Westjet 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2015 and 2014

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2015 | 95

16. Related parties

(a) Interests in subsidiaries

The consolidated financial statements of WestJet Airlines Ltd., the parent company, include the accounts of the Corporation and

its following four directly wholly-owned subsidiaries incorporated in Canada, as well as an indirectly wholly-owned Alberta

partnership:

WestJet Investment Corp. (WIC)

WestJet Operations Corp. (WOC)

WestJet Vacations Inc. (WVI)

WestJet Encore Ltd. (Encore)

WestJet, An Alberta Partnership (Partnership)

The Partnership is the primary operating entity of the Corporation. WIC, WOC, WVI and Encore were created for legal, tax and

marketing purposes and do not operate independently of the Partnership. Their relationship is such that they depend critically on

the Partnership for a variety of resources including financing, human resources and systems and technology. There are no legal

or contractual restrictions on the Corporation’s and subsidiaries’ ability to access or use assets or settle liabilities of the

consolidated group.

(b) Interests in consolidated structured entities

The Corporation also controls and consolidates six structured entities in which the Corporation has no equity ownership but

controls and has power over all relevant activities and is exposed to and has rights to variable returns by means of contractual

relationships. These entities were established for legal purposes to facilitate the financing of aircraft. These entities do not

conduct any operations except to hold legal title to specific aircraft and their related debt obligations. Through these contractual

relationships, the Corporation is required to fund all of the aircraft debt obligations of these entities. There are no legal or

contractual restrictions between the Corporation and these entities that limit the access or use of assets or the settlement of

liabilities. The full amount of the aircraft debt obligations are reported as long-term debt on the Corporation’s consolidated

statement of financial position. The nature of the risks associated with these entities is limited to specific tax legislation in

Canada and the U.S. Although considered remote by Management, the potential for future changes to Canadian and U.S. tax

legislation affecting these entities could have potential adverse tax effects on the Corporation.

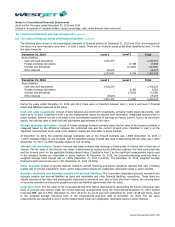

(c) Interests in unconsolidated structured entities

The Corporation is a party to 15 Fuel Facility Corporations (FFCs) and two De-Icing Facility Corporations (DFCs) for the purpose

of obtaining cost effective into-plane fuel services and aircraft de-icing services at select Canadian and US airports. These

operating costs are recorded in aircraft fuel and other expenses, respectively, on the consolidated statement of earnings. At

December 31, 2015, the Corporation has $1,992 in operating deposits with the FFCs and DFCs classified in prepaids, deposits

and other on the consolidated statement of financial position. The Corporation has no equity ownership and no control or

significant influence in the FFCs or DFCs. The financing and operating costs of these entities are shared amongst numerous

contracting airlines based on a variety of contractual terms including fuel volume consumption and qualifying flights. The

Corporation classifies its monthly operating cost obligations to the FFCs and DFCs as other financial liabilities and these

obligations are included in accounts payable and accrued liabilities on the consolidated statement of financial position. At

November 30, 2015, the 15 FFCs and two DFCs have combined total assets of approximately $626,272 and liabilities of

$595,855. In the event any or all contracting airlines default and withdraw from the FFCs and DFCs and no amounts are

recovered through legal recourse, the Corporation and any remaining contracting airlines are liable for the outstanding

obligations of the FFCs and DFCs. These obligations represent the Corporation’s maximum exposure to loss from the FFCs and

DFCs.

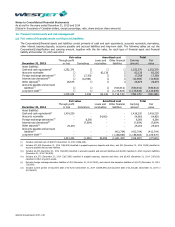

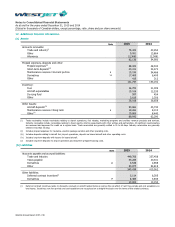

(d) Key management personnel

The Corporation has defined key management personnel as Senior Executive Officers and the Board of Directors, as they have

the collective authority and responsibility for planning, directing and controlling the activities of the Corporation. The following

table outlines the total compensation expense for key management personnel for the years ended December 31, 2015 and

2014.

2015

2014

Salaries, benefits and other compensation(i)

10,754

5,845

Share-based payment expense(ii)

3,284

6,835

14,038

12,680

(i) Other compensation includes the employee share purchase plan, profit share, cash compensation paid to the Board of Directors, payments under the

Corporation’s short-term incentive plan to Senior Executive Officers and amounts paid on departure.

(ii) Includes amounts expensed pursuant to the stock option plan, executive share unit plan and deferred share unit plan.