Air New Zealand 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2015

Air New Zealand Annual Financial Results 2015 29

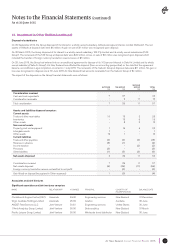

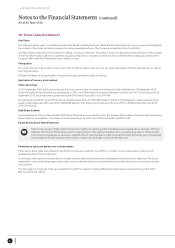

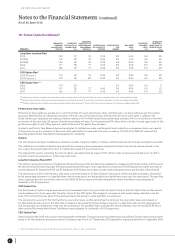

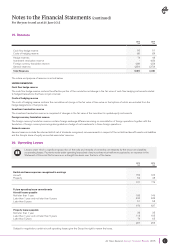

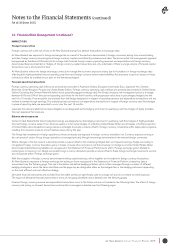

23. Financial Risk Management (continued)

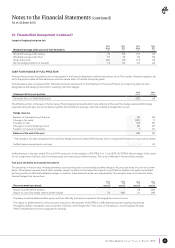

MARKET RISK

Foreign Currency Risk

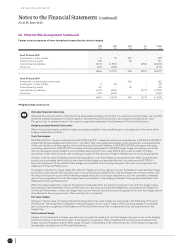

Foreign currency risk is the risk of loss to Air New Zealand arising from adverse fluctuations in exchange rates.

Air New Zealand has exposure to foreign exchange risk as a result of transactions denominated in foreign currencies, arising from normal trading

activities, foreign currency borrowings and foreign currency capital commitments, purchases and sales. The documented risk management approach

(as approved by the Board of Directors) is to manage both forecast foreign currency operating revenues and expenditure and foreign currency

denominated balance sheet items. Hedges of foreign currency capital transactions are only undertaken if there is a large volume of forecast capital

transactions over a short period of time.

Air New Zealand enters into foreign exchange contracts to manage the economic exposure arising due to fluctuations in foreign exchange rates

affecting both highly probable forecast operating cash flows and foreign currency denominated liabilities. Any exposure to gains or losses on these

contracts is offset by a related loss or gain on the item being hedged.

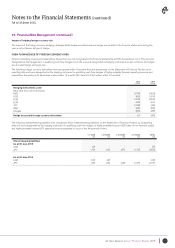

Forecast operating transactions

Foreign currency operating cash inflows are primarily denominated in Australian Dollars, European Community Euro, Japanese Yen, Chinese

Renminbi, United Kingdom Pounds and United States Dollars. Foreign currency operating cash outflows are primarily denominated in United States

Dollars. Excluding the Chinese Renminbi (which has a generally pegged exchange rate), the Group’s treasury risk management policy is to hedge

between 60% and 90% of forecast net operating cash flows for the first 6 months, with progressive reductions in percentages hedged over the

next 6 to 12 months. Forward points are excluded from the hedge designation in respect of operating revenue and expenditure transactions and are

marked to market through earnings. The underlying forecast revenue and expenditure transactions in respect of foreign currency cash flow hedges

in place at reporting date, are expected to occur over the next 12 months.

Japanese Yen denominated finance lease obligations are designated as the hedging instrument in qualifying cash flow hedges of highly probable

forecast Japanese Yen revenues.

Balance sheet exposures

Certain United States Dollar denominated borrowings are designated as the hedging instrument in qualifying cash flow hedges of highly probable

forecast foreign currency sales of non-financial assets or in fair value hedges of underlying United States Dollar aircraft values. A further proportion

of United States denominated borrowings remains unhedged to provide a natural offset to foreign currency movements within depreciation expense,

resulting from revisions made to aircraft residual values during the year.

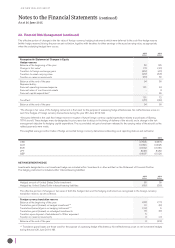

The Group has investments in foreign operations, whose net assets are exposed to foreign currency translation risk. Currency exposure arising on

the net assets of certain Group foreign operations is managed primarily through borrowings denominated in the relevant foreign currencies.

Where changes in the fair value of a derivative provide a natural offset to the underlying hedged item as it impacts earnings, hedge accounting is

not applied. Foreign currency translation gains or losses on lease return provisions and the remaining non-hedge accounted United States Dollar

denominated interest-bearing liabilities are recognised in the Statement of Financial Performance within “Foreign exchange gains”. Marked to

market gains or losses on non-hedge accounted foreign currency derivatives provide a natural offset to these foreign exchange movements, and are

also recognised within “Foreign exchange gains”.

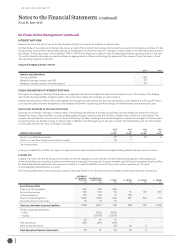

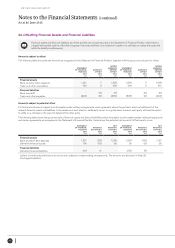

With the exception of foreign currency denominated working capital balances, which together are immaterial to foreign currency fluctuations,

Air New Zealand’s exposure to foreign exchange risk arising on items recognised in the Statement of Financial Position at reporting date is

summarised over the following page. This risk is translation risk before hedging activities, which is then managed through a number of different

hedging strategies in which the items identified over the page may be designated either as the hedged item or the hedging instrument depending

on the most efficient and cost effective strategy.

Derivative financial instruments are excluded from this table as they are specifically used to manage risk and do not create an initial exposure.

The impact of derivative financial instruments in terms of managing identified risks is detailed over the following pages.

Forecast foreign currency revenue and expenditure transactions occur in the future and are not included in the following table. The effect of foreign

currency risk arising on forecast transactions and how this is managed is detailed over the following pages.