Westjet 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WestJet Annual Report 2015 | 44

We are dependent on single aircraft and engine suppliers for our Boeing 737 NG and Boeing 767 aircraft and

separate single aircraft and engine suppliers for our Bombardier Q400 aircraft. Any interruption in the

provision of goods and services from these suppliers, or other significant third party suppliers, as well as

mechanical or regulatory issues associated with their equipment, could have a material adverse effect on our

business, operating results and financial condition.

We secure goods and services from a number of third party suppliers. Any significant interruption in the provision of goods

and services from such suppliers, some of which would be beyond our control, could have a material adverse effect on our

business.

We are dependent on Boeing as supplier for our Boeing 737 NG aircraft, we are dependent on Bombardier as supplier for our

Bombardier Q400 aircraft. If we were unable to acquire additional aircraft from these suppliers, or if they were unable or

unwilling to provide adequate support for their products, our operations would be materially adversely affected. If either of

the suppliers was unable to adhere to its contractual obligations in meeting scheduled delivery dates for our aircraft, we would

be required to find another supplier of aircraft to fulfill our growth plans. Acquiring aircraft from another supplier would

require significant transition costs and, additionally, aircraft may not be available at similar prices or received during the same

scheduled delivery dates, which could adversely affect our business, operating results and financial condition. In addition, we

would be materially adversely affected in the event of a mechanical or regulatory issue associated with the aircraft type,

including negative perceptions from the travelling community.

We are also dependent on General Electric as supplier of aircraft engines on both our Boeing 737 NG and Boeing 767 aircraft,

and are dependent on Pratt & Whitney Canada as supplier of aircraft engines for our Bombardier Q400 aircraft and would

therefore be materially adversely affected in the event of a mechanical or regulatory issue associated with our engines or if

either supplier was unable or unwilling to provide adequate support for their products.

Our ability to obtain parts, materials, inventory, consumables and services from third party vendors and outside service

providers on commercially reasonable terms will also impact our low cost operating structure and the loss of any such

suppliers or service providers may negatively impact our business.

Loss of contracts, changes to our pricing agreements or access to travel suppliers’ products and services could

have an adverse impact on WestJet Vacations.

We depend on third parties to supply us with certain components of the travel packages sold through WestJet Vacations. We

are dependent, for example, on a large number of hotels in our transborder and international destinations in the US, Mexico,

Central America, the Caribbean and Europe. In general, these suppliers can terminate or modify existing agreements with us

on relatively short notice. The potential inability to replace these agreements, to find similar suppliers or to renegotiate

agreements at competitive rates could have an adverse effect on the results of WestJet Vacations. Furthermore, any decline in

the quality of products or services provided by these suppliers, or any perception by travelers of such a decline, could

adversely affect our reputation or the demand for the products and services of WestJet Vacations.

A significant change in our unique corporate culture, guest experience or brand could have adverse operational

and financial consequences.

Our corporate culture and brand recognition are key competitive advantages for us, especially in the Canadian market. We

strive to maintain an innovative corporate culture that results in a unique, safe and caring guest experience that sets our

company and our brand apart from our competitors. Failure to maintain our unique corporate culture that results in a safe and

caring guest experience could adversely affect our strong brand, our operating results and our financial condition.

We have a significant amount of fixed obligations and expect to incur significantly more fixed obligations,

which could harm our ability to service our fixed obligations, obtain future sources of financing and meet our

growth strategy.

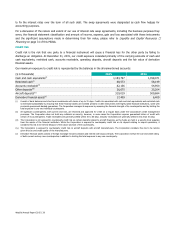

Our significant fixed obligations include our working capital requirements, long-term debt, aircraft maintenance provisions,

future tax liabilities and certain contractual lease payments for aircraft and other operating assets and services to maintain

and expand our operations. We also have significant future firm commitments for new aircraft, engines and other operating

assets and services to support our growth strategy. Our existing fixed obligations require significant funds to service interest,

principal and other contractual operating obligations. Our future operating performance and cash flows as well as changes in

the debt and equity markets will determine whether we are able to continue to successfully service our fixed obligations as