Air New Zealand 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND GROUP

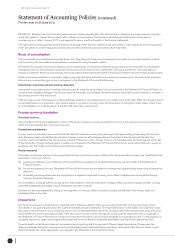

Notes to the Financial Statements (continued)

As at 30 June 2015

14

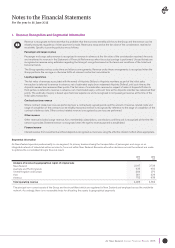

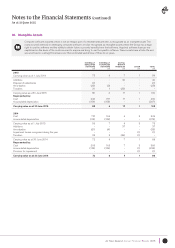

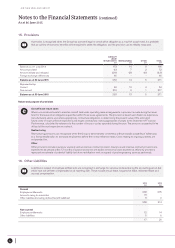

8. Other Assets (continued)

2015

$M

2014

$M

Current

Amounts owing from joint ventures and associates

Contract work in progress

Assets held for resale

Defined pension assets

Other assets

24

19

12

12

2

7

23

4

7

4

69 45

Non-current

Interest-bearing assets

Assets held for resale

Other assets

141

2

8

125

2

6

151 133

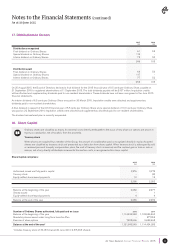

With the current fleet replenishment programme, spares are being marketed for sale. It is expected that proceeds will be received over the

next three years. In addition the Group is disposing of three Beech aircraft which are expected to be sold within 12 months and land and

buildings which will be settled by November 2015. The carrying value of the assets held for resale reflects the lower of their previous carrying

value at the date of transfer or external market assessments of the fair value, less costs to sell. No impairment expense was recognised

during the year (30 June 2014: $3 million).

The Group operates two defined benefit plans for qualifying employees in New Zealand and overseas. A net asset of $12 million (30 June

2014: $7 million) was recognised in respect of the New Zealand plan, which is now closed to new members. A net liability was recognised

in respect of the overseas plan of $1 million (30 June 2014: $1 million), which is included within Note 16 Other current liabilities. The plans

provide a benefit on retirement or resignation based upon the employee’s length of membership and final average salary. Each year an

actuarial calculation is undertaken using the Projected Unit Credit Method to calculate the present value of the defined benefit obligation and

the related current service cost. The current service cost recognised through earnings was $2 million (30 June 2014: $2 million).

Interest-bearing assets include registered transferable certificates of deposit (RTDs) that have been provided as security over credit card

obligations incurred by Air New Zealand. The RTD’s bear a three month fixed interest rate and mature in December 2018. These are subject

to potential offsetting under master netting arrangements, as disclosed in Note 24.