Air New Zealand 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND GROUP

Notes to the Financial Statements (continued)

As at 30 June 2015

20

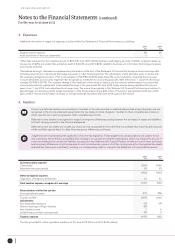

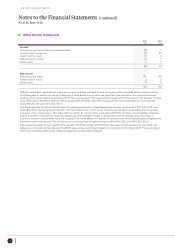

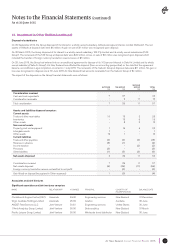

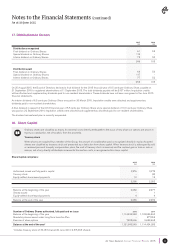

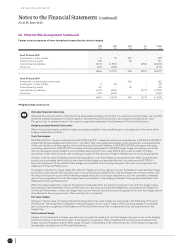

12. Investment in Other Entities (continued)

Summary financial information of associates

VIRGIN

AUSTRALIA

2015

$M

CEC

2015

$M

TOTAL

2015

$M

CEC

2014

$M

TOTAL

2014

$M

Assets and liabilities of associates* are as follows:

Current assets

Non-current assets

Current liabilities

Non-current liabilities

1,778

4,720

(2,598)

(2,880)

156

47

(51)

(25)

1,934

4,767

(2,649)

(2,905)

139

37

(62)

(20)

139

37

(62)

(20)

Net assets

Less non-controlling interest

1,020

63

127

-

1,147

63

94

-

94

-

Net identifiable assets 1,083 127 1,210 94 94

Group share of net identifiable assets

Goodwill

281

79

62

-

343

79

46

-

46

-

Carrying value of investment in associates 360 62 422 46 46

Investments at quoted market price 440 N/A N/A N/A N/A

Results of associates*

Revenue

Earnings after taxation

Other comprehensive losses (net of taxation)

5,098

(93)

(199)

387

15

-

5,485

(78)

(199)

360

23

-

360

23

-

Total comprehensive income (292) 15 (277) 23 23

Non-controlling interest 18 -18 - -

Group share of net earnings after taxation (29) 7(22) 11 11

Group share of total comprehensive income (79) 7(72) 11 11

*Inclusive of fair value adjustments identified at the date of obtaining significant influence, less amortisation.

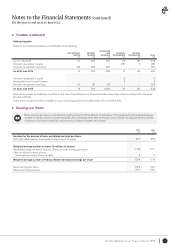

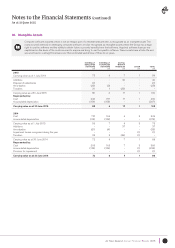

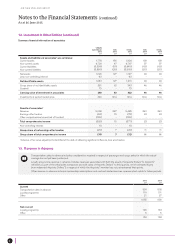

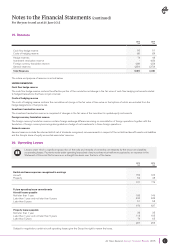

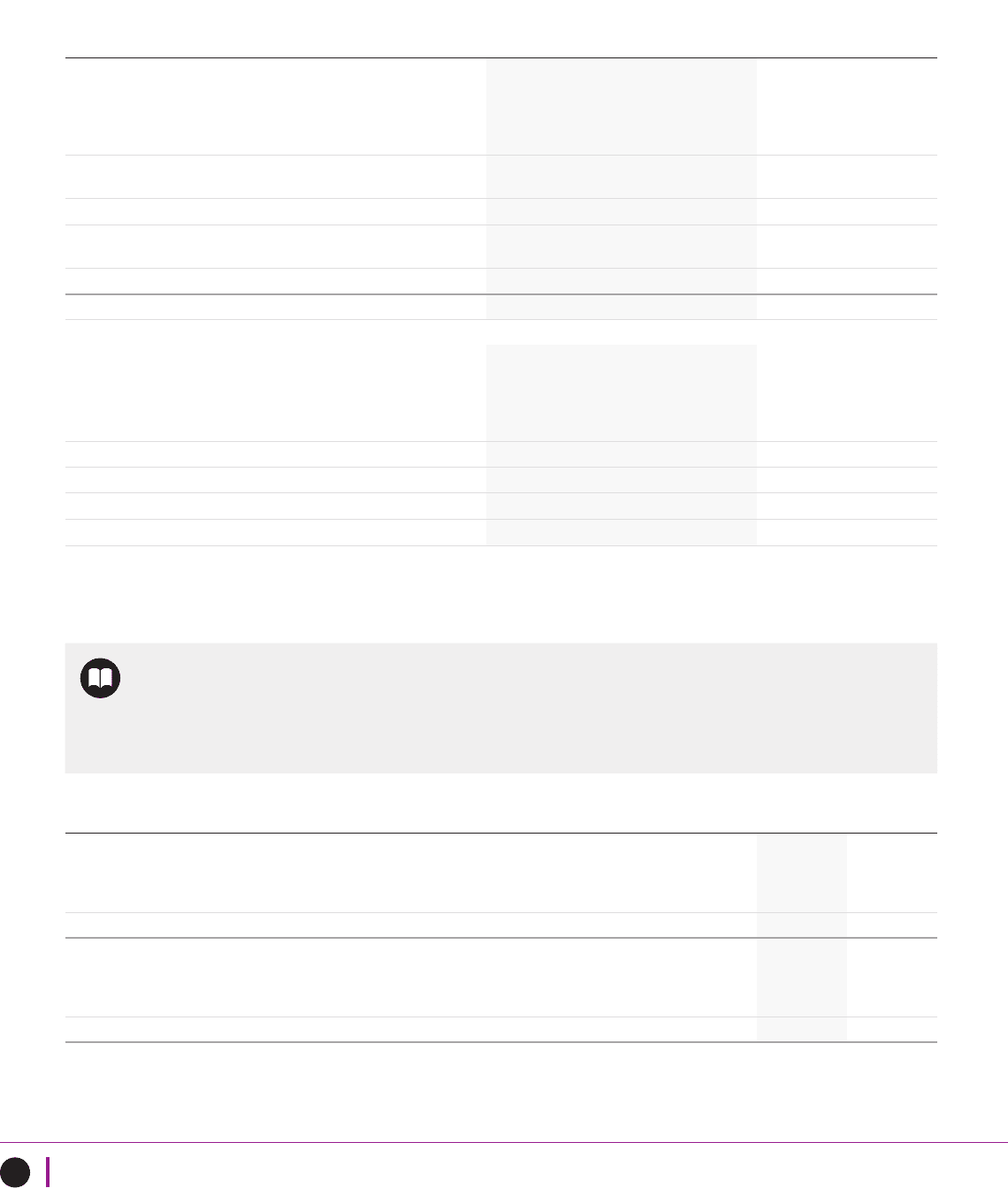

13. Revenue in Advance

Transportation sales in advance includes consideration received in respect of passenger and cargo sales for which the actual

carriage has not yet been performed.

Loyalty programme revenue in advance includes revenues associated with both the award of Airpoints Dollars™ to Airpoints™

members as part of the initial sales transaction and with sales of Airpoints Dollars™ to third parties, net of estimated expiry

(non-redeemed Airpoints Dollars™), in respect of which the Airpoints™ member has not yet redeemed their points.

Other revenue in advance includes membership subscriptions and contract related services revenue which relate to future periods.

2015

$M

2014

$M

Current

Transportation sales in advance

Loyalty programme

Other

924

110

21

802

101

27

1,055 930

Non-current

Loyalty programme

Other

145

5

143

5

150 148