Air New Zealand 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND GROUP

Notes to the Financial Statements (continued)

As at 30 June 2015

30

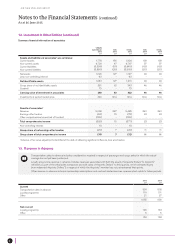

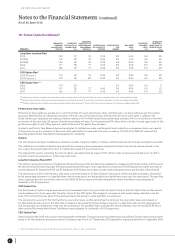

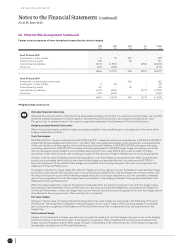

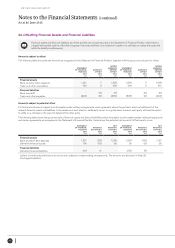

23. Financial Risk Management (continued)

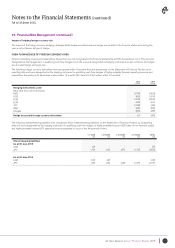

Foreign currency exposure of items recognised at reporting date, before hedging

NZD

$M

USD

$M

AUD

$M

JPY

$M

TOTAL

$M

As at 30 June 2015

Investments in other entities

Interest-bearing assets

Interest-bearing liabilities

Provisions

2

105

(514)

(29)

63

-

(1,558)

(242)

360

36

-

-

-

-

(250)

-

425

141

(2,322)

(271)

(436) (1,737) 396 (250) (2,027)

As at 30 June 2014

Investment in quoted equity instruments

Investments in other entities

Interest-bearing assets

Interest-bearing liabilities

Provisions

-

2

90

( 611)

(31)

-

46

-

(905)

(165)

422

-

35

-

-

-

-

-

(217)

-

422

48

125

(1,733)

(196)

(550) (1,024) 457 (217) (1,334)

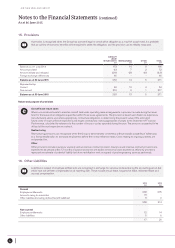

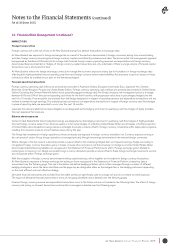

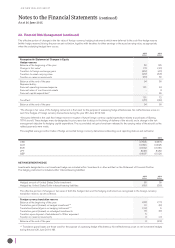

Hedging foreign currency risk

Derivative financial instruments

Derivative financial instruments, other than those designated as hedging instruments in a qualifying cash flow hedge, are classified

as held for trading. Subsequent to initial recognition, derivative financial instruments in this category are stated at fair value.

The gain or loss on remeasurement to fair value is recognised immediately in the Statement of Financial Performance.

Hedge accounted financial instruments

Where financial instruments qualify for hedge accounting, recognition of any resultant gain or loss depends on the nature of the

hedging relationship, as follows:

Cash flow hedges

NZ IFRS 9 (2010) – Financial Instruments and NZ IFRS 9 (2013) – Hedge Accounting and amendments to NZ IFRS 9, NZ IFRS 7

and NZ IAS 39 were adopted with effect from 1 July 2014. They add requirements related to the classification and measurement

of financial liabilities, and derecognition of financial assets and financial liabilities to NZ IFRS 9 (2009) and replace the hedge

accounting requirements of NZ IAS 39. The hedge accounting requirements in NZ IFRS 9 align hedge accounting more closely

with risk management and establish a more principles-base approach than under NZ IAS 39. In order to qualify for hedge

accounting, certain criteria must be met, including an analysis of the sources of hedge ineffectiveness for accounting purposes.

Changes in the fair value of hedging instruments designated as cash flow hedges are recognised within Other Comprehensive

Income and accumulated within equity to the extent that the hedges are deemed effective in accordance with NZ IFRS 9 –

Financial Instruments. To the extent that the hedges are ineffective for accounting, changes in fair value are recognised in the

Statement of Financial Performance.

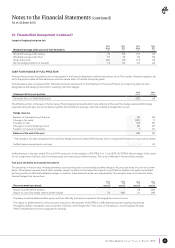

If a hedging instrument no longer meets the criteria for hedge accounting, expires or is sold, terminated or exercised, then hedge

accounting is discontinued. The cumulative gain or loss previously recognised in the cash flow hedge reserve remains there until

the forecast transaction occurs. If the underlying hedged transaction is no longer expected to occur, the cumulative, unrealised

gain or loss recognised in the cash flow hedge reserve with respect to the hedging instrument is recognised immediately in the

Statement of Financial Performance.

Where the hedge relationship continues throughout its designated term, the amount recognised in the cash flow hedge reserve

is transferred to the Statement of Financial Performance in the same period that the hedged item is recorded in the Statement

of Financial Performance, or when the hedged item is a non-financial asset, the amount recognised in the cash flow hedge reserve

is transferred to the carrying amount of the asset when it is recognised.

Fair value hedges

Changes in the fair value of hedging instruments designated as fair value hedges are recognised in the Statement of Financial

Performance. The hedged item is adjusted to reflect changes in its fair value in respect of the risk being hedged. The resulting

gain or loss is also recognised in the Statement of Financial Performance with an adjustment to the carrying amount of the

hedged item.

Net investment hedge

Hedges of net investments in foreign operations are accounted for similarly to cash flow hedges. Any gain or loss on the hedging

instrument relating to the effective portion of the hedge is recognised in other comprehensive income and accumulated in the

foreign currency translation reserve within equity. The gain or loss relating to the ineffective portion of the hedge is recognised

immediately in the Statement of Financial Performance.