Air New Zealand 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements

For the year to 30 June 2015

Air New Zealand Annual Financial Results 2015 9

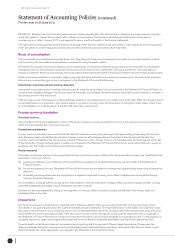

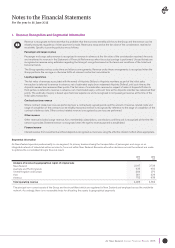

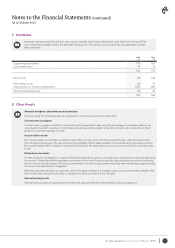

1. Revenue Recognition and Segmental Information

Revenue is recognised to the extent that it is probable that the economic benefits will flow to the Group and the revenue can be

reliably measured, regardless of when payment is made. Revenue is measured at the fair value of the consideration received or

receivable. Specific accounting policies are as follows:

Passenger and cargo revenue

Passenger and cargo sales revenue is recognised in revenue in advance at the fair value of the consideration received. Amounts

are transferred to revenue in the Statement of Financial Performance when the actual carriage is performed. Unused tickets are

recognised as revenue using estimates regarding the timing of recognition based on the terms and conditions of the ticket and

historical trends.

The Group operates various code share and alliance arrangements. Revenue under these arrangements is recognised when the

Group performs the carriage or otherwise fulfils all relevant contractual commitments.

Loyalty programmes

The fair value of revenues associated with the award of Airpoints Dollars to Airpoints members as part of the initial sales

transaction is deferred to revenue in advance, net of estimated expiry (non-redeemed Airpoints Dollars), until such time as the

Airpoints member has redeemed their points. The fair value of consideration received in respect of sales of Airpoints Dollars to

third parties is deferred to revenue in advance, net of estimated expiry, until such time as the Airpoints member has redeemed their

points. The estimate of expiry is based upon historical experience and is recognised in net passenger revenue at the time of the

initial sales transaction.

Contract services revenue

Where contract related services are performed over a contractually agreed period, and the amount of revenue, related costs and

stage of completion of the contract can be reliably measured, revenue is recognised by reference to the stage of completion of the

contract at balance date. Other contract related revenue is recognised as services are performed.

Other revenue

Other revenue includes lounge revenue, Koru membership subscriptions, commissions and fees and is recognised at the time the

service is provided. Dividend revenue is recognised when the right to receive payment is established.

Finance income

Interest revenue from investments and fixed deposits is recognised as it accrues, using the effective interest method where appropriate.

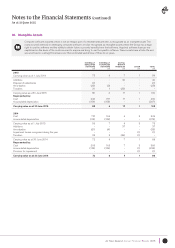

Segmental information

Air New Zealand operates predominantly in one segment, its primary business being the transportation of passengers and cargo on an

integrated network of scheduled airline services to, from and within New Zealand. Resource allocation decisions across the network are made

to optimise the consolidated Group’s financial result.

2015

$M

2014

$M

Analysis of revenue by geographical region of original sale

New Zealand

Australia and Pacific Islands

United Kingdom and Europe

Asia

America

2,917

639

286

381

702

2,736

682

270

326

638

Total operating revenue 4,925 4,652

The principal non-current assets of the Group are the aircraft fleet which are registered in New Zealand and employed across the worldwide

network. Accordingly, there is no reasonable basis for allocating the assets to geographical segments.