Westjet 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 7

Contents

About WestJet ............................................................. 8

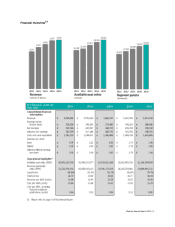

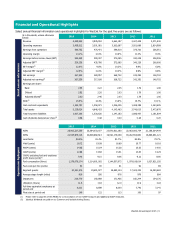

Financial and operational highlights ............................... 9

Annual overview ........................................................ 10

Outlook ..................................................................... 14

2015 Results of operations .......................................... 15

2015 Fourth quarter results of operations ..................... 21

Summary of quarterly results ...................................... 26

Nature-based reporting .............................................. 26

Guest experience ....................................................... 29

Liquidity and capital resources .................................... 29

Fleet ......................................................................... 34

Off-balance sheet arrangements and related party

transactions ............................................................... 35

Share capital .............................................................. 36

Financial instruments and risk management .................. 37

Risks and uncertainties ................................................ 40

Accounting ................................................................. 48

Controls and procedures .............................................. 52

Forward-looking information ........................................ 53

Definition of key operating indicators ............................ 55

Non-GAAP and Additional GAAP Measures ..................... 56

Advisories

The following Management’s Discussion and Analysis of Financial Condition and Operating Results (MD&A), dated February 1, 2016, should be read in conjunction

with the cautionary statement regarding forward-looking information below, as well as audited consolidated financial statements and notes thereto, for the years

ended December 31, 2015 and 2014. The consolidated financial statements for each of the two years ended December 31 have been prepared in accordance with

International Financial Reporting Standards (IFRS). All amounts in the following MD&A are in Canadian dollars unless otherwise stated. References to “WestJet,”

“the Corporation,” “the Company”, “we,” “us” or “our” mean WestJet Airlines Ltd. and its subsidiaries and consolidated structured entities, unless the context

otherwise requires. Additional information relating to WestJet, including periodic quarterly and annual reports and Annual Information Forms (AIF), filed with

Canadian securities regulatory authorities, is available on SEDAR at sedar.com and our website at westjet.com.

Cautionary statement regarding forward-looking information

This MD&A contains “forward-looking information” as defined under applicable Canadian securities legislation. This forward-looking information typically contains

the words “anticipate,” “believe,” “estimate,” “intend,” “expect,” “may,” “will,” “should,” “potential,” “plan,” “project” or other similar terms. Our actual results,

performance or achievements could differ materially from those expressed in, or implied by, this forward-looking information. We can give no assurance that any

of the events anticipated will transpire or occur or, if any of them do, what benefits or costs we will derive from them. By its nature, forward-looking information is

subject to numerous risks and uncertainties including, but not limited to, the impact of general economic conditions, changing domestic and international airline

industry conditions, volatility of fuel prices, terrorism, pandemics, currency fluctuations, interest rates, competition from other airline industry participants

(including new entrants, capacity fluctuations and changes to the pricing environment), labour matters, government regulations, stock market volatility, the ability

to access sufficient capital from internal and external sources, and additional risk factors discussed in other documents we file from time to time with securities

regulatory authorities, which are available on SEDAR at sedar.com or, upon request, without charge from us.

The disclosure found under the heading

Outlook

in this MD&A, including the guidance summary for the three months ended March 31, 2016 and the year ended

December 31, 2016 may contain forward-looking information that constitutes a financial outlook. The forward-looking information, including any financial outlook,

contained in this MD&A, is provided to assist investors in understanding our assessment of WestJet’s future plans, operations and expected results. The forward-

looking information, including without limitation, the disclosure found under the heading “Outlook”, contained in this MD&A may not be appropriate for other

purposes and is expressly qualified by this cautionary statement. Please refer to page 53 of this MD&A for further information on our forward-looking information

including assumptions and estimates used in its development. Our assumptions and estimates relating to the forward-looking information referred to above are

updated in conjunction with filing our quarterly and annual MD&A and, except as required by law, we do not undertake to otherwise update forward-looking

information.

Non-GAAP and additional GAAP measures

Certain measures in this MD&A do not have any standardized meaning as prescribed by Generally Accepted Accounting Principles (GAAP) and, therefore, are

considered non-GAAP measures. These measures are provided to enhance the reader’s overall understanding of our financial performance or current financial

condition. They are included to provide investors and management with an alternative method for assessing our operating results in a manner that is focused on

the performance of our ongoing operations and to provide a more consistent basis for comparison between periods. These measures are not in accordance with,

or an alternative to, GAAP and do not have standardized meanings. Therefore, they may not be comparable to similar measures presented by other entities.

Please refer to page 56 of this MD&A for definitions of the non-GAAP measures and a reconciliation of non-GAAP measures, including cost per available seat mile

(CASM), excluding fuel and employee profit share; return on invested capital (ROIC); free cash flow; diluted free cash flow per share; diluted operating cash flow

per share; adjusted net earnings, adjusted diluted earnings per share, and adjusted earnings before income tax (EBT) margin, and for a reconciliation of additional

GAAP measures, including adjusted debt-to-equity; adjusted net debt to earnings before interest, taxes, depreciation and aircraft rent (EBITDAR), adjusted net

debt to adjusted EBITDAR and the cash to trailing twelve months revenue ratio.

Included in net income for the year ended December 31, 2014, is an after-tax $33.2 million non-cash loss associated with the sale of 10 aircraft to Southwest

Airlines being classified to assets held for sale. As this non-cash loss is a non-recurring item we have adjusted certain non-GAAP measures to remove this item so

as to improve comparability of such measures between periods. In the fourth quarter of 2014, this resulted in the presentation of new non-GAAP measures or a

change in composition of certain non-GAAP measures including: adjusted net debt to adjusted EBITDAR, adjusted EBT margin, adjusted net earnings, and

adjusted diluted earnings per share, all of which exclude this non-cash loss (pre-tax or after-tax depending on the measure).

Definitions

Various terms used throughout this MD&A are defined at page 55 under the title

Definition of key operating indicators

.