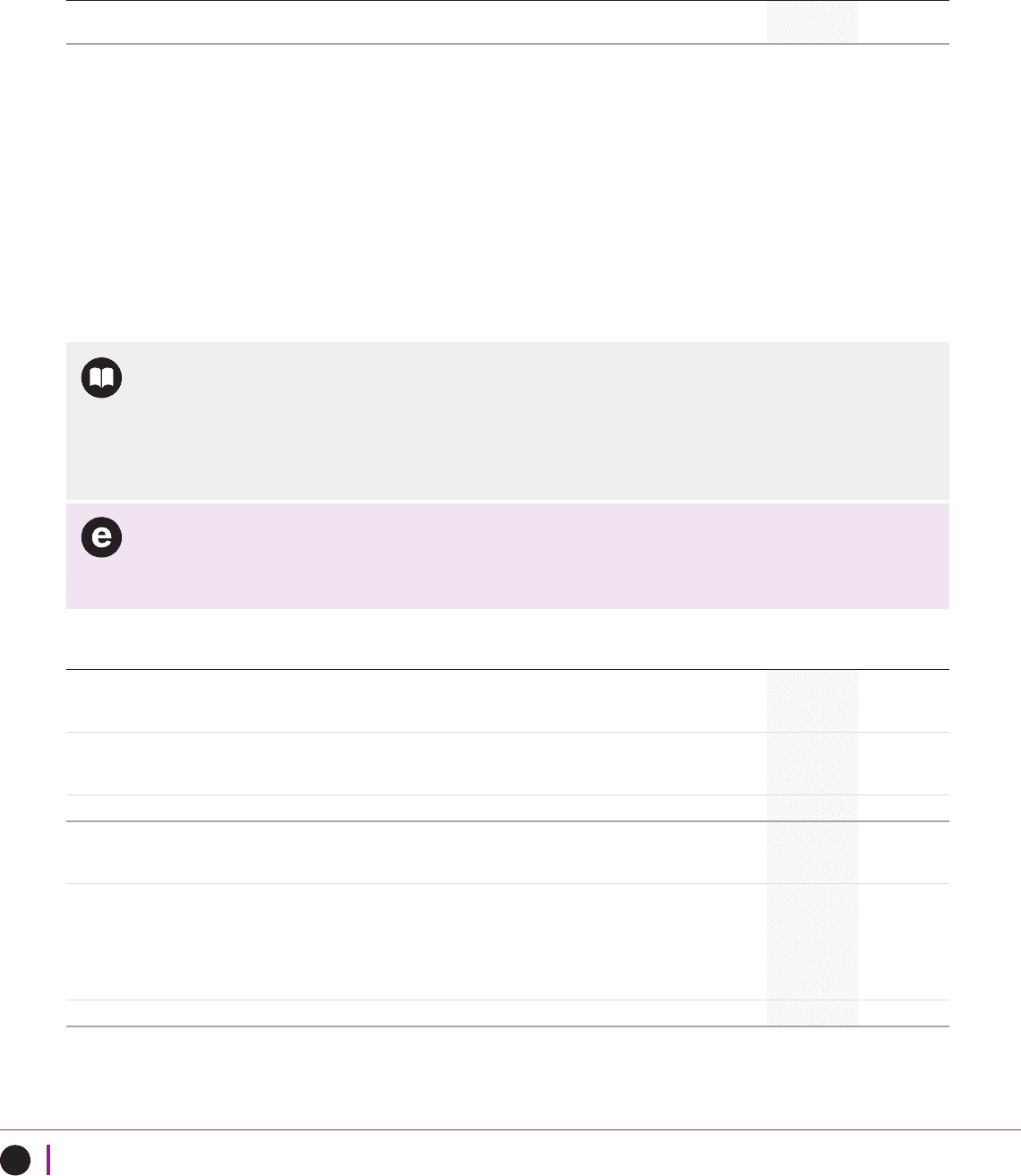

2. Expenses

Additional information in respect of expenses included within the Statement of Financial Performance is as follows:

2015

$M

2014

$M

Superannuation expense

Audit and review of financial statements*

46

1

46

1

*Other fees were paid for tax compliance work of $17k (30 June 2014: $19k), business roadmapping services of $190k, employee speak-up

line service of $25k and student fee protection audit of $4k (30 June 2014: $26k related to business and information technology processes

and security controls).

“Normalised earnings”, disclosed as supplementary information at the foot of the Statement of Financial Performance, shows earnings after

excluding movements on derivatives that hedge exposures in other financial periods. The adjustments match derivative gains or losses with

the underlying hedged transaction. Prior to the adoption of NZ IFRS 9 (2013) (refer Note 23), such movements comprised the time value

on open derivatives and amounts required to be recognised as ineffective for accounting purposes. With effect from 1 July 2014, the Group

adopted NZ IFRS 9 (2013). The resultant change in the treatment of time value of options and the reduced ineffectiveness has meant that

amounts presented as adjustments to Normalised Earnings in the year ended 30 June 2015 simply reverse timing adjustments from prior

years. From 1 July 2014, such adjustments no longer arise. The amounts recognised in the Statement of Financial Performance in relation to

(gains)/losses on derivatives which hedge exposures in other financial periods are $20 million of losses for fuel derivatives (30 June 2014:

gains of $23 million) and $2 million of losses on foreign exchange derivatives (30 June 2014: gains of $3 million).

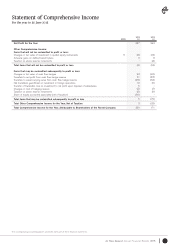

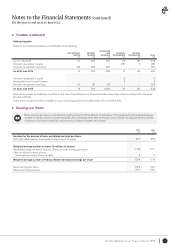

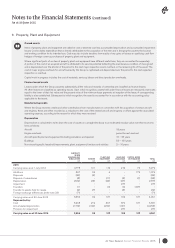

3. Taxation

Current and deferred taxation are calculated on the basis of tax rates enacted or substantively enacted at reporting date, and are

recognised in the income statement except when the tax relates to items charged or credited to other comprehensive income, in

which case the tax is also recognised in other comprehensive income.

Deferred income taxation is recognised in respect of temporary differences arising between the tax bases of assets and liabilities

and their carrying amounts in the financial statements.

Deferred income tax assets and unused tax losses are only recognised to the extent that it is probable that future taxable amounts

will be available against which to utilise those temporary differences and losses.

Judgements are required about the application of income tax legislation. These judgements and assumptions are subject to risk

and uncertainty, hence there is a possibility that changes in circumstances will alter expectations, which may impact the amount of

current and deferred tax assets and liabilities recognised in the Statement of Financial Position and the amount of other tax losses

and temporary differences not yet recognised. In such circumstances, some or all of the carrying amounts of recognised tax assets

and liabilities may require adjustment, resulting in a corresponding credit or charge to the Statement of Financial Performance.

2015

$M

2014

$M

Current taxation expense

Current year

Adjustment for prior periods

(158)

(1)

(155)

(1)

Deferred taxation expense

Origination of temporary differences

(159)

12

(156)

61

Total taxation expense recognised in earnings (147) (95)

Reconciliation of effective tax rate

Earnings before taxation 474 358

Taxation at 28%

Adjustments

Non-deductible expenses

Share of earnings of Virgin Australia

Non-taxable income

(Under)/over provided in prior periods

(133)

(3)

(8)

1

(4)

(100)

(4)

-

6

3

Taxation expense (147) (95)

The Group has $200 million imputation credits as at 30 June 2015 (30 June 2014: $146 million).