Air New Zealand 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

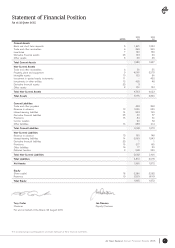

As at 30 June 2015

Air New Zealand Annual Financial Results 2015 13

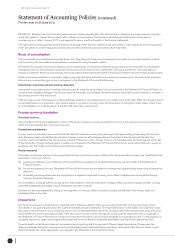

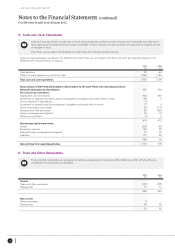

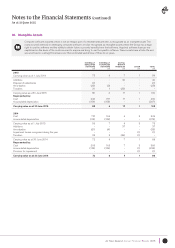

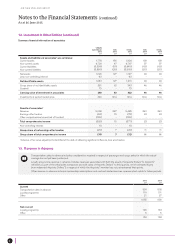

7. Inventories

Inventories are measured at the lower of cost and net realisable value. Cost is determined using the first-in, first-out (FIFO)

cost method. Net realisable value is the estimated selling price in the ordinary course of business, less applicable variable

selling expenses.

2015

$M

2014

$M

Engineering expendables

Consumable stores

107

13

154

15

120 169

Held at cost

Held initially at cost

Less provision for inventory obsolescence

88

82

(50)

139

75

(45)

Held at net realisable value 32 30

120 169

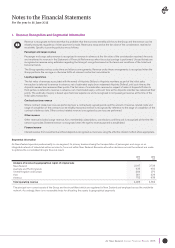

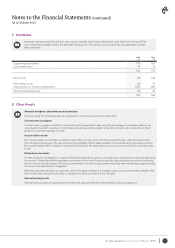

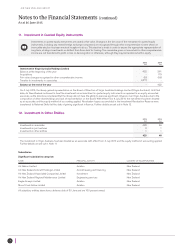

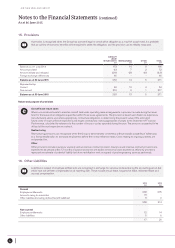

8. Other Assets

Amounts owing from joint ventures and associates

Amounts owing from related parties are recognised at cost less any provision for impairment.

Contract work in progress

Contract work in progress is stated at cost plus the profit recognised to date, using the percentage of completion method, less

any amounts invoiced to customers. Cost includes all expenses directly related to specific contracts and an allocation of direct

production overhead expenses incurred.

Assets held for resale

Non-current assets are classified as held for resale if their carrying amount will be recovered through a sale transaction rather

than through continuing use. The sale must be highly probable and the asset available for immediate sale in its present condition.

Non-current assets held for resale are measured at the lower of the asset’s previous carrying amount and its fair value less costs

to sell.

Defined pension assets

Air New Zealand’s net obligation in respect of defined benefit pension plans is calculated by an independent actuary, by estimating

the amount of future benefit that employees have earned in the current and prior periods, discounting that amount and deducting

the fair value of the plan’s assets. The discount rate reflects the yield on government bonds that have maturity dates approximating

the terms of Air New Zealand’s obligations

When the calculation results in an asset, the value of the asset is limited to the present value of economic benefits available in the

form of any future refunds from the plan or reductions in future contributions from the plan.

Interest-bearing assets

Interest-bearing assets are measured at amortised cost using the effective interest method, less any impairment.