Westjet 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2015 and 2014

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2015 | 82

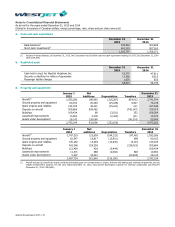

9. Long-term debt (continued)

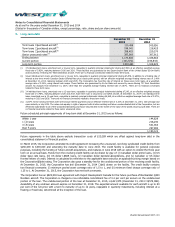

On January 5, 2016, the Corporation entered into an unsecured, non-revolving $300,000 4-year term credit facility with a

syndicate of banks. The credit facility is available for general corporate purposes, including the funding of future aircraft

acquisitions. Funds from the credit facility can be drawn by way of Canadian dollar prime loans or Canadian dollar bankers’

acceptances. Interest is calculated by reference to the applicable base rate plus an applicable pricing margin based on the

Corporation’s debt rating. On January 7, 2016, the Corporation received the $300,000 funds flow from the term facility using

Canadian dollar bankers’ acceptances. The credit facility contains two financial covenants: (i) minimum pooled asset coverage

ratio of 1.5 to 1, and (ii) minimum fixed charge coverage ratio of 1.25 to 1. The Corporation has fixed the interest rate over the

4-year term of the facility at 2.757% using an interest rate swap.

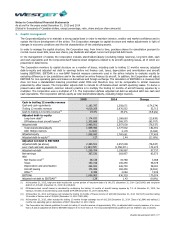

10. Income taxes

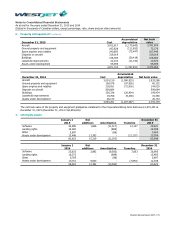

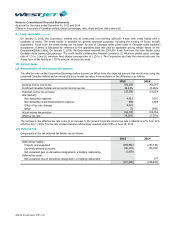

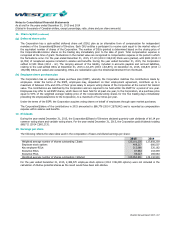

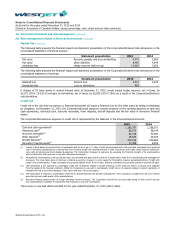

(a) Reconciliation of total income tax expense

The effective rate on the Corporation’s earnings before income tax differs from the expected amount that would arise using the

combined Canadian federal and provincial statutory income tax rates. A reconciliation of the difference is as follows:

2015

2014

Earnings before income tax

520,258

390,307

Combined Canadian federal and provincial income tax rate

26.44%

25.96%

Expected income tax provision

137,556

101,324

Add (deduct):

Non-deductible expenses

4,611

3,931

Non-deductible share-based payment expense

859

1,985

Effect of tax rate changes

9,671

-

Other

31

(890)

Actual income tax provision

152,728

106,350

Effective tax rate

29.36%

27.25%

The increase in the effective tax rate is due to an increase to the general corporate income tax rate in Alberta to 12% from 10%

effective July 1, 2015. The tax rate increase became substantively enacted under IFRS on June 18, 2015.

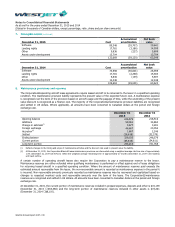

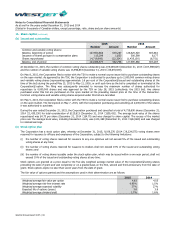

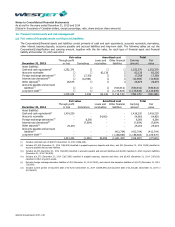

(b) Deferred tax

Components of the net deferred tax liability are as follows:

2015

2014

Deferred tax liability:

Property and equipment

(269,880)

(251,444)

Deferred partnership income

(56,139)

(45,785)

Net unrealized gain on derivatives designated in a hedging relationship

(1,009)

−

Deferred tax asset:

Net unrealized loss on derivatives designated in a hedging relationship

−

337

(327,028)

(296,892)