Westjet 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2015 and 2014

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2015 | 81

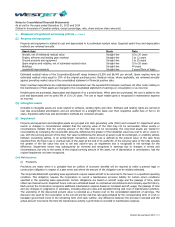

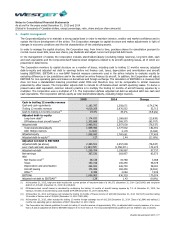

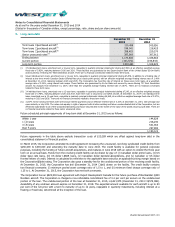

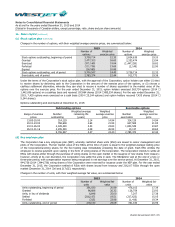

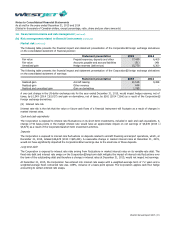

9. Long-term debt

December 31

2015

December 31

2014

Term loans – purchased aircraft(i)

220,458

343,056

Term loans – purchased aircraft(ii)

198,041

218,425

Term loans – purchased aircraft(iii)

358,415

229,270

Senior unsecured notes(iv)

397,919

397,912

Ending balance

1,174,833

1,188,663

Current portion

(141,572)

(159,843)

Long-term portion

1,033,261

1,028,820

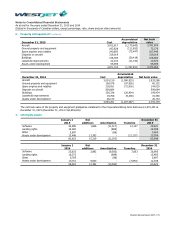

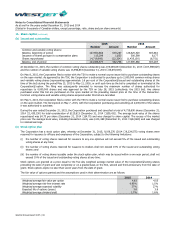

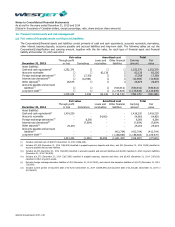

(i) 37 individual term loans, amortized over a 12-year term, repayable in quarterly principal instalments totaling $27,539, at an effective weighted average

fixed rate of 5.92%, maturing between 2016 and 2020. These facilities are guaranteed by the Export-Import Bank of the United States (Ex-Im Bank)

and secured by 37 Boeing 737 Next Generation aircraft. There are no financial convenants related to these term loans.

(ii) Seven individual term loans, amortized over a 12-year term, repayable in quarterly principal instalments totaling $5,576, in addition to a floating rate of

interest at the three month Canadian Dealer Offered Rate plus a basis point spread, with an effective weighted average floating interest rate of 2.40%

at December 31, 2015, maturing between 2024 and 2025. The Corporation has fixed the rate of interest on these seven term loans, at a weighted-

average rate of 3.20%, using interest rate swaps. These facilities are guaranteed by Ex-Im Bank and secured by seven Boeing 737 Next Generation

aircraft. No changes from December 31, 2014, other than the weighted average floating interest rate of 2.87%. There are no financial convenants

related to these term loans.

(iii) 24 individual term loans, amortized over a 12-year term, repayable in quarterly principal instalments totaling $7,245, at an effective weighted average

fixed rate of 3.46%, maturing between 2025 and 2027. Each term loan is secured by one Q400 aircraft. At December 31, 2014 – 15 individual term

loans, amortized over a 12-year term, repayable in quarterly principal instalments totaling $4,269, at an effective weighted average fixed rate of 3.87%,

maturing in 2025 and 2026. There are no financial convenants related to these term loans.

(iv) 3.287% Senior Unsecured Notes with semi-annual interest payments and an effective interest rate of 3.31% at December 31, 2015, with principal due

upon maturity in July 2019. The notes rank equally in right of payment with all other existing and future unsubordinated debt of the Corporation, but are

effectively subordinate to all of the Corporation’s existing and future secured debt to the extent of the value of the assets securing such debt. There are

no financial covenants related to these senior unsecured notes.

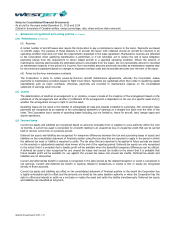

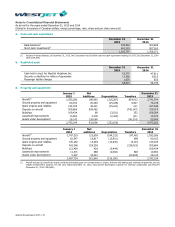

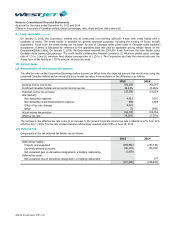

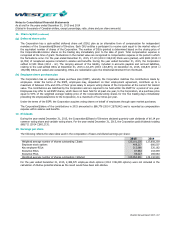

Future scheduled principal repayments of long-term debt at December 31, 2015 are as follows:

Within 1 year

144,829

1 – 3 years

216,240

3 – 5 years

531,063

Over 5 years

297,990

1,190,122

Future repayments in the table above exclude transaction costs of $15,289 which are offset against long-term debt in the

consolidated statement of financial position.

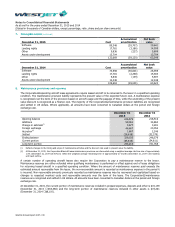

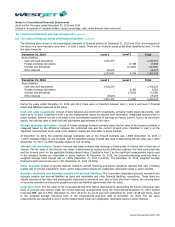

In March 2015, the Corporation amended its credit agreement increasing the unsecured, revolving syndicated credit facility from

$250,000 to $300,000 and extending the maturity date to June 2018. The credit facility is available for general corporate

purposes, including the funding of future aircraft acquisitions, and matures in June 2018 with an option to extend the three year

term on an annual basis. Funds from the revolving credit facility can be drawn by way of: (i) Canadian dollar prime loans, (ii) US

dollar base rate loans, (iii) US dollar LIBOR loans, (iv) Canadian dollar bankers’ acceptances, and (v) Canadian or US dollar

fronted letters of credit. Interest is calculated by reference to the applicable base rate plus an applicable pricing margin based on

the Corporation’s debt rating. The Corporation also pays a standby fee for the undisbursed portion of the revolving credit facility.

At December 31, 2015, the Corporation has $nil (December 31, 2014 – $nil) drawn on the facility. The credit facility contains

two financial covenants: (i) minimum pooled asset coverage ratio of 1.5 to 1, and (ii) minimum fixed charge coverage ratio of

1.25 to 1. At December 31, 2015, the Corporation has met both covenants.

The Corporation has an $820,000 loan agreement with Export Development Canada for the future purchase of Bombardier Q400

NextGen aircraft. The Corporation is charged a non-refundable commitment fee of 0.2 per cent per annum on the undisbursed

portion of the loan. The undisbursed portion of the loan at December 31, 2015, is $421,975 (December 31, 2014 – $575,088).

Availability of any undrawn amount expires on December 31, 2018. The expected amount available for each aircraft is up to 80

per cent of the net price with a term to maturity of up to 12 years, repayable in quarterly instalments, including interest at a

floating or fixed rate, determined at the inception of the loan.