Air New Zealand 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

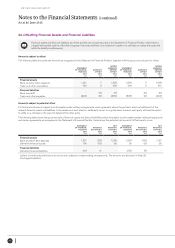

Notes to the Financial Statements (continued)

As at 30 June 2015

Air New Zealand Annual Financial Results 2015 35

23. Financial Risk Management (continued)

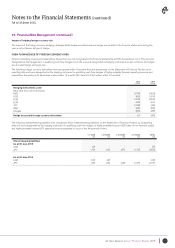

Impact of hedging fuel price risk

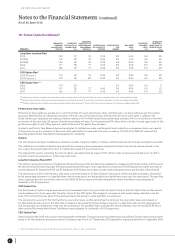

Weighted average strike prices of fuel derivatives

2015

Brent

USD

2015

WTI

USD

2014

Brent

USD

2014

WTI

USD

Weighted average collar ceiling

Weighted average collar floor

Swap strike price

Barrels hedged (millions of barrels)

70

57

N/A

1.9

83

76

95

0.6

107

99

104

3.6

96

86

96

0.6

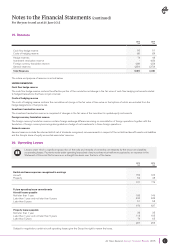

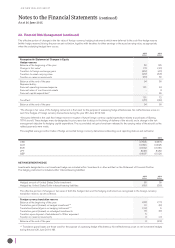

CASH FLOW HEDGES OF FUEL PRICE RISK

Forecast fuel purchase transactions are not recognised in the financial statements until the transactions occur. The number of barrels hedged is set

out in the previous table. All fuel derivative contracts mature within 12 months of reporting date.

Fuel derivatives were recognised within ‘Derivative financial instruments’ on the Statement of Financial Position as at reporting date and were

designated as the hedging instrument in qualifying cash flow hedges.

Statement of financial position 2015

NZ$M

2014

NZ$M

Derivative financial (liabilities)/assets (22) 25

The effective portion of changes in the fair value of fuel hedging instruments which were deferred to the cash flow hedge reserve (within hedge

reserves) during the year are set out below, together with transfers to earnings, when the underlying hedged item occurs.

Hedge reserves

Balance at the beginning of the year

Change in fair value*

Transfers to fuel

Changes in cost of hedging reserve

Taxation on reserve movements

(2)

(151)

130

(2)

7

(4)

11

(7)

(1)

(1)

Balance at the end of the year (18) (2)

* The change in fair value recognised in the cash flow hedge reserve excludes ineffectiveness which is recognised through earnings as shown below.

Ineffectiveness recognised in earnings - 40

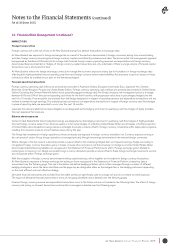

Ineffectiveness in the year ended 30 June 2014 arose prior to the adoption of NZ IFRS 9 on 1 July 2014. NZ IFRS 9 allows hedges of the crude

oil risk component of jet fuel, which minimises basis risk and reduces ineffectiveness. This is also reflected in the sensitivity analysis.

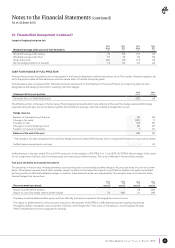

Fuel price sensitivity on financial instruments

The sensitivity of the fair value of these derivatives as at reporting date to a reasonably possible change in the price per barrel of crude oil is shown

below. This analysis assumes that all other variables remain constant and the respective impacts on profit before taxation and equity are dictated

by the proportion of effective/ineffective hedges. In practice, these elements would vary independently. This analysis does not include the future

forecast hedged fuel transactions.

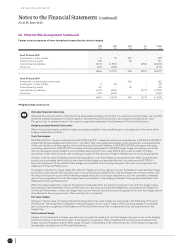

Price movement per barrel:

2015

$M

+USD 20

2015

$M

-USD 20

2014

$M

+USD 20

2014

$M

-USD 20

Impact on profit before taxation

Impact on cash flow hedge reserve (within equity)

-

54

-

(40)

58

21

(49)

(14)

The above would be deferred within equity and then offset by the fuel price impact of the hedged item when it occurs.

The impact on profit before tax in the prior year was prior to the adoption of NZ IFRS 9. Ineffectiveness has been significantly reduced

through the ability to designate a risk component of jet fuel as the hedged item. Time value on fuel options is now recognised through

Other Comprehensive Income as opposed to earnings.